- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

All can be reported as follows.

StubHub and LiveNation is the sale of tickets which is a personal item unless you are in the business of buying and selling tickets in trying to achieve a profit.

Likewise personal items could be a sale of investment or a business.

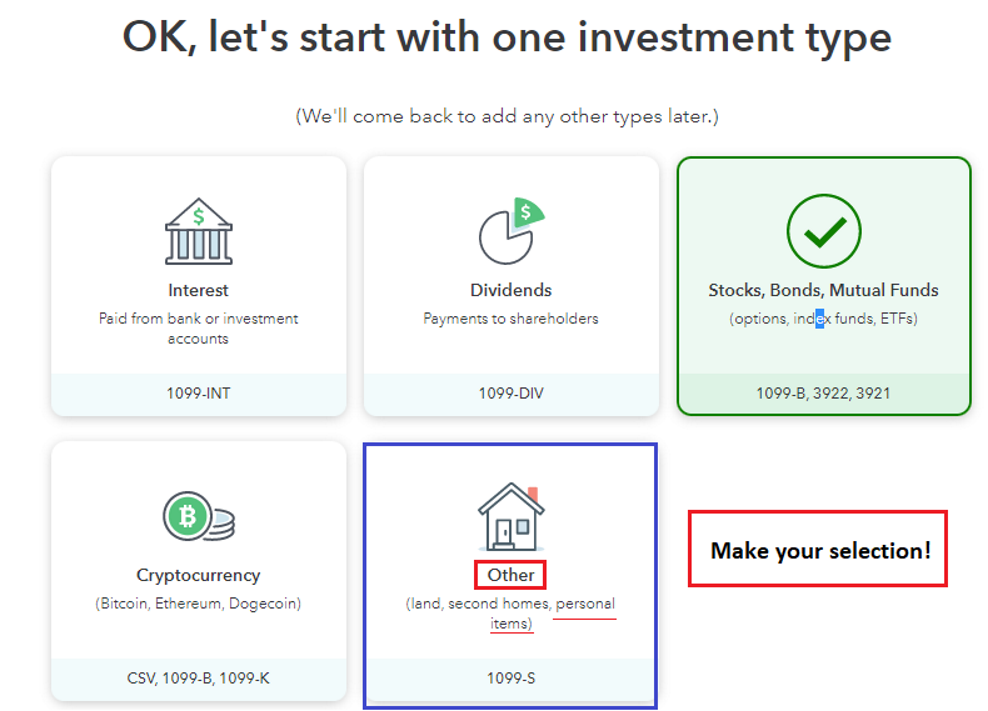

Sale of Personal Items: if you had a cost for the items you sold, you would report that in the 'Investment Sales' section. Do not select Form 1099-B as the type of entry. Instead select 'Other' sales. Do not enter this through your Form 1099-K entry, instead use the following instruction,

- Search (upper right) > type schedule d > use the Jump to... link select 'Review' on Personal items sale (Form 1099-K) > follow the prompts to complete the cost entry

- See the image below.

NOTE: One personal item or a group of personal items sold in one transaction at a gain requires the gain to be taxed.

One personal item or a group of personal items in one transaction sold at a loss, the loss is suspended and not allowed to reduce or offset other income, even the gain on personal items sold in a different transaction.

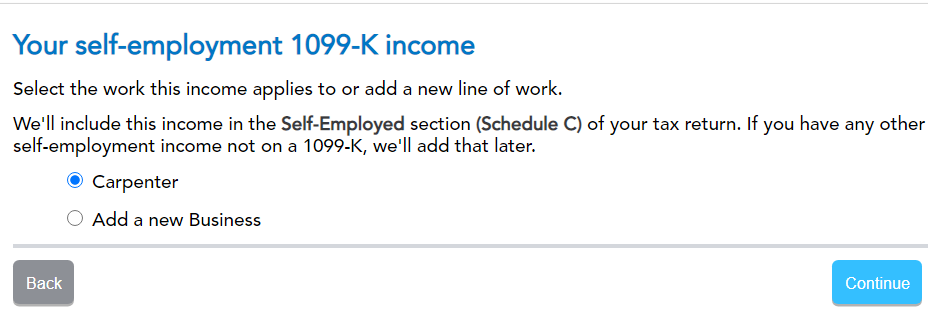

Self employment Income: Use the 1099-K entry or you can go directly to business income to enter your income and your expenses. If using the 1099-K entry continue with the instructions next.

- You will be asked the name or type of your self employment. You will also be instructed to complete the Schedule C for other income not reported on Form 1099-K. When you arrive back at the 'Wages & Income' screen you will notice under Business Items there will be a note 'Needs Review' beside your Schedule C. This is where you will enter your expenses as well as any other income for the same business that was not reported on the 1099-K. See the images below.

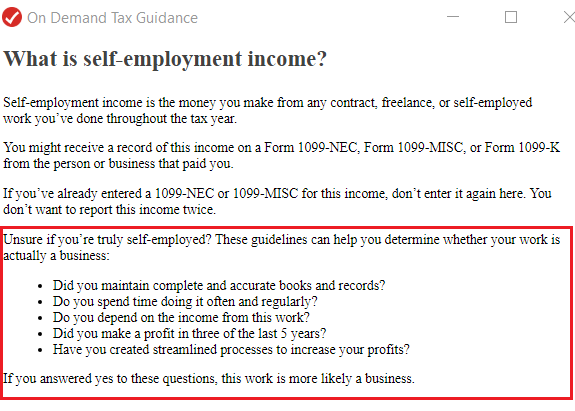

Hobby or Business: You have to decide if it's a hobby or a business for tax purposes. Review this page from IRS:

Key elements:

- A hobby requires you to report the income you received and under the current tax law, Tax Cuts and Jobs Act (TCJA), no expenses are allowed to be used to reduce the money collected even if you itemize deductions.

- A business allows you to deduct the costs necessary to obtain the income. The law explains that 'you must be engaged in the activity to produce a profit'. The test under IRS is that you must show a profit three out of every five consecutive year.

Personal items:

1099-K Self Employment

**Mark the post that answers your question by clicking on "Mark as Best Answer"