- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Re:Schedule 8812 (Child Tax Credit) Error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

There are people who received Advance Child Tax Credit Payments in 2021, but now are not claiming Dependents.

These people may need to repay the payments they received but are now not eligible for.

Without dependents listed on their return, the question about the credit and advance payments would not come up.

This year TurboTax has the Child Tax Credit (Schedule 8812) come up for ALL Taxpayers so that the IRS knows if they need to investigate for advance payments possibly received by Taxpayers filing a return which claims no dependents.

It may seem like a slight inconvenience, but it is a good way to eliminate any loophole that allows the payments to be "unreported".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

If this is the case then why doesn't TT just ask at some point if the credits were recieved instead of genrating an error during smart check and creating a lot of confusion.

Also, a program popup saying that TT is automatically generating this form for ALL users would clear up confusion before it even starts.

It doesn't help when telephone support confirms this is a bug and says to just delete the form in the form editor.

Not sure who to believe.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

I am receiving sme error. Do not have those boxes checked for CTC??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

xmasbaby0 above is correct.

Everyone has to answer whether they received advance child tax credit payments.

There are many scenarios where taxpayers receive the advance child tax credit payments in 2021 but not qualify for the Child Tax Credit on their 2021 Federal tax return.

If you did not receive any of those payments between July and December, you need to report that you received $0.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

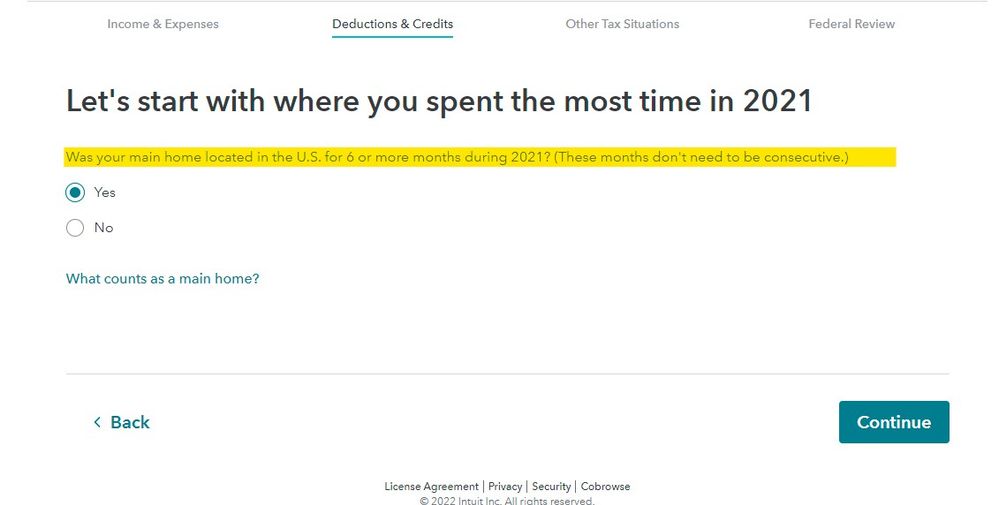

If you follow the interview screens section by section and don't skip about the questions about the advance CTC and the third stimulus are presented automatically for everyone who uses the program. I did several test returns and the program always mentioned these every time... trick is to not skip any section.

The program also asks everyone about several other items including foreign accounts, EIC if eligible, crypto currency, etc. By following the interview screens in the order they are presented all needed sections are covered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

@Critter-3 is correct.

If you go into and review the section on child tax credits (even if they don't apply to you) then you will not get the error and it will not generate Schedule 8812.

This SHOULD be a standalone pop up that everyone answers BEFORE you start the deductions section if they want everyone to answer it just like the foreign accounts, crypto, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

Since the Federal Review generated an error and produced a Schedule 8812, I have gone back to the child tax credit section, answered all the questions, and still have and 8812 that cannot be deleted. Is the correct procedure from here 1) eFile the tax return with an unnecessary 8812, or 2) scrap the return and start from the beginning to avoid possible problems with the IRS? This entire issue seems so easily avoidable if TT had done as RDS17 suggested with a stand alone pop up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

I have now answered my own question. The 8812 still appears in FORMS, but when checking a preview of the return that will be eFiled there is no 8812. Thanks all for your input on this topic!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

I completely agree with your complaints. My children have been out of my home for more than 15 yrs. I had absolutely no reason to take the path of Child Care Credits. Only after finding this conversation thread was I able to find how to get around the error. If the IRS requires this question to be answered, TT should clearly ask this question, rather than depend on users to search out the answer in a community thread.

Sorry TT. Your handling of this topic is disappointing, and only casts doubt in my trust for the tool.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

I'm also having this problem and my system updated today. I cannot get past this error. I'll go ahead and answer the two questions, but it is annoying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

Thank you for this work around

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

"Without dependents listed on their return, the question about the credit and advance payments would not come up"

But the bug here is "Without dependents listed on their return", and the question about the credit and advance payments STILL COME UP.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

Everyone has to answer whether they received advance child tax credit payments. If you did not receive any of those payments between July and December you need to answer that you did not receive any payments.

There are so many scenarios with those payments---like divorced/never married parents who have issues over who received the payments, who claimed the children, etc. --- the software has no way of knowing if any of that involves you---so you have to answer the questions about it.

Please follow these steps to indicate you did not receive any advanced payments:

- Click on the "Search" on the top and type "Child tax credit"

- Click on “Jump to Child Tax Credit”

- Continue through the questions until the "Tell us about any advance Child Tax Credit payments" screen and select "No".

- Continue through the questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

The problem is, if you have zero reasons to “visit” the child care forms, you’re never presented with the advanced payment questions until the Error Check is done. It’s not intuitive to even look down that path. As others have shared, if answering the question is mandatory for all tax filers, then it should be presented as an independent question, and not leave everyone guessing what the error means!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Scedule 8812 (Child Tax Credit) Error

I got the same error. After reading the replies here, I entered 0 as suggested. Schedule 8812 shows in FORMS view, but when I print, it is not part of the return. So I think I'm good. I'll wait a week or so and see if there are any updates though. Thanks, everybody.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

blueeaglewenzl

New Member

jjon12346

New Member

bkeenze1

New Member

KELC

Level 1

IRS notice transfer error

Level 1