- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Can you convert section 179 assets to expenses under de minimis safe harbor election the foll...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you convert section 179 assets to expenses under de minimis safe harbor election the following year?

I have a few assets for which I took a section 179 deduction last tax year (2018). They were all items that cost less than $500 each. IIRC, when I ran Turbo Tax Business last year, it suggested that I take a de minimis safe harbor election for items under some threshold. I wasn't really sure what this election was last year, and I chose not to take it. However, Turbo Tax still did prepare a Section 1.263(a)-1(f) for me.

This year, I'm taking this election for items purchased in 2019. I was wondering if I can convert assets for which I've already taken a section 179 deduction in the 2018 tax year into de minimis safe harbor expenses this year. Obviously, I don't intend to expense these items again this year. I just want to retroactively convert them to de minis safe harbor as if I took the election last year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you convert section 179 assets to expenses under de minimis safe harbor election the following year?

The only way to change this is to amend your 2018 tax return. There is really no reason to do this since the overall outcome is the same.

The reason for the de minimis election was to help simplify tax preparation. You have already done the additional steps to take the items as 179 depreciation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you convert section 179 assets to expenses under de minimis safe harbor election the following year?

Thanks for your response. The main reason I wanted to use the de minimis election is so I don't have to worry about keeping track of when I dispose of the items. The assets in question are basically components that I used to build a computer for my business. These are parts that I will pull out and replace with newer parts in the future.

Also, when booking the expense in QuickBooks to take this election, which account should be used? I typically record computer parts in a fixed asset account that I called "Computer Equipment". To take this election in my taxes, do I need to record the purchases in my books differently? Like "Computer Expense"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you convert section 179 assets to expenses under de minimis safe harbor election the following year?

Yes, you should categorize them as an expense and enter them in the Business Expenses area and not depreciate them.

Here is how to do that in TurboTax:

When items are purchased for a business, a decision is made whether it’s an expense that you deduct all of the cost now, or you deduct the cost over multiple years (depreciation).

There are two elections you can make. One is used to deduct items with a cost of $2,500 or less instead of depreciating. The second election deals with deducting improvements to business buildings.

These elections are available for Schedule C businesses, rentals, farms, and farm rentals.

For 2019, items $2,500 or less

Items that cost $2,500 or less can be taken as an expense this year and don’t have to be depreciated over time. To do this, an annual election must be made. It’s called the De Minimis Safe Harbor election.

How do I do this with TurboTax?

After entering your business expenses, you will go to the Assets/Depreciation area. The first screen will ask: Did you buy any items that each cost $2,500 or less in 2019? It’s asking about any items that you haven’t entered yet as expenses.

If you say Yes, here’s the next screen:

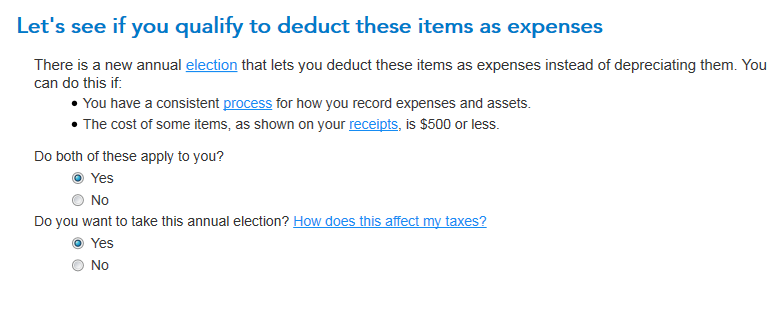

We ask a couple of questions and if you say Yes they both apply to you, we ask if you want to take the election to expense items costing $2,500 or less. If you say Yes to that question, TurboTax will add the De Minimis Safe Harbor Election form to your tax return.

The next screen in TurboTax has you review other items you bought. If every item you bought cost $2,500 or less, TurboTax will take you back to Your Business screen and you can enter those additional items in the Business Expenses area and not have to depreciate them.

If some items cost $2,500 or less and some cost more, the next screen asks you about Building Improvements. After answering the questions about Building Improvements, you can determine which items you will still depreciate and which items you choose to expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

alec-ditonto

New Member

alec-ditonto

New Member

shend004

New Member

dp92

Level 1