- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

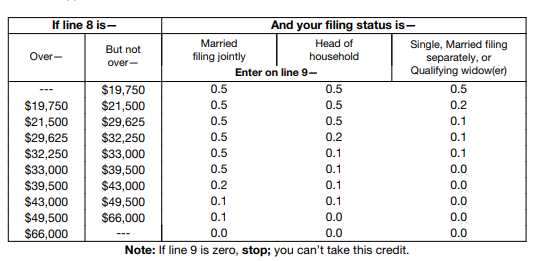

Your credit amount depends on your adjusted gross income that is reported on your Form 1040- the amount of the credit is 50%, 20% or 10%. This could explain the difference- as last year you qualified for the 50% credit and this year you had the 10%. See below.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 3, 2022

3:03 PM