- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

I prepared the entry in TurboTax Desktop Home and Business.

I entered the 1099-K as a Personal item sale.

Under Investment Income I selected 1099-B or broker statements.

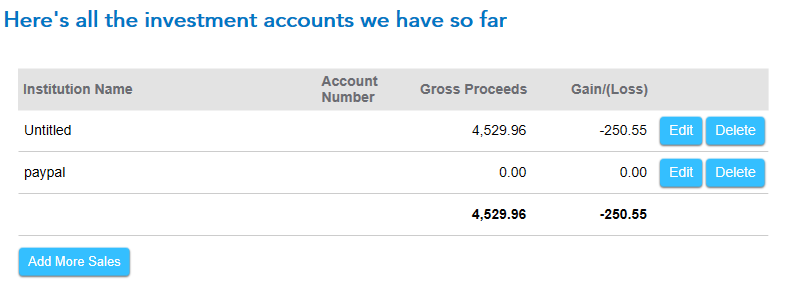

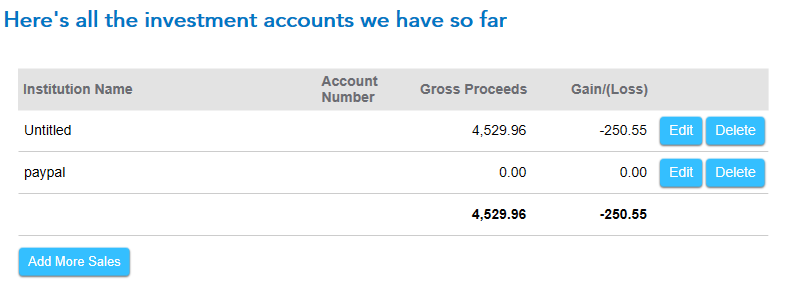

At the screen Here’s all the investment accounts, I selected Edit to the right of the Paypal entry created by the 1099-K.

At the screen Here’s all the sales reported by Paypal, I clicked Add and entered one sale at a time.

At the screen Was this a sale of employee stock, I selected No.

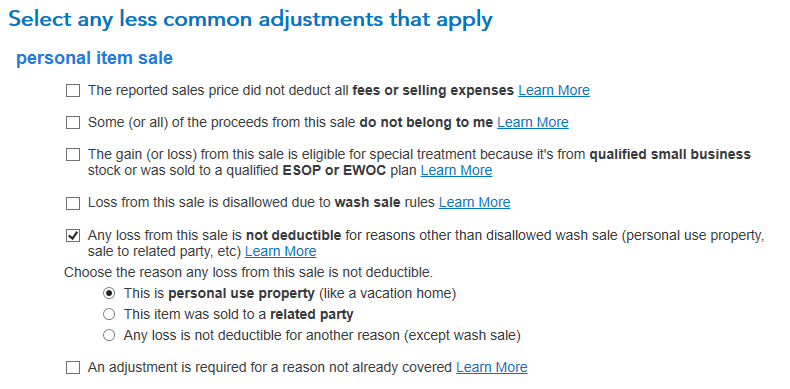

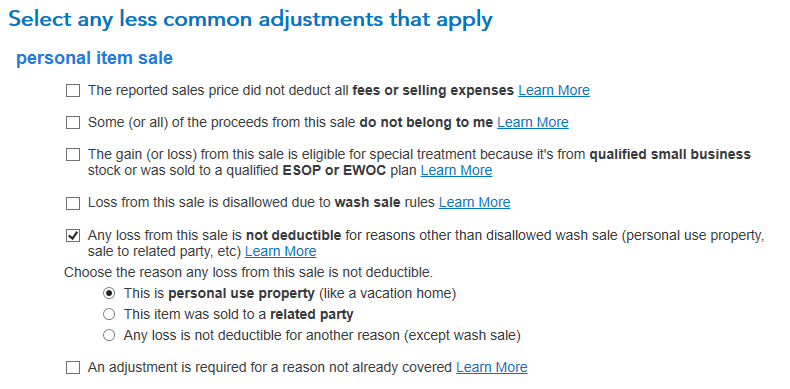

At the screen Select any less common adjustments that apply, I selected Any loss from this sale is not deductible and This is a personal use property.

