- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 2019 version and estimated taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

When I submitted my taxes for 2019, it appears that Turbo Tax mis-categorized my Federal @Estimated Tax Payments with my Income Tax Withheld. The IRS reviewed my record and added in my Estimate Tax Payments due to the mis-categorization. The IRS sent me a check for the Estimated Tax Payments because they didn't realize it was already included in Income Tax Withheld.

Now the IRS is requesting a return of the Estimated Tax Payments plus interest and penalties.

The error has apparently been fixed, because when I reopened TurboTax for 2019, there were quite a few updates and the Estimated Tax Payments are correctly categorized. Luckily I still have a pdf of what was generated by TurboTax in 2019.

I would like some assistance from TurboTax about the error in the software. I am willing pay back the IRS in the base amounts, but I don't believe I should be required to pay the interest and penalties. HELP!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

What you should have done since you know what happened was to void the check and return it immediately and not wait for the IRS to figure it out. You may be able to get the penalties and interest waived if you explain what happened ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

For the Accuracy Guarantee claims, see: https://ttlc.intuit.com/community/charges-and-fees/help/how-do-i-submit-a-claim-under-the-turbotax-1...

But it only covers actual CALCULATION errors in the program, not user error , and it only pays any penalties or interest resulting from that error, not the taxes. Either way, you are still responsible for the increase in tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

Estimated tax payments are entered by the user of the software totally separate from taxes withheld on a W-2 or Form 1099. For tax year 2019 estimated tax payments are on Schedule 3 Part II Line 8. The total from Schedule 3 Part II Line 14 flows to Form 1040 Line 18d. The Form 1040 Lines 17 and 18e are added together with the result entered on Line 19 as your Total Payments.

There is and was no other way to enter the estimated tax payments.

Contact the IRS since the error is on their part as you should never have received your estimated taxes back as a refund from the IRS. There should be a phone number on the letter you received for payment due. The IRS should waive the penalty and interest since it was their error and not yours.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

It was entered correctly. When I applied the update, TurboTax changed the documentation, correcting their categorization. Luckily I have copies of what was generated in 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

If you talk to Turbo Tax please post back and let us know how it works out. There were other posts saying estimates ended up with withholding. But I think most of them entered it in the wrong place. There must have been a screen that could be worded better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

Thank you @VolvoGirl ! Glad to hear others may have had this problem.

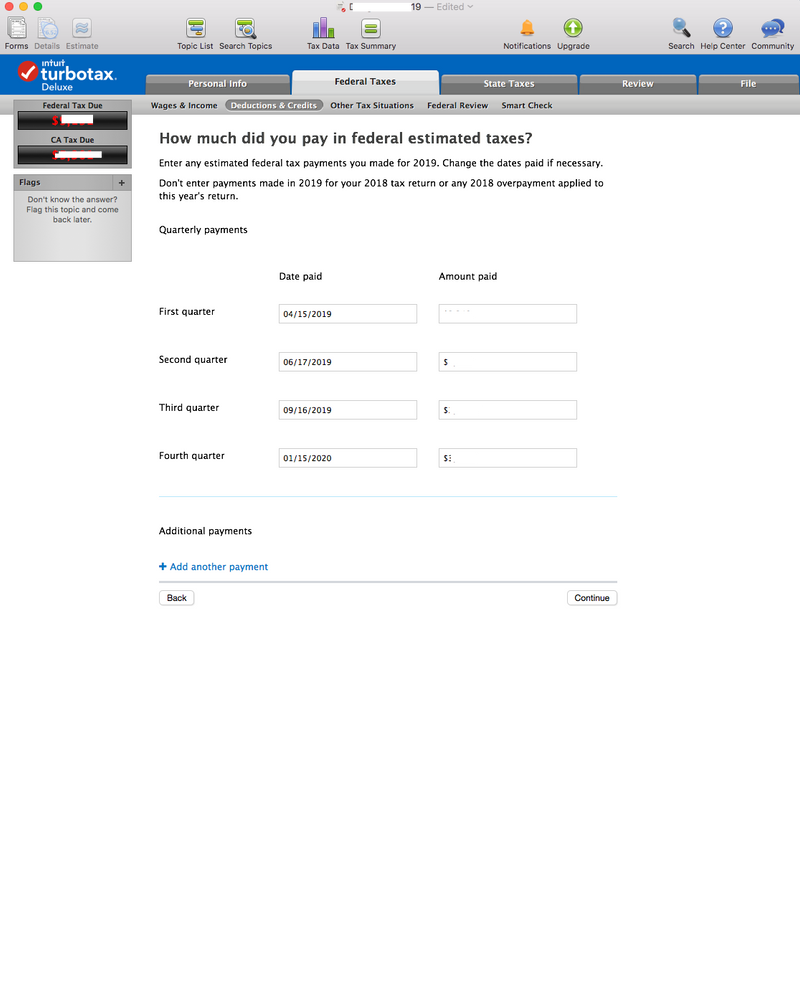

I have screenshots (below) demonstrating that I entered the estimates on the correct screen. (These other responses telling me I've entered it wrong, or what I should've done a year ago are of no help.) 🙂

If I hear anything back from TurboTax, I'll post it here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

When you updated and it ended up on the the right line did you check if Turbo Tax also removed it from the withholding line?

Did Turbo Tax ask if you made any other tax payments or did you go to Estimates Paid and select federal estimates directly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

@VolvoGirl, yes exactly that. After the update was installed today, TurboTax reduced the withholding amounts by the amount in question, then generated a Schedule 3 (which it didn't do before), identifying the amount in question as Estimated Tax payments.

When I entered the data in 2020 (for tax year 2019), I just followed the prompts as they come up through the software. (I've been using TurboTax for more than a decade and always walk through every category.) I made no other changes to the data that was entered in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

Here's how it was entered in 2020. If it's user error, then the software has a major issue:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 version and estimated taxes

@VolvoGirl --I spoke with Intuit customer service. They agreed that I should submit a claim for the interest and penalties. It appears that Turbo Tax incorrectly categorized my Estimated Tax payments.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ilian

Level 1

Kiwi

Returning Member

r-beckwith

New Member

bagator1

New Member

yolotom

Returning Member