- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

No, you are not wrong. As Custodial Parent you are the only one who can claim EIC and Head of Household for your Child.

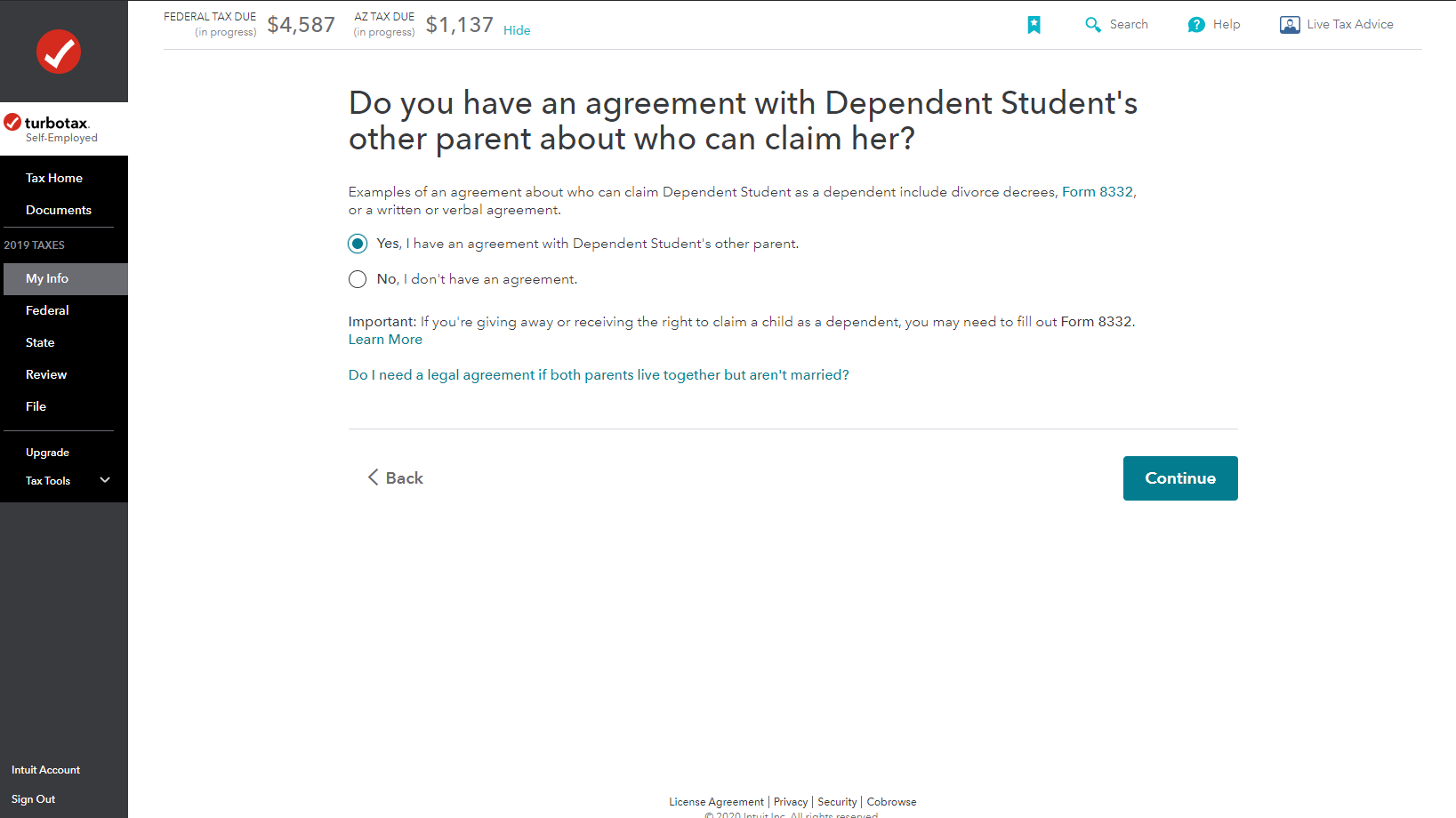

However, when you enter your Dependent in the My Info section, you need to indicate that you are letting the other parent claim the Dependent on their return, by agreement (screenshot).

If you missed this, the child's father may have tried to Efile and claim them, but was unable to as you had already filed.

What he can do is to still claim your child as his Dependent, but he will need to mail in his return to the IRS.

If this is the case, you can mail in an Amended Return after you receive your refund.

Click the link for instructions on How to Amend a 2019 Return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 30, 2020

5:13 PM