- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@DaveF1006 wrote:What kind of investment property is it?? Also, did you pay any closing costs in 2020 or is all your closing costs factored into your payments?

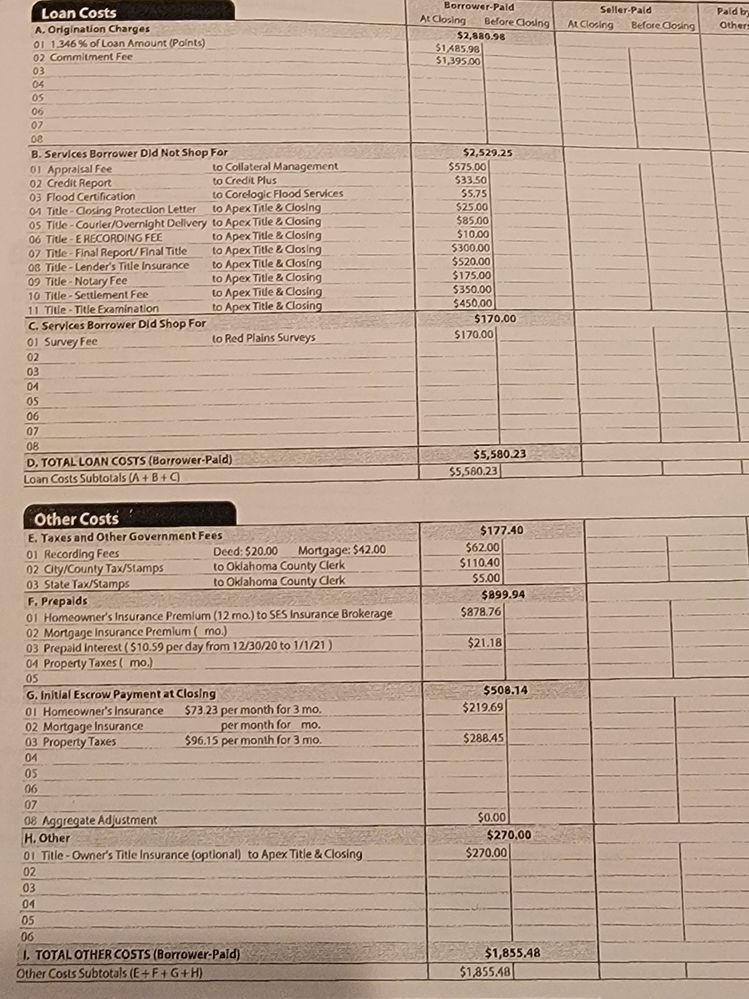

It's a SFH. I paid closing costs up front, including some advance insurance, taxes, mortgage interest, appraisal, titling, inspection, etc.

if the costs are factored into your mortgage payment, then no closing costs will be deducted because part of that mortgage interest you pay because those costs are already included in the mortgage balance. However if you prepaid some closing costs separately from your mortgage payment, then say so.

Yes, I paid them in advance. On top of the closing cost statement, I also received a 1098 for mortgage interest received on the investment property loan. Again, I didn't take possession of the house until 2021, but I received mortgage interest in TY2020. Where does this go?

Also, for the piece of property that you declined to buy. Those costs are not deductible because you never retained ownership of the property.

Here's a photo of the closing costs that I paid in 2020, even though I didn't take possession of the house until 2021.