- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an op...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

Well, 2/7/24 has arrived. Still no update that i see. If i were late with my taxes, they'd charge me interest and fees. Where will i be able to charge TT or the IRS for fees and interest?!!? Ha, ha!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

Not sure what is blatantly false about the 2023 form bring available on the IRS website since at least 02/01. Maybe it wasn't a week. I wasn't checking it daily since I figured TT would have it once available. Which they do not.

https://www.irs.gov/forms-pubs/about-form-5695

As for filing late, no, of course that isn't yet a concern. However currently if you file using TT you get a discount... at some point that will go away. Probably the same day the make the form available lol.

I do concur that they really should have a pop-up of some sort to let you know you aren't working with the 2023 version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

@silversubaru23you're a consumer. You don't get to charge fees and interest. You get to take your business elsewhere. The only power you have as a consumer is to take your pocketbook to a competitor. That's how you send the message is by not giving TT anything at all; if you want fees & interest due to this form, all you're theoretically doing is just giving TT a little less $$ in the end. 😉

I also do not see the form updated yet. @DoninGA I'm not sure if you're a TT rep, but some explanation at this point would be nice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

As of 2/7 updated form is still not available for the $2000 credit! Any update?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

The form is still showing that is it to be updated today. So you may want to wait until tomorrow night as the updates generally happen overnight.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

Received an email and text from TT around 4pm eastern saying that the forms are now available. Still don't see where to enter the amount to get my credit. Still only get $300. Anyone else have any luck? Maybe it needs to update overnight.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

I just received an email stating it's ready and I could continue filing. Turbo Tax online doesn't show an area for me to list my heat pump that does qualify. There is a spot for a Geothermal heat pump but that's it. Starting to really wonder about TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

i get it....it was a joke.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

Same here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

Same here. Still waiting for a spot to add my Heat Pump for the $2000 credit...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

It says it was updated today, but i am still getting the wrong credit calculated for the insulation portion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

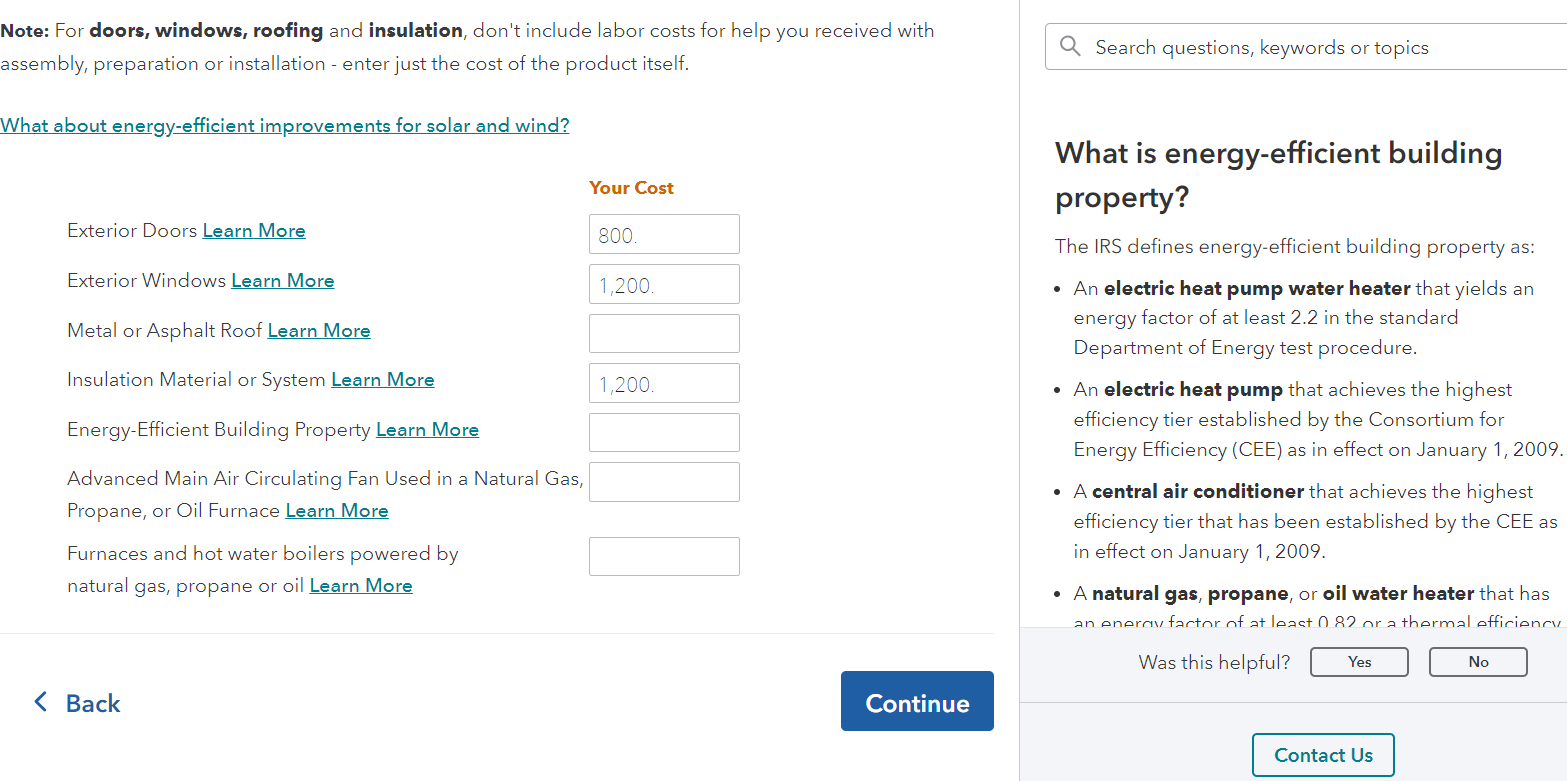

@silversubaru23 The heat pump water heater is included in the Energy Efficient Building Property Category. See screenshot below.

It seems as though part of the update happened. Wait until tomorrow to come back and check as it should update overnight fully. But, in the meantime below is where you will enter your heat pump water heater.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

That increases the $150 credit to $450 lol. Instead of $2600. (Furnace and heat pump) And not at all consistent with the official and final IRS form. Neverending joke. (To be fair HR Block doesn't have it either and despite what someone earlier said nor does TaxAct. I guess they are all waiting for someone else to update before they do.. and screw their customers)

But I am chastised for whining, shrug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

I've been waiting to complete mine on Turbo Tax only because I have done them here for the last 8 years. I just completed mine on Tax Act and it's done.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm trying to get the $2000 tax credit for the heat pump water heater. But I do not see an option for that. I looked through all the Energy saving section.

I tried to file today and it still wasn't working. Are there any updates on when the form will be up and running so we can file??

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ed 49

Returning Member

karliwattles

New Member

blueeaglewenzl

New Member

user17555657897

New Member

trenton-mains

New Member