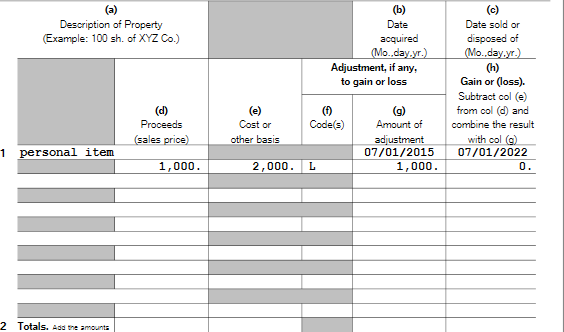

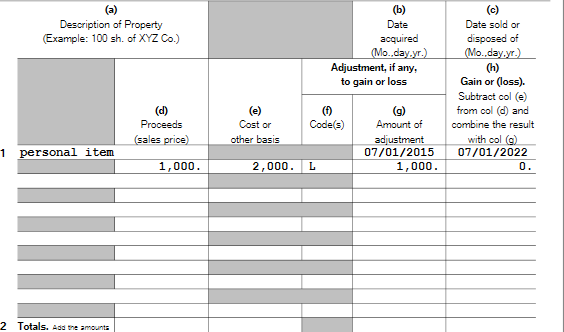

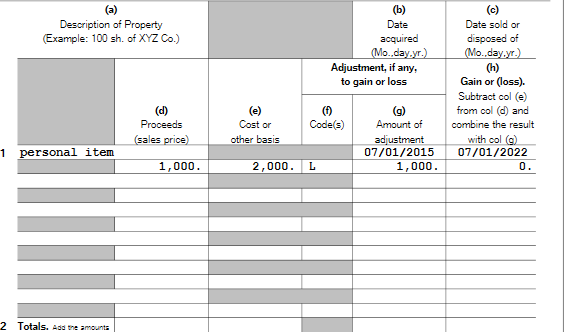

Here is the IRS form 8949.

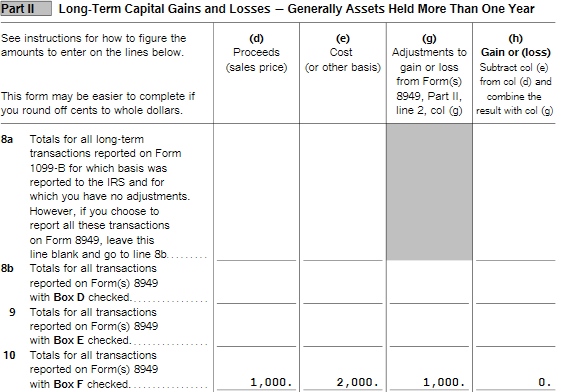

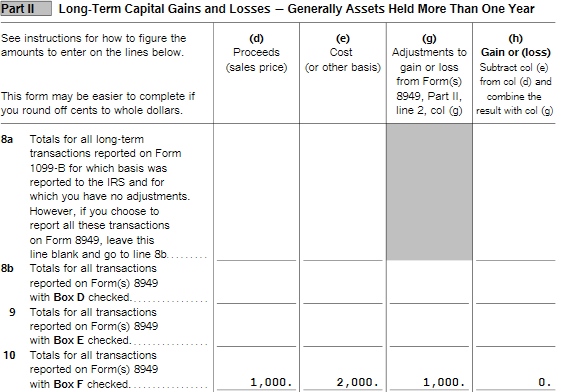

Here is the Schedule D Capital Gains and Losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

The following is the current guidance on receiving a 1099-K for personal items sold at a loss:

There was a revision on January 27, 2023, from the IRS reglong-termarding the reporting of 1099Ks, with losses from sales of personal item(s) reported to the taxpayer on form 1099K. It states to either report on Form 8949 as done, or Schedule I lines 8z and 24z, as applicable.

