- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: How and when to enter 1099-SA for 2024 taxes Turbotax premier desktop

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How and when to enter 1099-SA for 2024 taxes Turbotax premier desktop

Spouse received 1099-SA form for 10 years old HSA account; now received HSA debit card in 2024 year and 1099-SA form from custodian,

box.3 "distribution code "1" - normal distribution"

box.5 = HSA checked

Turbotax premier version desktop:

Q1: when to enter this 1099-SA form? is it under "Wages & Income" tab, -or- "Deductions & Credits" tab, -or- "Other Tax Situations" tab

Q2: Is this taxable by any means? - does it impact taxpayer due/refund amount (causes increase/decrease)

E.g.: If tax payer currently have due of $50, after 1099-SA will this due increases even more with distribution code "1"

There's no W-2 entry for this distribution, because it's more than 10 year old, very old contribution; also no W-2 for spouse. Tax filing: MFJ filer

Q3: what is search "Jump to" feature/means in Turbotax?

Heard this is not a taxable item; true or false - please share some insights.

When first entered during "Wages & Income" tab, "Federal refund" box on top decreased, so deleted the entry to better understand. Pictorial guidance is appreciated. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How and when to enter 1099-SA for 2024 taxes Turbotax premier desktop

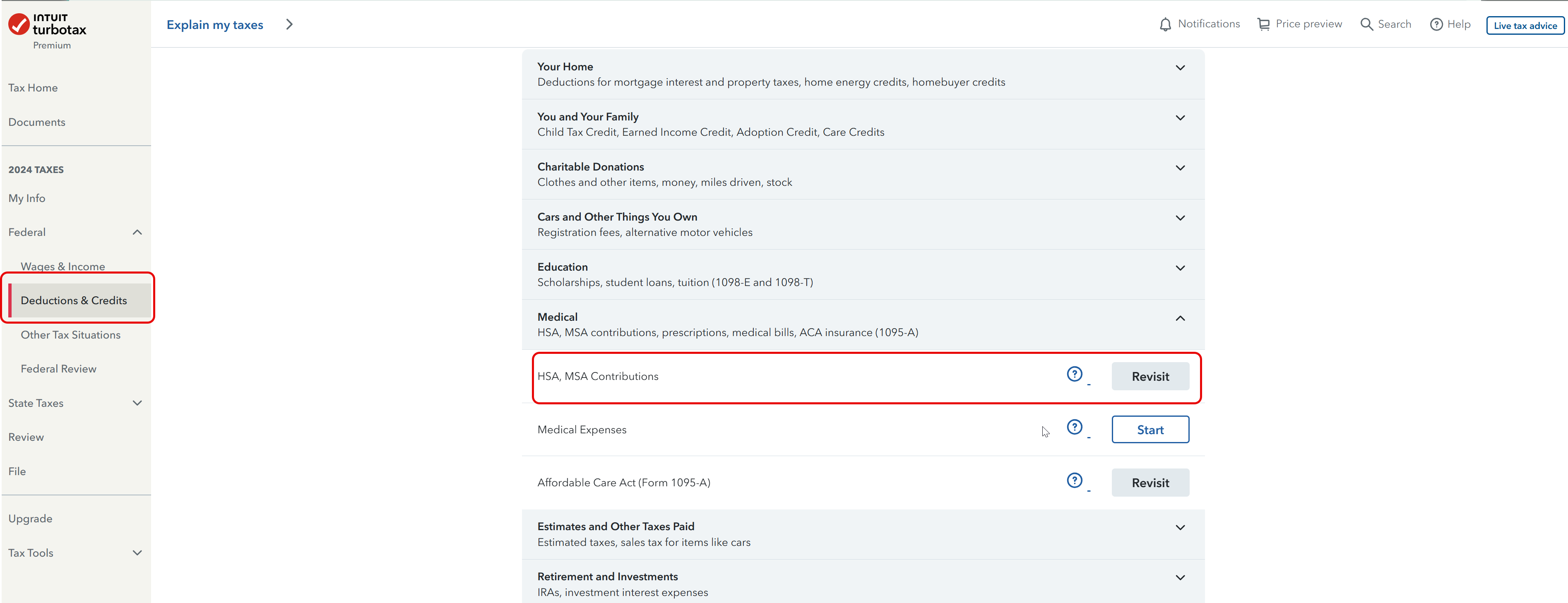

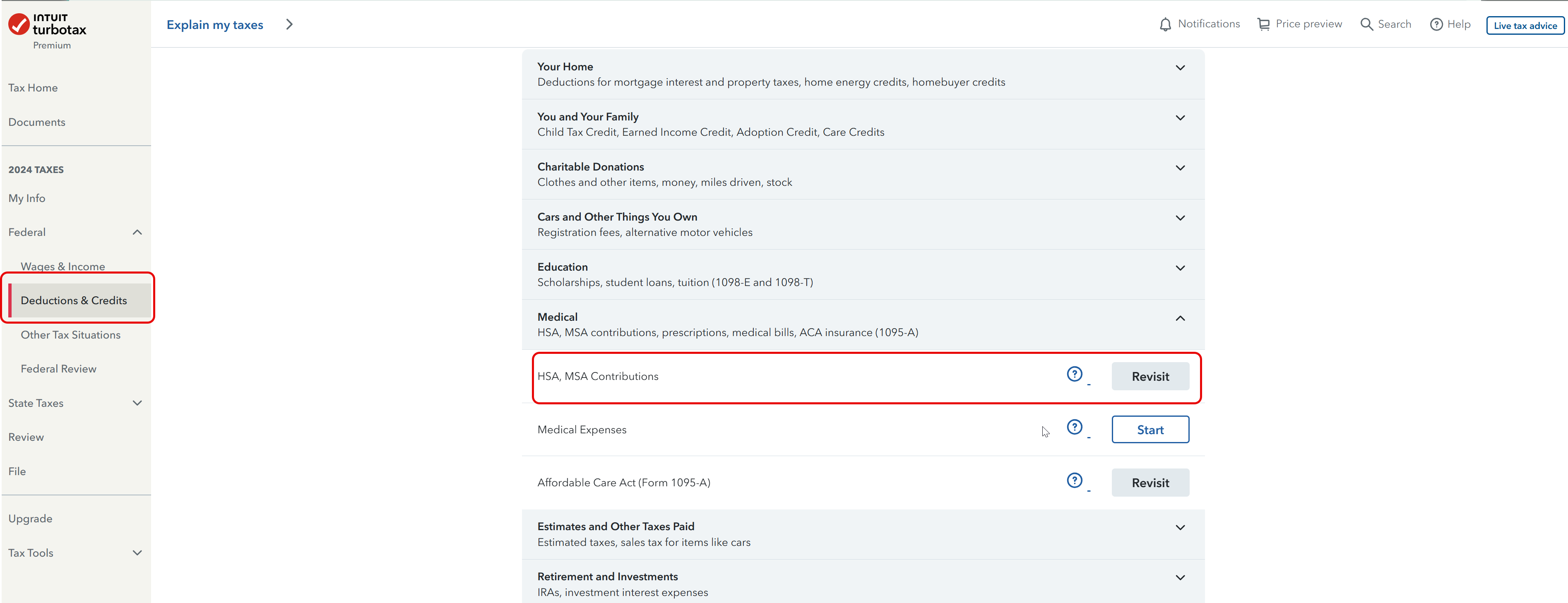

You enter the 1099-SA in the Deductions & Credits section- HSA, MSA Contributions.

It will ask "Did you use your Health Savings Account (HSA) to pay for anything in 2024? Choose Yes.

Enter the 1099-SA info.

It will ask "Did you spend your HSA money on medical expenses only?"- If you used the funds for medical expenses, it is not taxable. TurboTax will create the Form 8889 to file with your tax return.

