- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: If you've held the stock for more at least one year, you...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

It appears that the only caveat is if the stock was held for less than a year - then it is treated as a short term cap gain and you can only claim your basis.

I agree it is a problem/glitch with Turbo for constraining how to enter donations of appreciated stock held longer than a year without needing to enter a basis and specific dates (in our case it would be many dates over a few decades.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

If in fact the holding period were in excess of one year as entered above the Cost Basis inquiry in the program, Turbotax should fix their program so that the Cost Basis is not required, or at least be tell the preparer that the Cost Basis is not required. Otherwise, one has to hunt around to try and find it when it is not needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

I donated stock from an advised fund, so there are over 30 different stocks involved. The donor advised fund doesn't being to include all that info. Turbo tax is actually harder than filling out all the forms by hand. It does the same thing with requiring me to list each and every time I give money to a charity. this would result in a couple hundred entries. I'll never use Turbo Tax again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

Hi,

NO ONE appears to have answered this question satisfactorily. The fact of the matter is that, according to IRS rules, Full Market Value is deductible for stocks donated with only Long-Term Gains and there should be NO NEED to enter Cost Basis for these donations. We are considering such donations for the first time this year (2022 donations to a Donor-Directed Fund, to be distributed at a later time) so we have not done this before. and would appreciate a straight answer. As best as I can figure out from this thread, TurboTax INCORRECTLY requires Cost Basis to be entered for donated stocks with ONLY Long-Term gains.

Can someone who really understands this confirm that TurboTax treats these donations correction OR that TurbTax intends to correct this issue?|

Thanks,

dkvonr

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

about the only reason is that you can elect to deduct only the cost basis of the security.

instructions from form 8283

Column (g). Do not complete this column for publicly

traded securities (PTS) held more than 12 months, unless you

elect to limit your deduction cost basis. See section

170(b)(1)(C)(iii). Keep records on cost or other basis.

capital gain property contributed is limited to 30% of AGI. this limitation does not apply if cost basis is used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

If you've held the stock for less than a year and the stock has depreciated in value, do you get credit for the cost basis or current market value of the donation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

@JulietteMount - it's the market value - the IRS is not going to give you a benefit on stocks that depreciated.

Example:

I paid 1 million dollars for a stock.

it depreciated all the way to 1 dollar.

the IRS is not going to let me give $1 to a charity and take a $1 million deduction for my personal investment decision. But the IRS will let me take a $1 deduction for the donation of the stock.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

donations of stock held 1 year or less are treated as ordinary income property so the tax deduction is the lower of cost or FMV

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

I'm having the exact same issue for my 2022 returns. Turbotax is still incorrect at requiring a cost basis to be reported. I donated multiple stocks which I held all >1 year, and I do not even have the cost basis to report. I can use the back button to get out of the module, but Turbotax won't let me submit electronically as it considers the form incomplete. It also won't allow me to manually fill out the form, or write N/A, requiring only numbers input.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

To enter a cost basis, try entering the number 0 and see if that will clear the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

This clears the error, but I'm concerned that it's incorrect. In the instructions (https://www.irs.gov/instructions/i8283), the IRS states:

Column (g).

Do not complete this column for publicly traded securities held more than 12 months, unless you elect to limit your deduction cost basis. See section 170(b)(1)(C)(iii). Keep records on cost or other basis.

This implies that putting 0 has an effect, though to be honest I'm not sure what it means by "limit your deduction cost basis". The clear intent is to leave the column blank - why can't TurboTax just provide this option? If not, can we have an assurance that putting 0 will not affect the refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

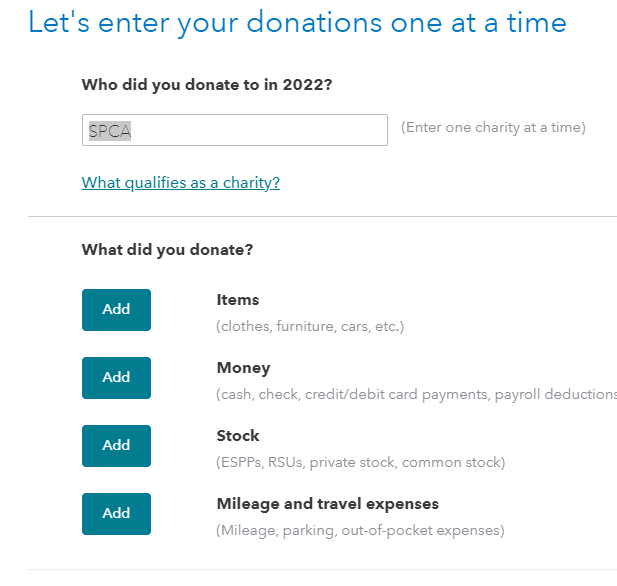

TurboTax is requesting a cost basis, but the charitable deduction does not take the cost basis into account. Please see these screen shots from TurboTax Online for a stock donation.

Re: How to enter appreciated stock donations to a Donor Advised Fund (DAF)?

Follow these instructions to enter the Stock donation. Please see the screenshots for details.

- When you enter the contribution in TurboTax, you should choose the Stock option in the list you will see.

- You will then be asked to enter the date of the donation, stock symbol, value at the date of the donation, the date you acquired it, and cost basis of the shares. Make sure the date you acquired it is more than one year from the date of the donation.

- You will receive a 30% of adjusted gross income deduction for the contribution of appreciated securities held long-term. Any unused deduction can be carried over to future years.

- This tells the IRS and Turbo Tax that this is a Donor Advised Fund contribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

So what does it mean to "elect to limit your deduction cost basis"? It sounds like putting a value there rather than leaving it blank does something, but I don't know what, and honestly I'm pretty concerned about putting a $0 value there when it very plausibly sounds like, according to the IRS, that does something meaningful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

There are contribution limits to certain types of organizations. It can benefit you to limit your deduction cost basis because some donations are limited to 30% of your AGI and some to 60%. Limiting your donation can change that percentage which can actually result in a larger donation credit for you.

If you think that this applies to you then you have some homework to do. First, you have to figure out what category of organization you are donating to -there are 50% organizations and 60% organizations. Check that information out here.

Then you have to figure out whether there is any benefit to limiting your deduction. You can read up on that here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What the need for Cost Basis information when reporting Stock Donations to Charities? The entire market value of the security on the day of donation is deductible.

I'm confused - does that mean that putting $0 in that field does actually limit my deduction? I definitely do not want to do that, I am very confident I am not anywhere close to the AGI limits. But leaving the field blank (again, as the IRS specifically instructs), is not possible. So what should I do?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lynn12111

Returning Member

rweddy

Returning Member

user17558684347

New Member

vicki1955vic

New Member

latriciaaldermanboone9

New Member