- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

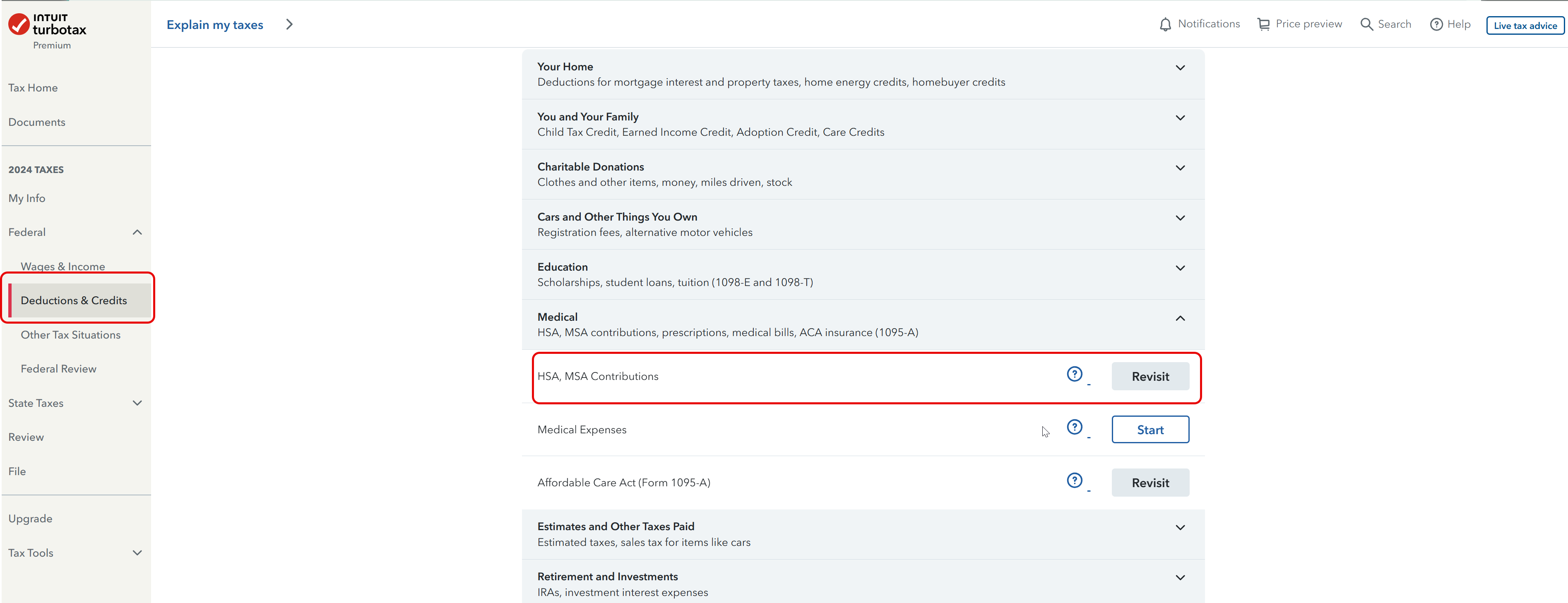

Deductions & credits

You enter the 1099-SA in the Deductions & Credits section- HSA, MSA Contributions.

It will ask "Did you use your Health Savings Account (HSA) to pay for anything in 2024? Choose Yes.

Enter the 1099-SA info.

It will ask "Did you spend your HSA money on medical expenses only?"- If you used the funds for medical expenses, it is not taxable. TurboTax will create the Form 8889 to file with your tax return.

Please let us know if you have any additional questions.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2025

6:30 PM

5,826 Views