- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Claiming child

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

My first year filing taxes as divorced. My ex husband is allowed to claim our son as a dependent this year. However, our son did not live with his father more than 2 months this year and I was told I could claim the EIC and head of household. Now my ex is saying he can’t claim our as a dependent which he should be able to. Am I in the wrong for claiming the EIC and head of household or can he still claim him as a dependent?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

Are you the custodial parent? Do you have an agreement with the other parent to allow the other parent to claim them--due to divorce or that you live apart and share custody? Did one of you sign a Form 8332?

If there is a signed 8332 then the custodial parent retains the right to file as Head of Household, get earned income credit and the childcare credit + education credits if the child is a full-time college student. The non-custodial parent gets the child tax credit for children under the age of 17.

As far as the IRS is concerned, the custodial parent is the one with whom the child spent the most nights during the tax year--at least 183 nights.

If you are a non-married couple who live together then only one of you can claim the child(ren) and the one not claiming the child does not enter anything at all on their tax return about the child.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

No, you are not wrong. As Custodial Parent you are the only one who can claim EIC and Head of Household for your Child.

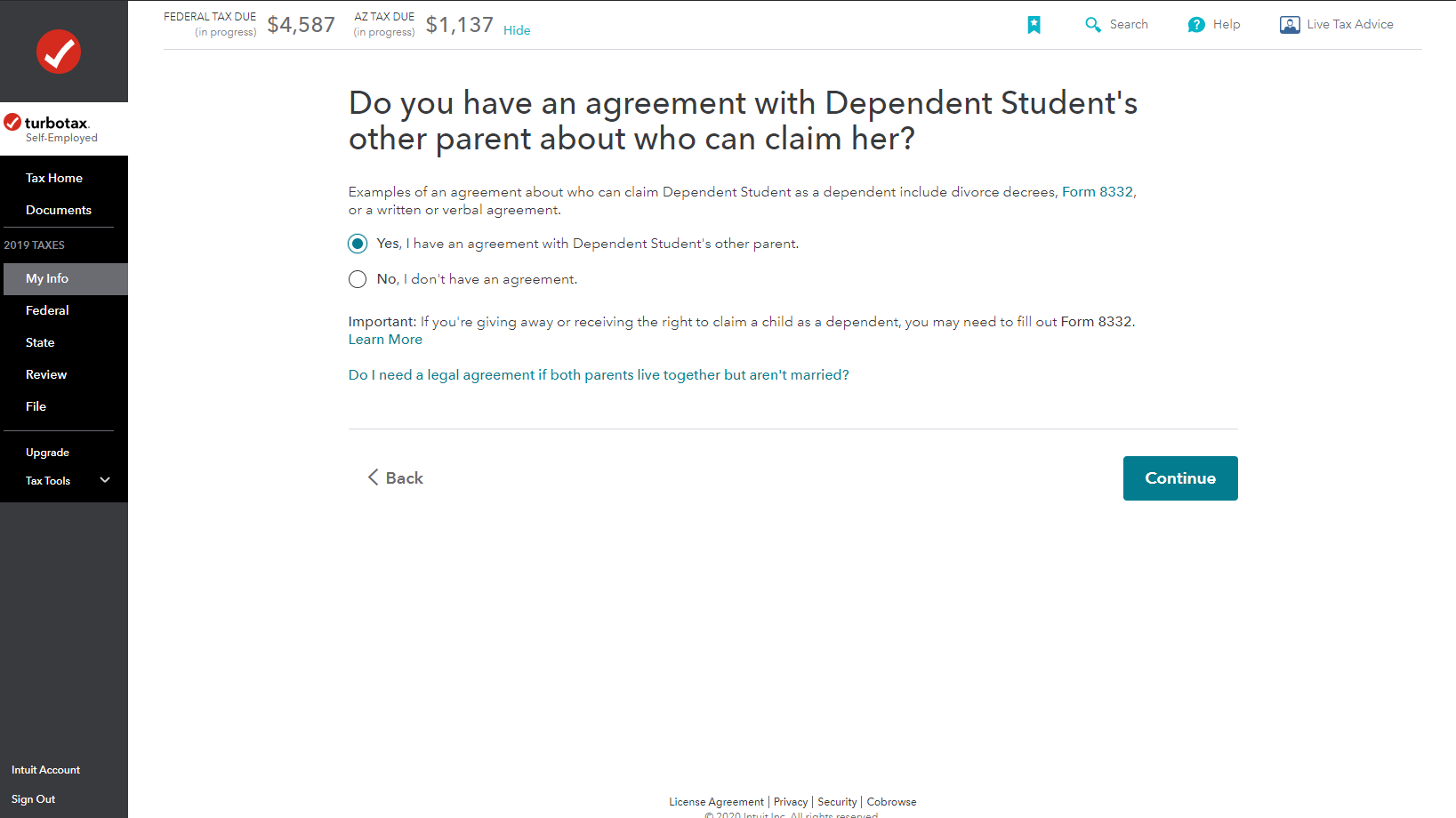

However, when you enter your Dependent in the My Info section, you need to indicate that you are letting the other parent claim the Dependent on their return, by agreement (screenshot).

If you missed this, the child's father may have tried to Efile and claim them, but was unable to as you had already filed.

What he can do is to still claim your child as his Dependent, but he will need to mail in his return to the IRS.

If this is the case, you can mail in an Amended Return after you receive your refund.

Click the link for instructions on How to Amend a 2019 Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

I’m 100 sure I checked the box because I got confused on how I was able to get the EIC. He is trying to efile through TT and it’s not letting him saying the ssn has been claimed already. He did not click any of the questions correct about court papers or anything. I am the custodial parent and he only goes to his fathers every other weekend. I tried to explain to him that by IRS laws he is not allowed to claim EIC due to our son not living with him more than 6 months. Our court decree states he can claim him as a dependent. Do I need to do anything more?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

I just clarified my taxes and I did not claim him as a dependent. Thank you so much for helping me out. Just wanted to make sure I did it right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming child

You are most welcome!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KarenL

Employee Tax Expert

amy_meckley

New Member

ilovesantos

New Member

AE_1989

New Member

Khan3855

New Member