- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

I prepared the entry in TurboTax Desktop Home and Business.

I entered the 1099-K as a Personal item sale.

Under Investment Income I selected 1099-B or broker statements.

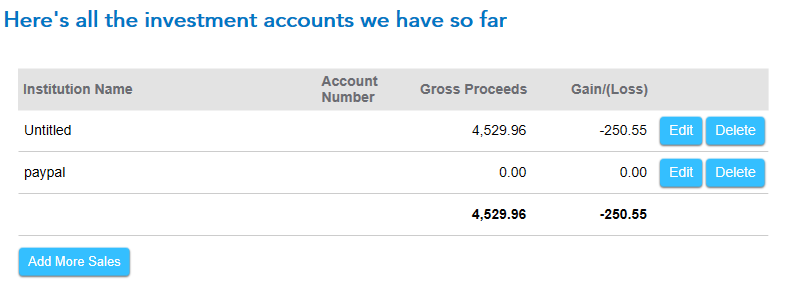

At the screen Here’s all the investment accounts, I selected Edit to the right of the Paypal entry created by the 1099-K.

At the screen Here’s all the sales reported by Paypal, I clicked Add and entered one sale at a time.

At the screen Was this a sale of employee stock, I selected No.

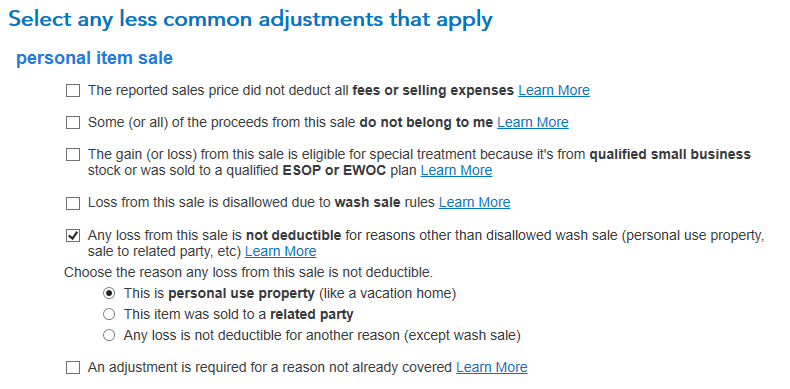

At the screen Select any less common adjustments that apply, I selected Any loss from this sale is not deductible and This is a personal use property.

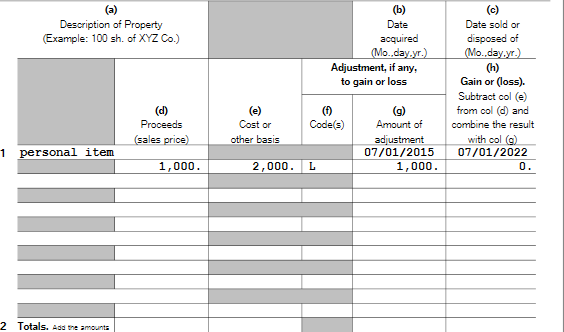

Here is the IRS form 8949.

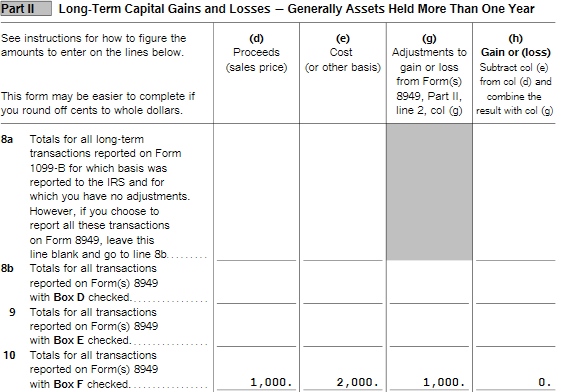

Here is the Schedule D Capital Gains and Losses.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 9, 2023

6:01 AM