Again, since it is Personal Items, in TurboTax it's correctly reported on Form 8949. First, enter your 1099K, after you enter your Box 1a gross amount and payer select continue. Select “Learn More” for instructions to enter your cost basis and proceeds in another section for your losses/gains (see instructions below).

We’ve collected your 1099-K information, but you’ll need to add more info about your sale in another section.

- Select Continue on this screen.

- On the Your 1099-K Summary screen, select Done.

- From the Income Landing table, navigate to Investment topics, and select Start or Revisit for "Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B).

- Go to Investments and Savings (1099-B, 1099-INT, 1099-DIV, 1099-K, Crypto) on the Income & Expenses screen. Select Edit/Add.

- On Your Investments and Savings Summary screen, you’ll see a line item for your 1099-K income. Select Edit or Review and enter the information for the first personal sale item.

- Be sure to select Personal Items under the What type of investment did you sell?

- The Cost or other basis amount should be the amount you originally paid for the item.

- Select Continue when you’re finished to go to the Review your Sales screen.

- If there was more than one personal item sale included in the 1099-K amount, select Add another sale to add each item.

If you sold your personal item(s) for a loss, that loss cannot offset other income on your tax return like capital loss items (stocks).

If you sold your personal item(s) for a gain, then you’ll need to pay short or long term gains tax on it, depending on how long you held the item. This is why you should enter each item separately and not net them together.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

Thank you Joseph. I have tried this several times. However, using Turbotax Home and Business 2022 Desktop, step 5 does not work. When I go to Investment and Savings Screen it shows a line for the 1099K income, however when I edit it it does not offer "What type of investment did you sell" so I cannot select "Personal Items". Instead it goes to "Sale #1, Total proceeds, COGS, and holding period" Turbotax is now entering data into a 1099B not filling out Schedule 1 lines 8z and 24z as instructed by the IRS. I assume that Turbotax Desktop Home and Business 2022 needs and update for this, but I was not able to get a correct answer from Intuit yesterday on a phone call. Do you know anything about an update???Thank you, PeggyH3

- On Your Investments and Savings Summary screen, you’ll see a line item for your 1099-K income. Select Edit or Review and enter the information for the first personal sale item.

- Be sure to select Personal Items under the What type of investment did you sell?

- The Cost or other basis amount should be the amount you originally paid for the item.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

In TurboTax Desktop H & B, I entered a sale of personal items (for a loss) through the 1099-K screen.

I then updated the 1099-B entries. The screen following Was this a sale of employee stock was the screen Select any less common adjustments that apply.

I selected Any loss from this sale is not deductible... and This is personal use property...

The loss of a personal item sale was correctly reported on IRS form 8949 / Schedule D Capital Gains and Losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

JamesG1,

Thank you for your reply. Before I try your solution, I have two questions.

Did you do it in Turbotax Home and Business Desktop?

How did you update the 1099B entries?

Thank you!!

PeggyH3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

I prepared the entry in TurboTax Desktop Home and Business.

I entered the 1099-K as a Personal item sale.

Under Investment Income I selected 1099-B or broker statements.

At the screen Here’s all the investment accounts, I selected Edit to the right of the Paypal entry created by the 1099-K.

At the screen Here’s all the sales reported by Paypal, I clicked Add and entered one sale at a time.

At the screen Was this a sale of employee stock, I selected No.

At the screen Select any less common adjustments that apply, I selected Any loss from this sale is not deductible and This is a personal use property.

Here is the IRS form 8949.

