- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Mortgage Interest Limit keeps defaulting to Yes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Hi all,

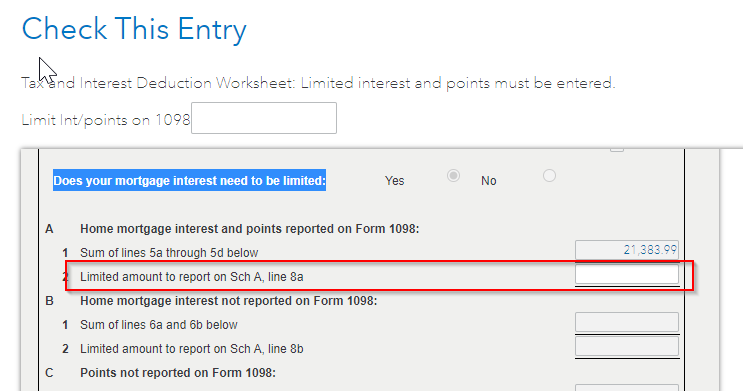

I refinanced a mortgage in 2020 and have a total of $21k of interest to deduct. When TurboTax is reviewing my forms it says I need to enter an amount of Limited Amount to report. For some reason the "Does your mortgage interest need to be limited" keeps defaulting to Yes. The mortgage amount is below the $750k limit, so I think there is a glitch.

Turbotax must be using the combined mortgage amount (which would be over $750k) of my two 1098s.

Is anyone experiencing this? Any TurboTax representatives know if this is a known issue and if there is a patch for this?

thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Carefully answer all questions relating to both mortgages.

When the software knows a mortgage was refinanced during the year, it will then know to not add that mortgage balance into the calculation to determine if the mortgage exceeds the 750K cap.

If this cap is exceeded, then the mortgage interest is subject to limitation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Your mortgage may be under the limit. But did you cash out on the refi? If so, and you did not use the cash out money to improve or maintain the property, then the interest paid on the cash out amount is not deductible.

Typically, when you refinance a house and cash out, you can only deduct the interest paid on the amount of the "old" loan at the time you refinanced. Example:

You owe $50K on the property and you refi for $100K, which leaves you with $50K in your pocket. Therefore, only 50% of the new loan was actually used to refinance the property. Only 50% of the interest on the new loan is deductible on SCH A for the life of that loan.

There are things that can change/increase that percentage though. For example, if you used money from the cash out to add on to your home, then that can be included in the percentage of interest you're allowed to claim on the new loan.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Hi @Carl,

No, I did not take any cash out. Maybe I answered one of the follow up questions wrong?

On the old loan, I did say that it was refinanced and made sure to select that it was a load which was paid off in 2020.

Any other ideas?

Thank for your input!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

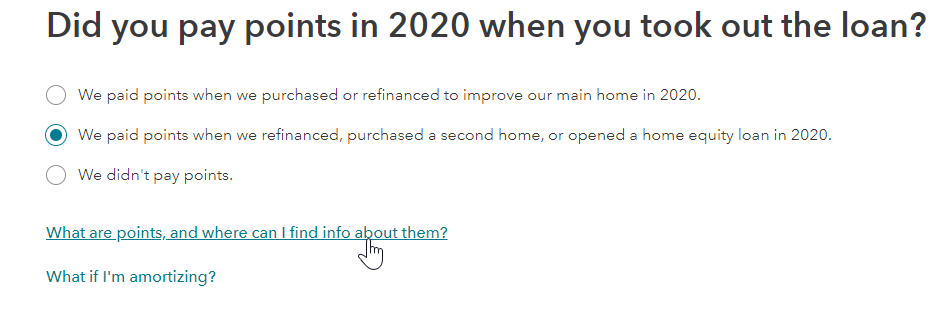

Ah, I think I found my mistake. Previously, I chose the first option. It should be the second option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Nope, still giving me the Yes on Mortgage Interest Limit after I changed it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Got it figured out. I had answered a question wrong regarding refinancing on one of the 1098s so it was adding the loan amounts together. thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Carefully answer all questions relating to both mortgages.

When the software knows a mortgage was refinanced during the year, it will then know to not add that mortgage balance into the calculation to determine if the mortgage exceeds the 750K cap.

If this cap is exceeded, then the mortgage interest is subject to limitation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

So what answers did you put then? I can't figure it out, it keeps adding mine together so it is defaulting to yes saying I need to limit my deduction. I also just refinanced and did not take out any extra money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

For the original loan which was paid off due to the refinance, make sure to select that it was paid off or refinanced with another lender, and that it is secured by a property of yours (assuming it is), and that it is the original loan you used to buy your home. Hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Which question was it? I'm having the same problem with it adding them together. Can you just be a little more specific? It asks "Is this a loan you refinanced?" but even when I put yes it is adding my final principal balance from that loan together with my new loan. There is even a page that asks "When did you make your final payment?" and I put the date there for the correct loan. It asks for the balance on the day you paid it off but maybe that is supposed to be a $0 for the outstanding loan balance on 1 Jan 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

I am still not getting it to work. When I put in my new refinace loan, it does have a box I can check saying I paid it off, but I can never get the first loan to say that! This seems like it shouldn't be this difficult.

On the original loan, it asks: Is this the original loan you took out?

yes-original loan or

no-Heloc or a loan that has been refinanced

How do you answer this? It is both, my original loan and a loan that I no longer have that has been refinanced.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

Delete both 1098's. Then enter the one for the old loan first.

Then, when you enter the 1098 for the new loan second, make sure to select the option that it's a refi.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

same problem here, none of the solutions listed work. I have deleted the forms, started completely over, changed the order that I input, changed selections. Nothing fixes this, has to be a glitch. Others still having this issue??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

I think I solved it, but not sure it is the right way. On the loan that was refinanced (the old loan) I changed the 'outstanding mortgage balance' to $0. This removed the doubling of my old and current mortgage balance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage Interest Limit keeps defaulting to Yes

On the 1098 for that old loan, does it show zero in box 2? I would fully expect it to if it was paid off in 2020.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

djpmarconi

Level 1

realestatedude

Returning Member

ramseym

New Member

eric6688

Level 2

user17523314011

Returning Member