- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Matching hobby income with 1099-k from paypal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

How am I supposed to enter a negative item adjustment (COGS) for the items?

From Section 5B:

Enter the applicable description and amount and Continue

- First, enter Form 1099-K as received. It is essential that the full amount be entered.

- For a description, include Form 1099-K and Personal Property Sales

- Next, enter an adjustment to reflect the cost of these items as an offsetting, negative amount up to the amount of the income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Hello,

I was wondering if I choose to do Option 2 (selling items less than what I paid for//used goods) How do I submit receipts that I paid more than I sold the items for? Or does the filing allow for estimates and receipts are only needed if there is an audit?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

When I enter my 1099K into the miscellaneous area in other income then make another entry for the cost basis for personal property sold. the entry works on the federal return. When I look a my NJ state return it dose nor calculate the cost basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

To enter the 1099-K for personal property sold, follow these steps:

- Select Income & Expenses.

- Scroll down to Less common income and select show more.

- Scroll to Miscellaneous Income, 1099-A, 1099-C, and check start.

- On the page Let's Work on Any Miscellaneous Income, scroll to " Other reportable income " and click start.

- On the page Any Other Taxable Income, select yes.

- On the page Other Taxable Income, enter a description indicating Personal 1099-K and amount.

- Select continue.

- Select done on the next page

Repeat the above steps this time; in step 6, add the amount as a negative value. Repeating steps 6-8 is to reduce the items that were received for personal use.

Update your NJ return and check the return entries by following these steps:

- Click Tax Tools from the left-side panel

- Click Tools

- Click View Tax Summary

- Click NJ Tax Summary from the left-side panel

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Hi All,

It looks like I'm in the right topic area, but still not sure if I'm understanding things correctly. In short, I had been buying coins (collectibles and bullion) over the years. I've now started selling them on eBay. Some are sold at a loss, and some at a profit. Can I deduct the losses from the profits (up to the profit limit, I understand)? Can I also deduct fees, packing supplies, etc. up to the profit limit? I understand I can't show (benefit from) a loss. However, can I get to zero if losses/expenses are equal to or greater than the profits?

Thanks!

Alex L.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Generally, if the IRS classifies your business as a hobby, it won't allow you to deduct any expenses or take any loss for it on your tax return.

If you are selling those items with the intent to make a profit, you can report your income and deduct expenses on Schedule C. If your business is legitimate, keeping accurate and extensive records could help prevent the classification of your business as a hobby.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Thank you! So, your reply is similar to what I've seen, but I'm just not understanding :( Let's assume that this IS a hobby, not business.

I'm not looking to show a loss on my taxes. I'm just trying to understand whether I have to (unreasonably in my mind) show just the profits. For example:

1. I bought two coins for $100 each

2. I sold one at $50; the other at $200

3. Paid $20 in fees; and another $20 in supplies and shipping

Do I report only $250 "profit" (doesn't make sense to me). Or, $250 (received)-$200 (cost of coins) = $50 (makes a little more sense) Or, subtract the $40 in other costs from the $50 "profit" and report a total of $10 in income (makes the most sense to me). I understand that if I have a loss, I have only $0 to report.

I hope that's a better/clearer way of asking what I'm trying to understand.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

To claim hobby expenses you can claim expenses that are required to carry out the hobby. Such as in your example, cost of the coins, supplies, and shipping are all acceptable expenses. You can even claim expenses that help you develop your hobby in the amount up to the sale proceeds. So you would claim the expenses in your example and report the $10 in income.

With hobby income the most important item to remember is you can not exceed the profit and claim a loss on the hobby income. For example, if you use your example, and you sold the coins for $200 instead of $250. You could only claim expenses up to $0 in income.

For more information on hobby income and expenses, see the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

Not sure I understand. how best to report receipt of 6 separate 1099k's.

3 from StubHub, 2 from LiveNation, and 1 from eBay representing sale of both tickets & personal items.

I have TurboTax Deluxe

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Matching hobby income with 1099-k from paypal

All can be reported as follows.

StubHub and LiveNation is the sale of tickets which is a personal item unless you are in the business of buying and selling tickets in trying to achieve a profit.

Likewise personal items could be a sale of investment or a business.

