- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How do I figure what the community property income adjustment is? We are married filing separ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

Community property states usually require that your income be split 50-50. Having said that, each state has nuances in their own laws that can make the calculations complicated.

If you have a situation where all of our income is under community property law, then each of you will be claiming approximately 94,000 of income (1/2 of 188,000, which is your total income). Your tax withholdings would also be split 50/50 between the two of you.

That is a general guide; you may need to look at specific Wisconsin law. And this FAQ can give you aditional information to assist you: https://ttlc.intuit.com/replies/3301943

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

would he write in addition adjustment or subtraction or both?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

When you are doing the Community Property allocation you will take the TOTAL for the community property for each category then divide it in half. For the amount attributed to each spouse, you add or subtract to make up the difference of the half. For example:

If Bob made $800 and Mary made $200 the total wages are $1000. One half is income to each spouse- which is $500.

Because Bob made more, he would have a subtraction to get his $800 to $500. Mary would have an addition of $300 to get her to $500.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

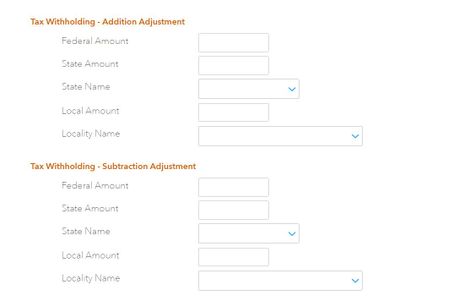

So in the image above, Bob would only add a subtraction of $300 in the Community Property Subtraction Adjustment field right and leave the other field blank?

And in the second image, I would do the same thing with tax (most likely a subtraction adjustment for Bob) withholding right? Another issue I noticed is that when I enter a positive value in the Tax Withholding - Subtraction Adjustment federal, state, and local amount fields, it says "maximum value is 0". I was wondering why this happens. Am i supposed to put a negative value? e.g. -300

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

I am having the same problem with the second image/section you are referring to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

Filing taxes in community property states (Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, Wisconsin) as married filing separately (MFS) can be complicated.

Certain states have laws about community property defining how they expect MFS couples to share, or allocate, income. TurboTax has allocation screens and a worksheet to assist you in entering any adjustments your community property state may require when filing separately.

For more information, refer to IRS Publication 555 Community Property.

If you're using TurboTax Online, we recommend that you transfer your return to the TurboTax CD/Desktop version. You'll save time by entering less information.

Begin by completing a MFS federal tax return for you and your spouse, as you'll need the amounts for different income categories, tax amounts, and all tax payments for each of you. If one of you plans to itemize deductions, the other person must itemize as well. Otherwise, you'll both have to use the Standard Deduction.

You may not be able to e-file, in which case TurboTax will guide you through the steps to print and mail your return.

Entering income adjustments for a community property state

Complete the community property worksheet

If you need additional assistance you may want to go to a LIVE Expert. There is a fee for this service but they will walk you through the screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

I think we need a clear cut example of filing MFS in a community property. I called TurboTax support a couple years ago on this but they couldn't provide a straight answer so Intuit refunded the software. I'm giving this one more shot but the provided TurboTax article is still not clear: https://ttlc.intuit.com/community/married/help/married-filing-separately-in-community-property-state...

I know how to file MFS in a community property state on paper but I can't figure out how to answer TurboTax's software questions such that it populates the underlying forms correctly.

Question 1: Entering W2 information in the Wages and Income section. When Spouse 1 enters W2 information, you cannot just enter a 50/50 Split for Box 1 (Wages, tips, other comp.) and Box 2 (Federal income tax withheld) and then input the values for the remaining boxes as is. If you do, TurboTax will notice the numbers don't jive. How exactly do we input W2 information in this section?

Question 2: If you are doing the 50/50 Split in the Wages and Income section of TurboTax, then what is the need for the Community Property Adjustments Section?

Question 3: Does Spouse 1 also input Spouse 2's W2 into Spouse 1's tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

It depends. Let's answer the questions in reverse order.

- You do not need to enter the spouse's W2 income into your return.

- Reason you are doing 50/50 splits because this would is what is required in community property states. If this requirement didn't exist, then you be able to make any split you like. Look at it like what is mine is mine and what is your is yours without any regard to a 50/50 split. Not allowed to do that in a community property state.

- As far as determining income, I have always prepared returns by combining totals of all W2's and then enter the 50/50 split in Turbo Tax. The information entered on your W2.

- For an example, your wages will appear in the community property wages screen. You will then enter your spouses total wages in the screen. Same is true for all other types of income and deductions. When all the reporting is done, Turbo Tax will determine the 50/50 split.

- Note some of the income such as dividends and interest may be reported in your return but your spouse might not have any. If this is the case, you will enter 0 in your spouse's entry

- To get to this section, type in 8958 in the search bar and then when it says Jump to 8958, this will bring you to the section to begin reporting this. Your spouse will do the same thing in theirs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

Correct me if I'm wrong but here is a simple example of how to populate TurboTax based on your advice. I've listed the TurboTax sections, fields and values to input for those fields:

Spouse 1 W2 from Company A

-Box 1 (Wages, tips, other comp.) = $60,000

-Box 2 (Federal income tax withheld) = $15,000

Spouse 2 W2 from Company B

-Box 1 (Wages, tips, other comp.) = $40,000

-Box 2 (Federal income tax witheld) = $7,000

Spouse 1's Tax Return

-Wages and Income

--Input Spouse 1's W2 Tax Return exactly as presented in W2. NO splitting here. Do NOT input Spouse 2's W2.

