- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Investment property closed before first payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

I purchased an investment property that closed on 12/31/20, but the first payment wasn't due until 2/1/21. I paid a number of closing costs, including points, insurance up-front, appraisal.

How do I deduct these fees on my 2020 taxes if the loan didn't start until 2021?

Also, I have TT Deluxe Mac Version, I see no way of entering investment property details.

Can anyone help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

If it is an investment property, most of the closing costs would be added to the basis and not currently deductible. You could deduct property taxes if they weren't prepaid as itemized deductions in the current year.

If it is a second home, you can deduct points or mortgage interest paid at closing as itemized deductions in the current year as well.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

I'm not sure I understand. It's an investment property. Wouldn't I need to enter all my closing costs for TY20 since that's when it closed? And then they'd carry over to future years?

The property closed on 12/31/20, so there's no way I paid any non-prepaid taxes. But what about my appraisal, inspection, insurance, title fees, etc? Where do I put those in TT given that I had no investment property income because I didn't take possession of the house until 1/3/21?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

Yes, you can apply appropriate closing costs to 2020.

However, you can’t completely deduct all the costs of closing on your property. Only a few eligible ones make the cut. The IRS denotes the following as deductible costs:

- Sales tax issued at closing

- Real estate taxes charged to you when you closed

- Mortgage interest paid when cost was settled

- Real estate taxes that were paid for by the mortgage lender

- The interest you paid at the house’s purchase

- Loan origination fees (a.k.a. “points”). These would be written as a percentage of the borrowed money.

Additional closing costs that are not deductible include:

- tax stamps,

- attorney fees,

- title insurance,

- title search and

- document preparation fees.

None of these closing costs are deductible on your federal income tax return.

However, those costs can be included in your cost basis when selling your home.

From <https://turbotax.response.lithium.com/console/agent/5846641?>

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

I'm very confused. You're saying I can deduct certain closing costs on my 2020 returns, but then you say I can't do it on my Federal taxes. Well then how am I deducting them? Where do they go in TT? I have no income on the property in 2020 since I didn't own it until 2021.

Also, I looked at another property that I backed out of last minute, but incurred appraisal and inspection fees. Where do I deduct those expenses?

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

What kind of investment property is it?? Also, did you pay any closing costs in 2020 or is all your closing costs factored into your payments?

if the costs are factored into your mortgage payment, then no closing costs will be deducted because part of that mortgage interest you pay because those costs are already included in the mortgage balance. However if you prepaid some closing costs separately from your mortgage payment, then say so.

Also, for the piece of property that you declined to buy. Those costs are not deductible because you never retained ownership of the property.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

@DaveF1006 wrote:What kind of investment property is it?? Also, did you pay any closing costs in 2020 or is all your closing costs factored into your payments?

It's a SFH. I paid closing costs up front, including some advance insurance, taxes, mortgage interest, appraisal, titling, inspection, etc.

if the costs are factored into your mortgage payment, then no closing costs will be deducted because part of that mortgage interest you pay because those costs are already included in the mortgage balance. However if you prepaid some closing costs separately from your mortgage payment, then say so.

Yes, I paid them in advance. On top of the closing cost statement, I also received a 1098 for mortgage interest received on the investment property loan. Again, I didn't take possession of the house until 2021, but I received mortgage interest in TY2020. Where does this go?

Also, for the piece of property that you declined to buy. Those costs are not deductible because you never retained ownership of the property.

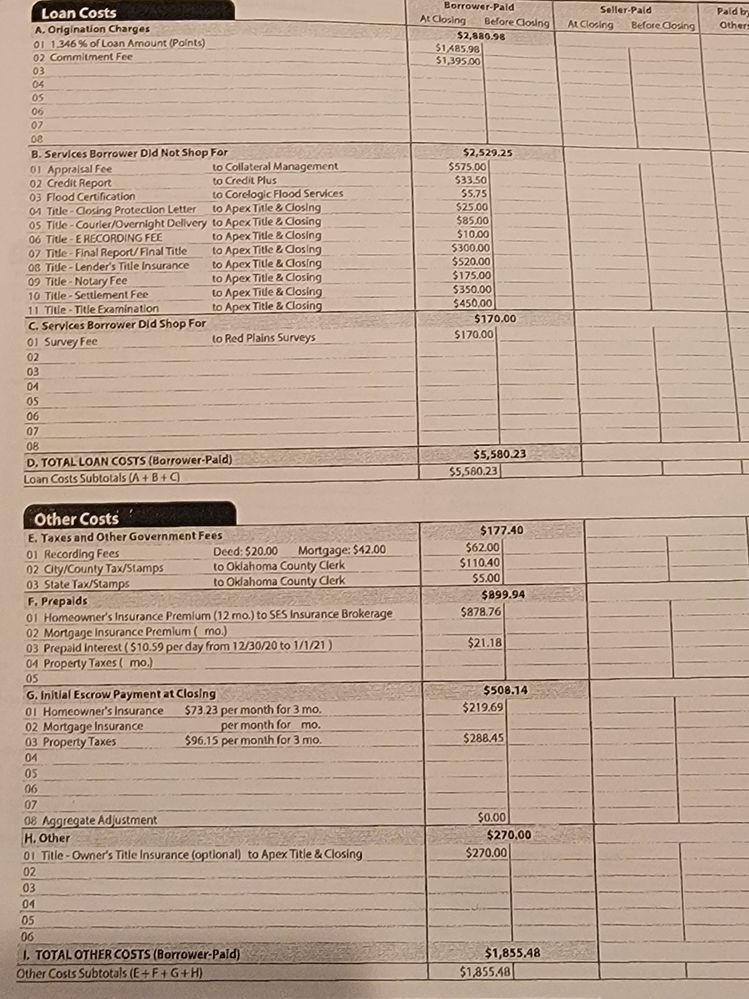

Here's a photo of the closing costs that I paid in 2020, even though I didn't take possession of the house until 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

By "investment property", do you mean a rental property?

If so, there is nothing to deduct this year. All closing costs (and any other expenses) are added to the Basis for depreciation. You start to depreciate the property when it is advertised, ready and available to be rented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

But how will next year's taxes reflect those costs if I don't enter them now? I'm just supposed to remember every little expense across multiple rental properties?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

According to awesome Turbo tax Agent Regina M, she states the following. "If you hold property for rental purposes, you may be able to deduct your ordinary and necessary expenses (including depreciation) for managing, conserving, or maintaining the property while the property is vacant. However, you can’t deduct any loss of rental income for the period the property is vacant."

My suggestion is to report it in 2020 and if losses were disallowed this year, they can be carried forward until you are able to deduct these once you start renting your property. This is good because Turbo Tax will have a profile on this investment property and will transfer over into next year's return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

But where do I report it? It seems TT doesn't let it be entered unless you have rental income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

You need to keep track of that for next year (when the property has been "placed in service"). Nothing would be deductible this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investment property closed before first payment

According to awesome Turbo tax Agent Regina M, she states the following. "If you hold property for rental purposes, you may be able to deduct your ordinary and necessary expenses (including depreciation) for managing, conserving, or maintaining the property while the property is vacant. However, you can’t deduct any loss of rental income for the period the property is vacant."

My suggestion is to report it in 2020 and if losses were disallowed this year, they can be carried forward until you are able to deduct these once you start renting your property. This is good because Turbo Tax will have a profile on this investment property and will transfer over into next year's return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IslandMan1

New Member

jlfarley13

New Member

jackkgan

Level 5

kim-gundler

New Member

scatkins

Level 2