- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Filed as a dependent by mistake! (Stimulus Check?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

So.. hear me out.

This was my first time filing my taxes ever, I just started my first job ever last year. I do live at my parents house but I earn more than 10k a year. Obviously my mom didn't claim me as a dependent because I make my own money now.

My question is, what information is the treasury using to determine who gets a stimulus check? My mom did not claim me as a dependent, I selected the dependent check box but will whoever is working on those stimulus checks notice that nobody actually claimed me as a dependent even though I clicked on the box?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

If you checked the box, on your return, that says you can be claimed as a dependent; you will not be getting a stimulus check. The IRS will not be checking to see if you were actually claimed.

This question has come up lot, here in this forum, and what is not clear is: what happens if you file an amended return to uncheck that box.

But, if you don't get it this year, you'll get it next year (if you still qualify). Under the CARES Act, if you are claimed as a dependent (or qualify to be claimed) on someone else’s return you cannot receive a stimulus check, in 2020. If you could be claimed as a dependent for 2019, but will not be for 2020, you will most likely get it in 2021.

"In essence, the stimulus check acts as an advance of your 2020 income tax refund. This means when you prepare your 2020 income tax return, there will be a line to include the section 6428 credit. The credit on your 2020 return is subtracted by any amount received as a stimulus check in 2020. If the amount you received as a stimulus check is less than the credit you are due, the difference will be included as part of your 2020 refund. If you have been overpaid by receiving the stimulus check, however, you will not be required to return any excess amount".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

No, the current guidance is that stimulus checks will be paid according to the 2019 tax return filing. If this was not filed, then the 2018 tax return will be used. For anyone that was claimed or could have been claimed as a dependent, there is no eligibility for a stimulus check as Champ @Hal_Al stated.

I recommend confirming whether or not you really are a dependent. Check 2019 Publication 501 Dependents, Standard Deduction, and Filing Information on page 4 and page 11 to determine if you are or are not qualified to be a dependent as a qualifying child or as a qualifying relative.

You can file an amended return to be independent. But, this is sent in through the mail and takes 16 weeks to process. It is best to pay the extra money and send it certified mail so you have proof. Click the link for instructions: How to amend (change or correct) a return you already filed

In the meantime, you can visit the following links for the most recent updates:

TurboTax Corona Virus Tax Center Updates

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

@sasha03m wrote:Obviously my mom didn't claim me as a dependent because I make my own money now.

That does not necessarily mean you are not a dependent.

How old are you? Were you a full-time student at all in 2019? What about in 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

If she can or qualify to claim you on the 2019 tax return, you will not receive a stimulus check even though she does not actually claim. However, if she does not qualify to claim you on their 2020 tax return, which will be done next year, you will still receive the stimulus payment.

Per IRS, if your parents qualify to claim you, but do not actually claim on the return, you are not eligible for the stimulus.

To check if she qualifies to claim you, click here: Credit for Other Dependents

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

Do you recommend filing the amendment now? I just read that the IRS is no longer processing paper returns. I'm in a similiar situation & wondering if I should leave it until later. I do appreciate the information on whether or not the IRS checks to see if you were actually claimed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

@suzygib You need to find out *IF* you QUALIFY as a dependent or not. You don't get to choose, it is a matter of fact. It does not matter if a parent actually claimed you or not. You need to find out if the parent was ELIGIBLE to claim you.

https://www.irs.gov/help/ita/whom-may-i-claim-as-a-dependent

After determine that, *IF* your tax return is wrong, yes, amend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

Hello @KathrynG3,

I am in the same situation. I checked the box "Someone can claim you as a dependent." But my parents did not claim me. Therefore I will file an amended tax return.

But will I still qualify to receive the Stimulus Check? If so, when would that be?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

@SamuelAmbar Read my comment above. If they are ELIGIBLE to claim you as a dependent, you won't amend. You CAN'T claim yourself if somebody else CAN claim you. Trying to do so would be fraud.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

I’m in the same boat as you... I filed as a dependent out of habit, for when I was still going to school. However, I found out they have not claimed me for the past couple of years. They did not claim me this year either, but the IRS will be going off of your filing status. Not by whether you were actually claimed. We are both screwed. Misery loves company I guess.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

Same!..... My father did not claim me, but I checked the dependent box out of habit also. I amended my return and will mail the 1040 today. I am not sure if I will receive the stimulus check because it takes 12-16 weeks to process and the deadline is July 15. I hope it comes after they process it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

Hey, what form did you use to uncheck the dependent box?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

My son is 16 and he filed taxes for the first time for tax year 2019. He definitely had the box checked for "Someone can claim you as a dependent". He received a stimulus payment of $1200. Will they correct the mistake and pull the money back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

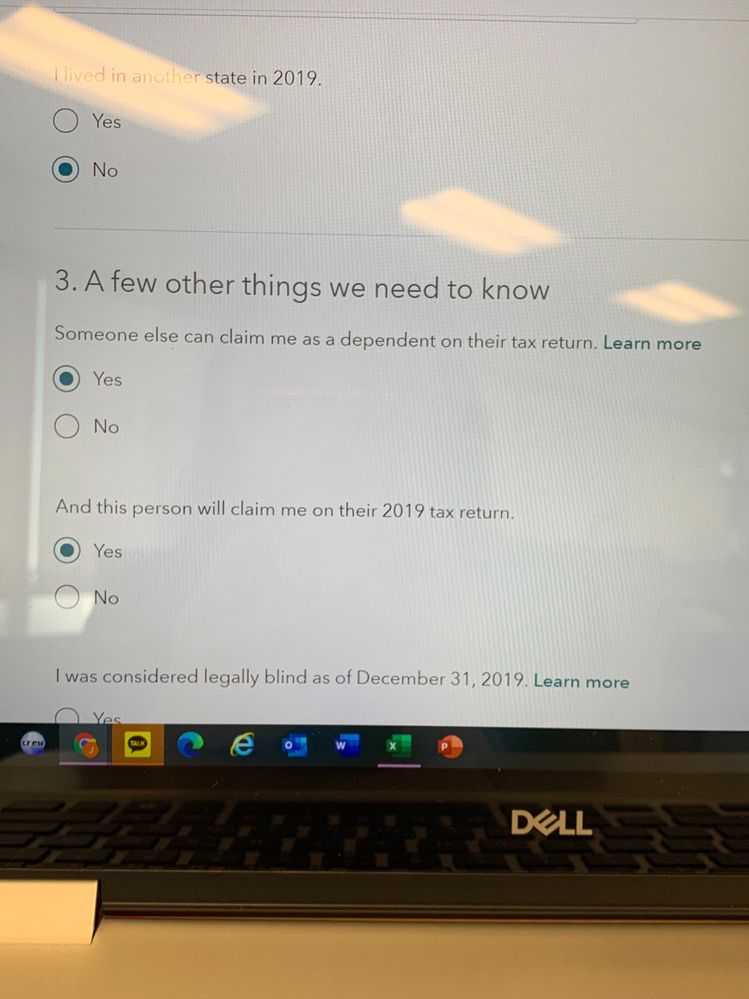

Just click on Amend Return and click No for this section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filed as a dependent by mistake! (Stimulus Check?)

I too did the same as you, but i amended my tax return as soon as i realized they were not going to claim me. My account got adjusted the 27th of March, but when i checked the status of my stimulus it said that it wasn't able to process if i am eligible. Can someone help me out? Will i still be receiving the stimulus check.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

stagen-pj

New Member

johndawson1

New Member

mshaikh010

Level 2

D4U

New Member