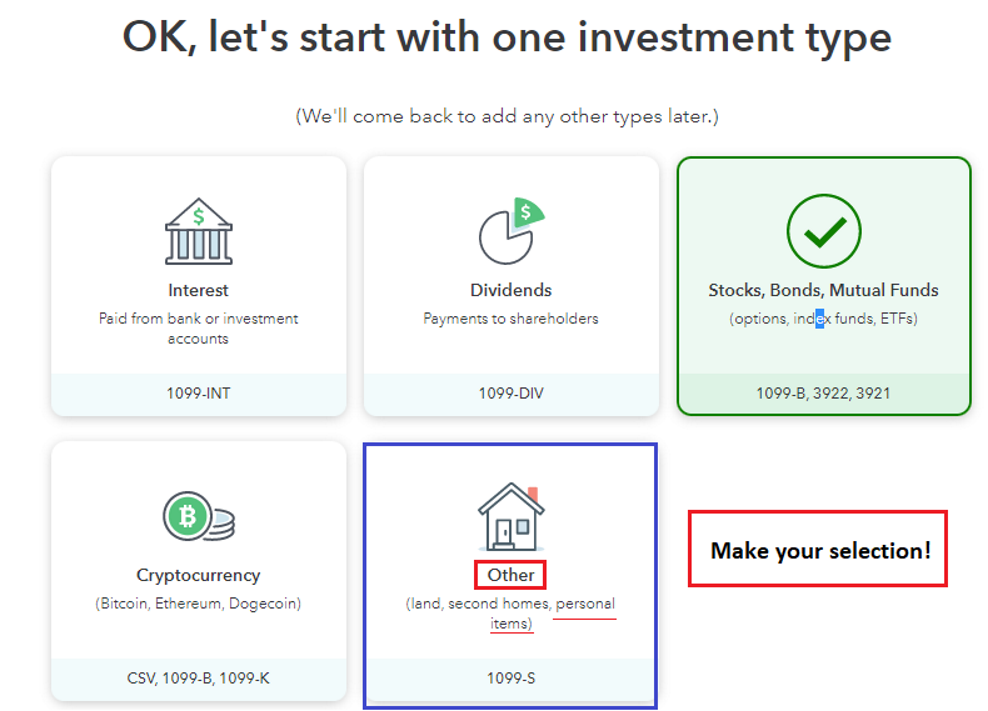

Sale of Personal Items: if you had a cost for the items you sold, you would report that in the 'Investment Sales' section. Do not select Form 1099-B as the type of entry. Instead select 'Other' sales. Do not enter this through your Form 1099-K entry, instead use the following instruction,

- Search (upper right) > type schedule d > use the Jump to... link select 'Review' on Personal items sale (Form 1099-K) > follow the prompts to complete the cost entry

- See the image below.

NOTE: One personal item or a group of personal items sold in one transaction at a gain requires the gain to be taxed.

One personal item or a group of personal items in one transaction sold at a loss, the loss is suspended and not allowed to reduce or offset other income, even the gain on personal items sold in a different transaction.

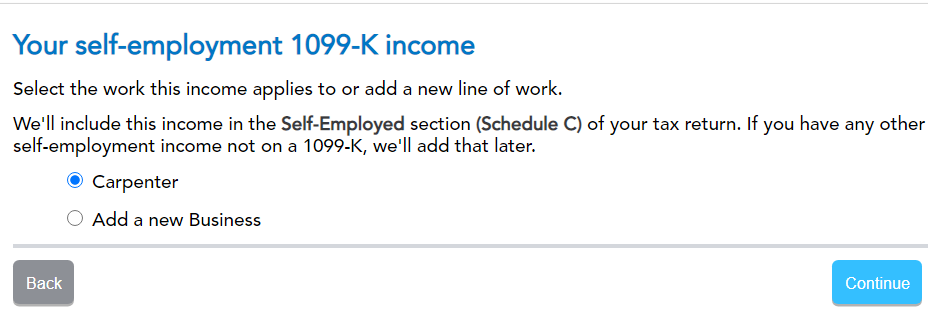

Self employment Income: Use the 1099-K entry or you can go directly to business income to enter your income and your expenses. If using the 1099-K entry continue with the instructions next.

- You will be asked the name or type of your self employment. You will also be instructed to complete the Schedule C for other income not reported on Form 1099-K. When you arrive back at the 'Wages & Income' screen you will notice under Business Items there will be a note 'Needs Review' beside your Schedule C. This is where you will enter your expenses as well as any other income for the same business that was not reported on the 1099-K. See the images below.

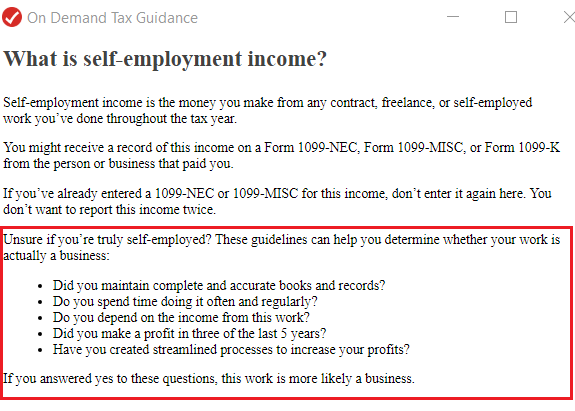

Hobby or Business: You have to decide if it's a hobby or a business for tax purposes. Review this page from IRS:

Key elements:

- A hobby requires you to report the income you received and under the current tax law, Tax Cuts and Jobs Act (TCJA), no expenses are allowed to be used to reduce the money collected even if you itemize deductions.

- A business allows you to deduct the costs necessary to obtain the income. The law explains that 'you must be engaged in the activity to produce a profit'. The test under IRS is that you must show a profit three out of every five consecutive year.

Personal items:

1099-K Self Employment

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

janainasferreira14

New Member

CluelessCamper

Level 1

Texyman

Level 1

wedajohnsons

New Member

james-charles-patterson

New Member