- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Employer Payroll Tax deduction on 1120-S

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

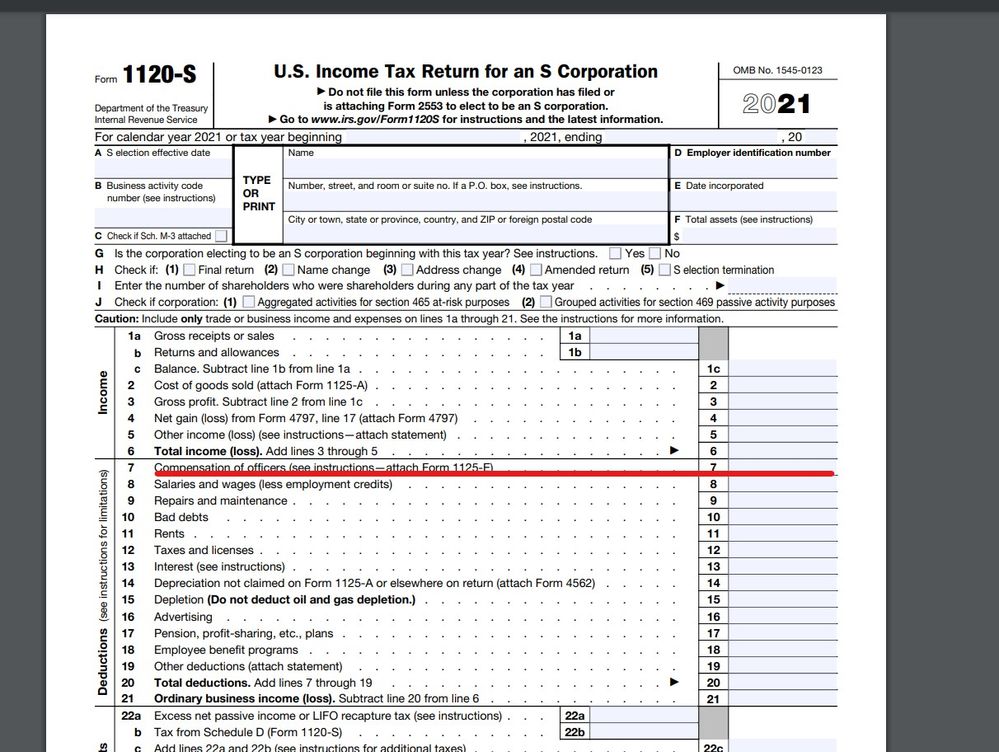

I just wanted to make sure Turbotax was working correctly and that I didn't file wrong due to the software algorithm being incorrect. I entered the employer payroll taxes into the section that turbo tax labels as payroll taxes assuming that it would know where to put it. However upon looking back at it after I already efiled, it appears that in addition to listing it on line 12 taxes and licenses as it should, it also added it into the w2 wages box 7 compensation of officers. I am the only employee so all income is reported in that box, but now the w2 does not match box 7 as I thought it should and it looks like it is double crediting me for the payroll taxes? I just wanted to see if this was an error and if it was let Turbotax know they need to fix their software. Doesn't save me from having to file an amended return but hopefully it will save someone else.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

Payroll taxes should be reported under the Compensation and Benefits section of the step-by-step for the 1120S in TurboTax Business.

The Taxes and Licenses category is for tax expenses like sales taxes or property taxes.

If you make this correction your W-2 should be reporting correctly again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

Ok ... I think you may be misunderstanding things ... the gross wages paid goes on the salaries and wages paid line for the officers of the company AND then the FICA taxes paid by the company (company's 1/2) are payroll taxes. Make sure the wages end up on line 7 ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

That is exactly where it was put but when looking on the actual forms that are filed it changes the actual numbers. My w-2 wages paid for line 7 are 45k. since I put in the payroll taxes where turbotax indicates and your picture shows for 3k we'll call it, when it fills to the actual form on the 1120-S it is now reporting the 3k in box 12 as well as adjusting line 7 to read as 48k. I don't want to get audited because turbo tax is reporting higher w2 wages than the w2 that was filed. Does that make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

Interesting ...

Please contact support via phone for assistance with this situation ... contact details can be found here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

Curious, did this ever get solved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

Is it true that we put 1/2 of our payroll tax payments in on line 12 of 1120S?

Is this number also combined with w2 wages to be included as compensation on line 7 of 1120S?

Does that number include STATE and FED?

IF so- and we take distributions already accounted in an S corp as in other taxable income for in previous years where do the distributions get posted?

If they get entered on line 17d, how do we determine which code to classify them as?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Employer Payroll Tax deduction on 1120-S

No, report 100% of the payroll taxes that were paid by the S-Corp under that topic under Deductions in the Step-by-Step interview. This amount is included on Line 12 of Form 1120S. Other taxes may be included in that total amount that appears on Line 12. You can see the complete calculation in Forms Mode under Line 11 "Taxes and Licenses Smart Worksheet."

We highly recommend that you make all entries from the interview screens so the amounts are recorded on the proper forms. Direct entry in the forms may invalidate the TurboTax Accuracy Guarantee and could invalidate the return for e-filing.

Form 1120S Line 7 reports Compensation of Officers only. No payroll taxes should be included in this amount.

Form 1120S Line 17 reports pension plans, which may include profit-sharing plans. This line does not include distributions to the shareholders.

Distributions (cash or property) are entered from the main screens under Business Info >> Shareholder Information >> Done Entering Shareholders >> 20XX Distributions to Shareholders. The amount you enter under Cash or Property is allocated to the shareholders according to their ownership percentages. The allocated distributions appear on Schedule K-1 Box 16 Code D.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shikhiss13

Level 1

1dragonlady1

Returning Member

maggie95andy

New Member

Acanex

Level 2

hgomez23

Level 1