Now we're done inputting W2s. Next is the Community Property Income (which you called "Jump to 8958")

-Community Property Income Adjustments:

---Community Property Subtraction Adjustment = $10,000

-Community Property - Wages:

--Company A: You=$30,000. Partner/Spouse=$30,000. Total Wages=$60,000

--Company B: You=$20,000. Partner/Spouse=$20,000. Total Wages=$40,000

-Tax Withholding Adjustments:

--Tax Withholding - Subtraction Adjustment

---Federal Amount= -$7,500

-Enter Your Spouse's Community Income:

--Taxes Withheld: You=$7,500. Spouse=$7,500. Totals=$15,000

Then, if you switch to Forms view in TurboTax you will see the 1040 lines populated as follows:

Line 1 = $60,000

Line 8 = $-10,000

Line 25a = $15,000

Line 25c = $-7,500

Important notes on this method:

1040 Line 1 and Line 25 does not take into account Spouse 2's W2. Spouse 2's W2 info is only recorded in 8958 and it does not make changes to the overall return.

Understand this is a different method to arrive at the same final amount owed/refunded to taxpayer. TurboTax makes income and withholding adjustments on Lines 8 and 25c. Instead, my CPA records $50,000 on Line 1 ($60,000+$40,000=$100,000, $100,000/2=$50,000) and $11,000 ($15,000+$7,000=$22,000 $22,000/2=$11,000) on Line 25a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

While we can't manually check your calculations here on this forum, you can be sure that they are done correctly by using Form 8958 to determine the allocation of tax amounts between married filing separate spouses or registered domestic partners (RDPs) with community property rights. TurboTax will guide you through the process. This form is intended for individuals who: 1. Are subject to community property laws, and 2. File separate federal income tax returns.

Here is how to enter the adjustments for a community property state:

First, use your community property state rules to determine what adjustments you expect to enter in TurboTax. Often one return has an addition to income and withholding, while the other will have a reduction (subtraction) to income and withholding.

- Sign in to TurboTax and open or continue your return.

- Search for community property and select the Jump to link.

- On the Community Property Income screen, select Yes and follow the instructions to enter any income adjustments.

Complete the community property worksheet

After you've told us your income adjustments, you'll have to fill out the community property worksheet. The worksheet shows how the income on this tax return compares with the other taxpayer's return.

Your community property worksheet will appear right after you complete your income adjustments.

If you can't find the worksheet:

- Sign in to TurboTax and open or continue your return.

- Search for community property worksheet and select the Jump to link.

We’ve added clear instructions directly on the worksheet to guide you through filling it out correctly.

Once you've determined how to split both your combined income and tax withholding between you and your spouse, continue with your state tax return (if applicable).

You may not be able to e-file, in which case TurboTax will guide you through the steps to print and mail your return.

@junsolicited

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

I've read the TurboTax article and it does not provide the detailed guidance which I need to answer my above question. Was hoping to get confirmation on my simple example. Thought I'd give TurboTax another shot this year but no dice. I'll just do it on paper again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

@junsolicited It's complicated to an extent because each state has their own community property laws, which means that there can be variances as to what is or what is not community property, so it is impossible to comment to that specific level.

Having said that, your calculations in your example look correct. Nevertheless, it may be that TurboTax calculates/reports the income in a slightly different way as the CPA, and neither is "wrong". However, I do suspect that you forgot to input your spouse's withholdings, because either you should be showing 22,000 in Box 25a and -11000 in box 25c or 15000 in Box 25a (what was actually withheld from your income) and -4000 in Box 25c (from Form 8958 adjustment after both spouses are factored in). So check your entries to make sure you got this in there correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

No and that highlights how TT differs from how my CPA does the taxes. If you only input Spouse 1's W2 into the Wages and Income section, then TurboTax only puts Spouse 1's income and withholdings on Line 1 and Line 25a. Nothing you do in the Community Property Income Adjustments section of TT will change that. TurboTax makes the adjustments in Line 8 and 25c whereas my CPA doesn't use those lines. He actually makes the adjustments in Line 1 and Line 25a, respectively.

To rephrase, the changes TurboTax makes to 8958 have no bearing on the W2.

-On Spouse 1's return, TurboTax only does a 50/50 split of Spouse 1's W2 on the 1040.

-On Spouse 2's return, TurboTax only does a 50/50 split of Spouse 2's W2 on the 1040.

My CPA inputs BOTH W2s in each return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I figure what the community property income adjustment is? We are married filing separately, her income was 111,661 and mine was 76,812.

I have the same dilemma and have been searching to find an answer all day. I like the example that you used and it seems as if the cpa is saying that your example is correct besides the missing information. Does it really matter where the adjustments are made as long as they are made and it's correct? I wish turbotax would have a walk-through so that people can see examples of how to do these things.

Also, I am confused how you got $7500 for the subtraction adjustment below? As i thought you would add both federal with-holdings from both spouse ($11,000 + $7000) and then divide by 2. But you just split the $15,000 in half. What about the other withholding of $7000? Do you just split that in half too?

-Tax Withholding Adjustments:

--Tax Withholding - Subtraction Adjustment

---Federal Amount= -$7,500

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

eric6688

Level 2

Candyman

New Member

Blue Storm

Returning Member

sy1phidscribb1es

Level 1

emark3365

New Member