- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: HSA Excess contribution - mistake

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

My employer made a mistake in my 2018 W2 i.e. they mentioned an excess contribution to my HSA account.. When I started the process of filing taxes on turbo tax I did not realize it but later got the W2 corrected. While I remember making corresponding changes in turbo tax it looks like my 2018 tax return has an excess contribution of about $3000 to my HSA mentioned in the 5329 (line 47).

This year it is asking me to pay $177 as tax for the excess contribution in 2018.

I am not sure how to rectify this. There was no excess contribution and I have statements from the HSA administering company to prove it and the corrected W2 for 2018.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

You should amend your 2018 return and enter your corrected W-2. The penalty on form 5329 will be eliminated and you will receive a refund of that penalty.

Please follow the instructions in this TurboTax Help topic to amend your 2018 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

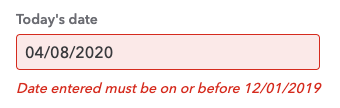

Thanks for the quick response. While trying to file state return electronically, it looks like there is a bug in the software. I am not able to e-file state return because of this. (screen shot attached)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

You can not efile the 2018. You will have to mail it in.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

First, the HSA custodian cannot know if you made an excess contribution because they are not doing your tax return, which has information that they are unaware of.

So let me ask you: Was there an excess HSA contribution in 2018 on the first W-2, or only on the corrected W-2? If it was on the corrected W-2, then - as you saw - the excess that is carried over to next year because it was not withdrawn by the due date of the return appears on the 5329 where you are assessed a 6% penalty for the carryover (if you had withdrawn the whole amount in a timely manner, there would have been no 6% penalty).

This amount appears on the Carryover Worksheet (you can;t see this in the Online product, but only in the CD/download product), and it is subtracted from your 2019 HSA contribution limit.

To fix your 2018 return (if indeed it actually had a problem), you will need to review your entries. It is possible to accidentally indicate to TurboTax that you had an excess contribution when perhaps you didn't. Please review the following admittedly lengthy list:

One of the purposes of the HSA interview is to determine your annual HSA contribution limit.

As you probably know, the maximum limits in 2018 are:

- $3,450 - individual with self-coverage

- $6,900 - individual with family coverage

- If the HSA owner is 55 or older, then you add $1,000 to these amounts.

However, these limits assume that you were in an HSA all year. If you left the HSA during the year or started Medicare or had one of a number of change events, then the limit is reduced.

There are several major culprits for excess contributions (other than just actually contributing more than the limit).

First, if you did not complete the HSA interview - that is, go all the way until you are returned to the "Your Tax Breaks" page - the limit still might be set to zero, causes a misleading excess contribution message.

There are questions all the way to the end of the interview that affect the annual contribution limit.

Second, it is not unusual for taxpayers to accidentally duplicate their contributions by mistakenly entering what they perceive to be "their" contributions into the second line on the "Let's enter your HSA contributions" screen.

Normally, any employee who made contributions to his/her HSA through a payroll deduction plan has the contributions included in the amount with code "W" in box 12 on the W-2. This is on the first line on this screen. Don't enter the code W amount anywhere on the return other than on the W-2 page.

Third, if you weren't in HDHP coverage all 12 months, then the annual contribution limit is reduced on a per month ratio. NOTE, this means that you have to indicate when and under what type of HDHP plan you had. Be sure to answer the questions on the screen entitled "Was [name] covered by a High Deductible Health Plan in 2018?".

Fourth, if you had a carryover of excess contributions from 2017, then this carryover is applied to 2018 as a personal contribution, which could cause an excess condition in 2018 as well. But note: if you had an excess contribution in 2017 but cured it by withdrawing the excess in early 2018, then do NOT report an "overfunding" on your 2018 return.

Fifth, the Family limit ($6,900) is for the aggregate of contributions by both taxpayers, even if both taxpayers have their own HSAs. That is, one taxpayer can’t contribute $6,900 to his/her HSA and the other contribute $3,450 to the other HSA – the $6,900 limit applies to the aggregate of all HSA contributions credited to the family (in this case, the excess contributions would be $3,450).

Do any of these apply to you?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

Here are the details.

Original W2 had a higher amount ($6400) - This was a mistake by the employer.

Corrected W2 had the correct contribution amount ($3400)

In the turbo tax interview, there was page which asked for "your contribution" where I think I duplicated the amount which resulted in the amount showing as excess in 5329. There was actually no excess contribution.

So I think I need to file an amendment. The product said that state return can be e-filed and the federal amendment must be mailed in. But right now I am not able to e-file state return as well so I guess I have to mail in both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HSA Excess contribution - mistake

Yes, you will need to amend your 2018 return. Your federal return will have to be printed and mailed. To learn more information on how to amend your return, please see this TurboTax FAQ: https://ttlc.intuit.com/replies/3288565

Note that this will create a new Carryover Worksheet with zeros in it for the excess carryover. When you re-import your 2019 tax return from the 2018 data (as amended), then the excess will not be subtracted from your 2019 HSA contribution limit (probably preventing another excess contribution message).

Now your 2019 federal return can be filed cleanly.

Note that once you do the amendment in TurboTax for 2018, you can proceed to doing your 2019 federal return. You do not have to wait for the amendment to be accepted by the IRS to file your 2019 federal return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

meltonyus

New Member

soccerfan1357

Level 1

xiaochong2dai

Level 3

user17545166365

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

march142005

New Member