- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Bug with refinance on a large mortgage

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

Yet another duplicate: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/mortgage-interest-deduction-limi...

Intuit, fix this bug!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

Another duplicate: https://ttlc.intuit.com/community/tax-credits-deductions/discussion/second-1098-from-refi-is-wiping-...

Intuit, am I just shouting into the void? Do software engineers receive any of these bug reports, particularly for issues that are encountered by so many different people?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

I'm experiencing the same bug and spent about 2 hours on the phone with TT walking them through it a couple of days ago. I supplied a diagnostic code for them as well. I'm still waiting to hear back from them.

Can anyone confirm that you can't efile if you override calculations on the interest deduction worksheet? I didn't know this. I generally prefer not to alter the 1098's if possible. I'm already annoyed at having to spend so much time troubleshooting their programming error after spending $50 for the software. I'll definitely be requesting a refund if they don't fix this and I can't efile. I'll also be looking for new tax software to use despite using TT for the last 12 years. This is ridiculous for such a simple and common tax situation.

In case it helps them narrow down the issue, I'm using the download version (desktop) for Mac. What version is everyone else using that's seeing this error? Maybe it's only affecting one of the versions and they can apply a solution from a version that does work correctly.

I'm also very concerned that this was an issue in 2019 that seems like it was never fixed. Aside from the frustration we're all experiencing trying to sort out workarounds, imagine how many people didn't catch this software error when they filed their taxes and have no idea they overpaid their taxes. It looks like Turbo Tax calculated too much tax liability for just about everyone who refinanced in 2019 (and now 2020) with a loan balance of at least half of the federal limit (or even smaller loan balances if they had more than 2 1098's). This seems like a class action lawsuit waiting to happen if they continue to show no interest in fixing it. Hopefully someone from TurboTax chimes in soon with a fix or an ETA for the fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

@AnnetteB6 @KrisD15 has this been escalated to Engineering yet? This is an actual software bug that many people are encountering that should be fixed!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

@jlbrick I'm not sure if it's been escalated to Engineering yet, but I called TT again this morning and they told me there is an active investigation into the issue and they attached my complaint to it. She also said the investigation showed activity as recently as 3 days ago. I'm not sure if that's helpful info, but wanted to share to increase transparency since their responses to this are lacking on this site.

Also, I came across the following work around that works for me and is supported by an IRS publication (in my opinion) as an alternative calculation for average balances on this worksheet. This way, when you add the average balances together on the worksheet, the total will reflect a weighted average for the year.

The rep I talked to also said that overriding a calculation on the worksheet won't prevent you from using efile. I don't have personal experience to prove it, but I hope she's right.

I still think this is a common enough tax situation that it shouldn't need a workaround, and should be fixed in the software immediately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

I created a new "combined" 1098 using the formula from the above link. This is so ridiculous.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

I'm jumping on this thread because I have the very same issue: I refinanced my mortgage and TT incorrectly adds the balances of the old and new (refinanced) mortgage together, making the total appear double and thus limiting my deduction incorrectly.

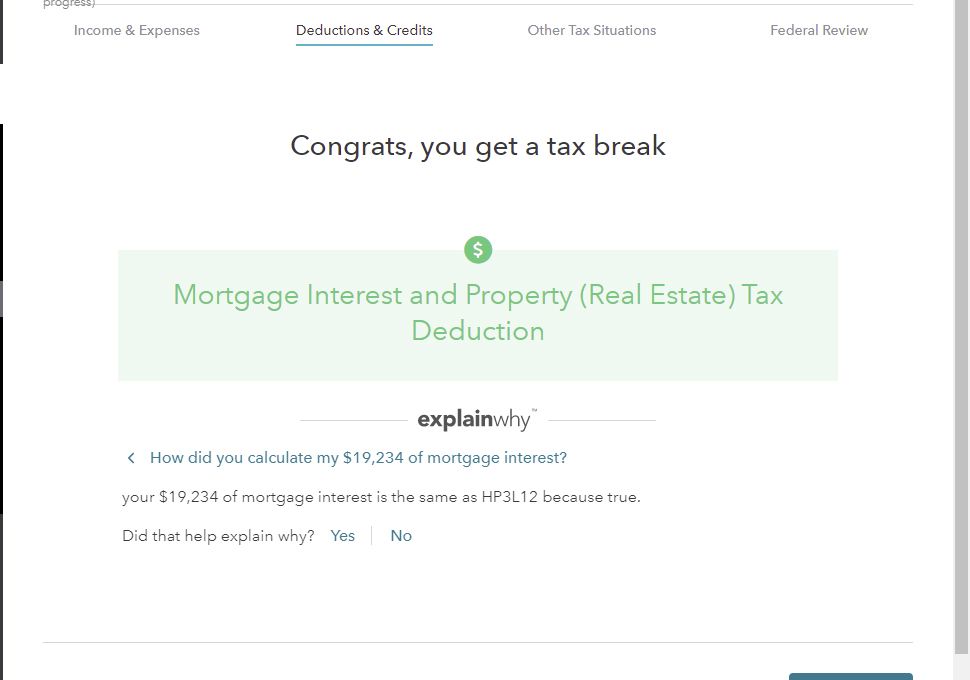

I noticed another error. TT Online has the "explain why" link that appears.

It gives the cryptic error that this newly calculated mortgage interest "is the same as HP3L12 because true."

