- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

TurboTax is requesting a cost basis, but the charitable deduction does not take the cost basis into account. Please see these screen shots from TurboTax Online for a stock donation.

Re: How to enter appreciated stock donations to a Donor Advised Fund (DAF)?

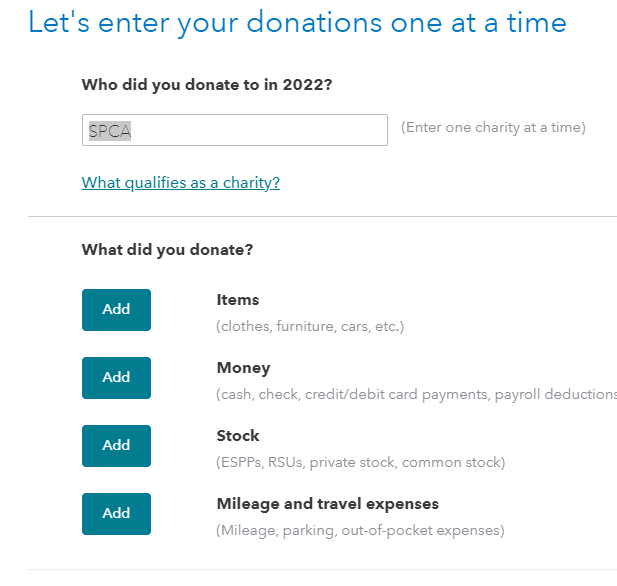

Follow these instructions to enter the Stock donation. Please see the screenshots for details.

- When you enter the contribution in TurboTax, you should choose the Stock option in the list you will see.

- You will then be asked to enter the date of the donation, stock symbol, value at the date of the donation, the date you acquired it, and cost basis of the shares. Make sure the date you acquired it is more than one year from the date of the donation.

- You will receive a 30% of adjusted gross income deduction for the contribution of appreciated securities held long-term. Any unused deduction can be carried over to future years.

- This tells the IRS and Turbo Tax that this is a Donor Advised Fund contribution.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2023

6:16 PM