Here is the Schedule D Capital Gains and Losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

JamesG1,

Thank you!!! I was able to do the entry into Turbotax Home and Business Desktop exactly as you wrote it! Thank you for the step by step exact procedure to take. I have only one question. On eBay's 1099K they include the cost of shipping collected from the buyer and then the net I receive is the sale price minus the shipping cost and eBay's fees. Do I increase the COGS for each sale by the cost of shipping and eBay's fees, or do I just use the purchase cost of the item sold?

Thank you!!!

PeggyH3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

No, the cost to ship to the customer is not part of the Cost of Goods sold. Both the shipping charge and the eBay fee are expenses that can be deducted in the calculation of your net profit.

The Cost of goods will include the purchase cost of the original item plus shipping charges to receive the item. IRS Cost of goods sold .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

JamesG1,

Reviewing your answer for entering the sale of personal items for a 1099K, why does your display of the IRS 8949 not show columns d (proceeds), e (cost), f (code), g (amount of adjustment), and h (loss or gain). Since the 1099K from eBay is detailed with monthly sales, I entered the sale item for each month and identified it as it was not as a "personal item" as in your 8949 column a (description of property). Doing it this way, the calculation for column h on 8949 actually came up with a $1 gain for two of the months. Obviously a $2 gain is not a problem, but I am wondering if I did the entries correctly.

Thank you!

Peggy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

The display may be awkward but it does report columns (d) through (h).

(d) $1,000

(e) $2,000

(f) L (code means nondeductible loss)

(g) $1,000

(h) $0

How did you code the entries if they were not 'personal items'?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

Hi JamesG1,

Thank you for your reply. When I entered the items I did code them as "personal items", and the code in column (f ) is "L" non-deductible loss". It was under column (a), on form 8949 that the exact name of the personal item sold is listed, i.e. one was a "saddle pad", where in your example of form 8949 in column (a), the description of property was "personal item". I just wondered if the description in column (a) for form 8949 made a difference. But I suspect not, since the calculation for column (h) in your reply above is the same calculation as on my form 8949. Please let me know if the description in column (a) does make a difference.

Thank you,

PeggyH3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

The description does not make any difference on your tax return. As long as you have reported the proceeds and not deducted any loss (since this was a sale of a personal item), form 8949 is correct as far as the IRS is concerned. @PeggyH3

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

Thank you DawnC, hope you have a good evening. PeggyH3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

OK since there are several experts here, I will ask this.

I'm selling items on Ebay like, a CD I bought in 1993, a LP I bought in 1981, an old stereo receiver I bought in 2003, a DVD from 2002 etc. You get the idea. There might be 100 of these types of items.

Does the IRS seriously believe I have to list each item with an accurate cost basis?

Sorry, but this is ludicrous and a waste of time, the best I can do is estimate what I paid for them and include shipping costs and fees.

I'm in VA and get 1099-Ks for as little as $600.

The only way to do this is to list as a lot on form 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to enter in TurboTax Home and Business 2022 DESKTOP a 1099K from Ebay under $20,000 for the sale of personal items at a loss

As long as none of the items were sold at a gain (if one or two things did sell at a profit, pull those out and enter them separately), you can enter them as one investment sale transaction/lot. Choose the option to list the sales individually (don't use the summary option or you will have to send documents to the IRS), but you can combine the personal items you sold at a loss. If you have any items that sold at a gain, enter the detailed information for those items as separate sales.

Anything you held for more than a year is long-term. Since these are all old items, choose an acquired date more than a year before the sale. Keep records of what you sold and your estimated costs for those items in the unlikely event that you are asked about the transactions. As long as you mark the sale as personal items and therefore do not deduct any investment losses, you should not have an issue or inquiry from the IRS. @johnmhtr

Personal items that you sell at a loss don't have to be reported at all, but since you received the 1099-K, this is just a way to report that tax form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

stays

New Member

user26879

Level 1

RyanK

Level 2

mikesaparito

New Member