Please let us know if you have any additional questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How and when to enter 1099-SA for 2024 taxes Turbotax premier desktop

You enter the 1099-SA in the Deductions & Credits section- HSA, MSA Contributions.

It will ask "Did you use your Health Savings Account (HSA) to pay for anything in 2024? Choose Yes.

Enter the 1099-SA info.

It will ask "Did you spend your HSA money on medical expenses only?"- If you used the funds for medical expenses, it is not taxable. TurboTax will create the Form 8889 to file with your tax return.

Please let us know if you have any additional questions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How and when to enter 1099-SA for 2024 taxes Turbotax premier desktop

@SreenuPrabhaGMAl , Namaste ji

Having read and agreed with the res[ponse of my colleague @MaryK4 on how to correctly enter the details of 1099--SA and use TurboTax to file a correct return for this "HSA Distribution", I would just like add the following:

(a) A complete guide to HSA -- statute section 223 --> 26 U.S. Code § 223 - Health savings accounts | U.S. Code | US Law | LII / Legal Information Institut....

(b) summary position ---

1. Is it taxable income -- NO , if you use the distribution for defraying health related expenses; YES it is taxable to the extent that it is not used for health costs;

2. Is there any surcharge/penalty --- there is an age based penalty of 20% of unqualified use

3. This money was never taxed but has been expensed by your employer.

This is only for context -- please follow the instructions of @MaryK4 for recognizing this distribution from the trust.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Micky2025

New Member

MaxRLC

Level 3

MaxRLC

Level 3

kkrana

Level 1

Impulse

Level 2