I can only imagine that the flawed algorithm that's used to come up with this value is also flawed in its reporting.

I tried contacting customer support about this, who was baffled, but could not provide an answer. Worse, they suggested that I upgrade to the "Tax Live" version to solve it. That's not what I want. I know the problem. I just want the software fixed.

Many of the workarounds require editing the worksheet. Does anyone know whether this is possible on the online version? I made the mistake of not purchasing the desktop version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

@discosagar @jlbrick @MattB @RecoveringEngineer @Ashramx4

Hi all,

Cross-posting here, but yet another person dealing with exactly this same issue. I thought it might be useful to collate several of the sophisticated affected users who have, in aggregate, likely spent dozens of hours trying to rectify this.

I posted this in another thread where I was unhelpfully told "this does not appear to be a bug at this time" [https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-turbotax-is-incorrectly-combi...] so have been searching for a reasonable solution.

I've posted an extensive detailed description of my issue in the above thread, but it is essentially identical to all of yours. As best I can tell, currently one's options are:

1. Enter "$0" for Box 2 of refinanced loan (not ideal as will not match 1098 and, in principle, might yield a slightly different average mortgage balance for the calendar year than if it was done accurately depending on how the loan was closed"

2. Creation of a pseudo-1098 with pooled data and a hand-calculated average mortgage balance. Also not ideal as rather laborious and may trigger IRS interest since only a single 1098 is being reported by the taxpayer despite 2 being issued.

3. Some kind of hand editing of schedule A, which may preclude e-filing based on prior posts (not sure if this is true)

Hoping we can iron this out - seems a trivial fix on the software side.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

Yes, @Bostondoc84 , those appear to be the three unfortunate methods.

I've entered the information for the 1098s in multiple different ways and am convinced that this is an issue for 100% of users who refinanced a mortgage this year. Likely, this is going partially unnoticed for some users the following reasons:

- The mortgage principles for some users may be low enough that even when the program incorrectly sums them it's still under the limit;

- Users may not be paying close attention to the amount of the return so the change that occurs with the second refinanced loan 1098, they don't notice; and/or

- Pro users using the proconnect version and know about the workaround here (https://proconnect.intuit.com/community/individual/help/entering-a-refinance-in-the-excess-mortgage-...) are used to many exceptions are are accustomed to editing the worksheets or forms.

@TurboTax, we are trying to help you: this error is causing an erroneous adjustment in the allowable credit lowering individual's tax returns. The many users in this community have outline the exact problem: TT is treating refinanced mortgages on the same property as though they were 2 mortgages and subjecting them to the limits when the principles are summed or otherwise calculated incorrectly.

Will someone at TT please review this issue? I think any one of the many posters where would be happy to show exactly where on the worksheets the error is occurring.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

Hi @Bostondoc84. Yes, the only thing I would clarify on option 3 is that you can do the manual override on one of the supporting schedules rather than the Schedule A itself. I only mention this since the "Deductible Home Mortgage Interest Worksheet" feeds the Schedule A, but doesn't get submitted to the IRS (it's one of the "Keep for your records" worksheets). I don't know if where you do the override might make a difference on whether TT allows you to efile.

The manual override workaround that seems to require the least overriding of calculations (at least to me), is overriding the "Average Balance" lines of Part 1 on the "Deductible Home Mortgage Interest Worksheet" using the Interest Paid divided by Interest Rate method described on some of the earlier posts (or links). Once I override these average balances, everything else on the worksheet and schedule A ends up correct.

I can't believe the response on another thread was that this isn't a bug. This is definitely a bug, and one that TT needs to take very seriously. The fact that TT can't calculate average loan balances correctly for anyone with more than one 1098 (due to refinancing or having their mortgage servicer change), means that the software is overstating taxes for anyone who doesn't catch the error and find a workaround. Imagine how many people refinanced and trust TT to calculate their taxes correctly. If I didn't dig into the details, TT would have cost me $2,000 this year! This seems ripe for a class action lawsuit if they don't fix it. Especially since it looks like it was an issue last year as well and was never fixed. The software doesn't even give a warning to users that it can't handle this tax situation (which is an incredibly common and basic situation) and you need to manually calculate the average balances yourself. I'm guessing that TT will be on the hook for millions if they don't fix it, and all of the users who didn't know about the error check their taxes. That's a lot of claims on their "100% Accurate Calculations Guarantee".

Thanks to everyone here for raising this issue and trying to get TT to do the right thing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with refinance on a large mortgage

In case of multiple Form 1098, it seems to be ideal to follow 'Interest paid divided by interest rate method' as suggested here

https://www.irs.gov/publications/p936#en_US_2019_publink[phone number removed]

Compared to my earlier approach which I mentioned in earlier post, this seems to be more closer.

Example of my workings, based on same use case as before:

Loan 1 Loan 2 Loan 3 Total

Interest 20,000 3,000 7,000 30,000

Interest rate 3.50% 6% 2.50%

Average Balance 571,429 54,545 280,000 905,974

Turbotax is also suggesting in the above link to do 'average balance override'.

Does it mean that overriding 'Average balance' under each loan in "Deductible Home Mortgage Interest Worksheet" of Schedule A, will NOT create any issue for us to e-file? Has anyone done this way last year without any issues? I don't want to be stuck during e-filing stage and restart the work.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timeflies

Level 1

sltantlinger

New Member

csmail13

New Member

Npadilla

New Member

CDJackson

Returning Member