- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Form 8936 (2019) has an error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Line 4a has the correct 7,500 credit; line 4b has the correct phase-out percentage (24% for Tesla purchased in September) but line 4c should be 7,500 X 25% = 1,875 but instead it says 7,500. This results in an incorrect credit calculation and excessive refund!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

See this TurboTax support FAQ for the form 8936 error - https://ttlc.intuit.com/community/tax-topics/help/form-8936-qualified-plug-in-electric-drive-motor-v...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

This form is not final yet.

It should be available 24 hours after the IRS approves TurboTax to use the form. Currently, the IRS has not finalized the form. Here is the IRS web page to check the status of form 8936: Available Forms and Limitations. Scroll down to Form 8936.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

It IS available, and as the original poster stated, the application is not processing the calculation correctly. I suggest TurboTax fix this ASAP otherwise they'll be on the hook for a lot of improperly submitted tax returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

The IRS has NOT finalized this form yet. Please click the link below.

It should be available 24 hours after the IRS approves TurboTax to use the form. Currently, the IRS has not finalized the form. Here is the IRS web page to check the status of form 8936: Available Forms and Limitations. Scroll down to Form 8936.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Might be worth mentioning to Inuit/TurboTax to NOT include a form that's not finalized.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

@Idelatorre We have tested your situation and it does limit the tentative credit correctly. Can you run and update, then re-enter the data. If you continue to have issues, please contact support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

I am having the same issue. It's not doing the math. This is on the online version, with a Chevrolet Volt.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

I would if I could, but Intuit's horrid site goes out if its way to make it impossible to open a support ticket.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

The IRS just released Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit yesterday. This form is needed to claim the credit. We are working fast to get this update into the TurboTax software. Form 8936 will be available by March 8, 2018.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Yes, 2018 seems appropriate (eye roll). I love these constant posts by so called "experts" about it not being available yet, when it's clearly available in the app. Do you guys get a commission for each post?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

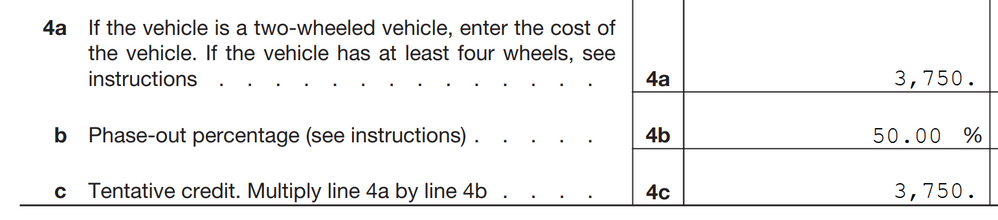

Oof yea, this is really bad. The software incorrectly calculated my credit as $7,500 (Tesla model 3 purchased in March of 2019 should be $3,750) so I manually changed it to $3,750. But then when I view the form it generates when I go to file, it's doing incorrect calculations. On form 8936 line 4a it says "3,750" (should be $7,500), line 4b correctly says "50.00%", and line 4c has the correct value of $3,750, but is doing the wrong math because it should be 4a multiplied by 4b.

So mine looks like:

$3,750

50%

$3,750

But it should look like:

$7,500

50%

$3,750

Now stop giving this nonsense about the form not being available, the software *has* the form available, and is entering it onto 8936 incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

See this TurboTax support FAQ for the form 8936 error - https://ttlc.intuit.com/community/tax-topics/help/form-8936-qualified-plug-in-electric-drive-motor-v...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Please don't respond if you don't know what you are talking about. This already a know issue and has nothing to do with IRS approval.. Turbotax software programmers dropped the ball on this one. It calculates it wrong!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Unacceptable!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

I am a victim of the Form 8936 error when I filed on 2/14/2020. After I filled in the information for the EV credit I noticed that TurboTax calculated the wrong EV credit value so I put $1,875 for the credit (per IRS) to claim and after filing I received a rejection email. The TurboTax email didn't clearly explain the problem but said to refile on 2/20/2020. I logged back into TurboTax to see if there were any obvious errors in the EV credit data but didn't see any. I looked at Line 4c of Form 8936 and it correctly listed $1,875 so I figured I would wait for TurboTax to fix their software as the email didn't specify what the error was and I didn't know what to look for.

On 2/20/2020 I logged back in and TurboTax said everything was fixed and I should just continue to refile. However, I noticed that the refund amount was lower than expected so I revisited the EV credit section and noticed that TurboTax said I would get an EV credit of $469, not the expected $1,875. I changed the EV credit from $1,875 to $7,500 and then TurboTax correctly said I would get an EV credit of $1,875. I tried other values and TurboTax just blindly divided it by 4.

Upon further analysis of my 2/14/2020 Form 8936 I noticed that Line 4a showed $1,875 (this should have been $7,500), Line 4b correctly showed 25.00%, and Line 4c correctly showed $1,875. The 2/20/2020 TurboTax software fixes the math on the form but not the section where you input the data.

After changing the EV credit to $7,500 in TurboTax, Form 8936 now shows $7,500 on Line 4a so hopefully my resubmitted return will be accepted.

Lesson Learned: Don't assume software fixes are properly implemented. Had I believed that TurboTax was fixed I would have received a $469 EV credit instead of $1,875.

TurboTax Design/Software Problem Report: The EV credits are listed on the IRS website that you provide a link to your users. The software should use this information rather than relying on user inputs that can potentially be incorrect. The user should enter the date of purchase and the VIN which the software can decode into make and model which can be confirmed by the user or rejected and then allowed to manually enter in Vehicle and EV credit information (including phase out information). For vehicles listed on the IRS website, the software can determine the correct EV credit and the users won't have to waste their time looking up gross vehicle weights or looking up the EV credit they think their vehicle qualifies for. Since users are not expected to look up taxes in the IRS tables to input it into TurboTax, users should not need to look up EV credits on the IRS website to enter it into TurboTax. TurboTax should allow exceptions but should not penalize all users to input information readily available from the IRS.

Update 2/21/2020 (updated):

The IRS has accepted the updated form that I filed on 2/20/2020.

Since others on this forum have also encountered this problem, I would suggest Intuit audit all of the Form 8936 victims to see if they are getting the correct EV credit amounts and contact them if they aren't getting the correct EV credit. Some people may not have noticed that the "fixed" Form 8936 contained the wrong EV credit amounts and TurboTax may not have flagged it as an error so some people may not receive the correct EV credit.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jtrevor

Level 3

angeeeee

New Member

user17683222006

Level 1

quinnamg

Level 1

gerardh

New Member