- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: 1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

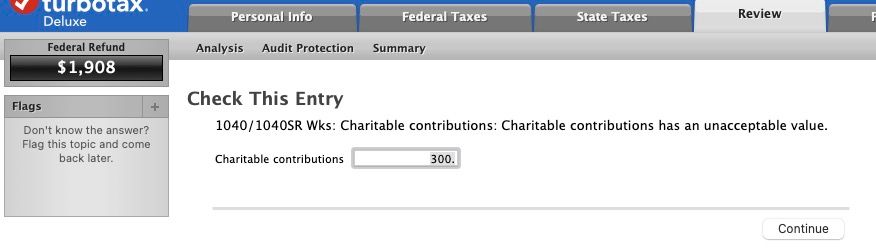

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Hello @normang

I am an Intuit TurboTax Employee, so I need to take blame for any Intuit/TurboTax issues, as should any other employee, however I am not tasked with coding software. Like most agents in Community, I am a Tax Practitioner and I try to assist customers with tax issues.

With that said, when we see the software not behaving as we think it should, we work with the program to formulate a "work-around' so that those customers that want to file ASAP can get the correct tax result on their returns and file. while the programmers look at and correct the issue if needed.

This year the "Cash contributions for individuals who do not itemize deductions" was extended for use on the 2021 Tax Year Federal Return. Additionally the limit for when filing Married Filing Jointly was raised to $600.

It was reported that some customers were having trouble getting the $600 cash contribution to show on their 1040 and were getting an error message as well.

Along with other agents, I tested different scenarios in the different TurboTax programs to recreate the error and find a temporary solution. I do not have access to a MAC.

I found that if CASH donations were entered on the Federal return under Deductions & Credits (which would flow to schedule A if Itemizing) the program will trigger this error. If the cash donations were deleted, the program would ask about this "Cash contributions for individuals who do not itemize deductions" at the end of the review and a 600 entry would be accepted no longer leading to an error.

Some states, such as Minnesota, allow a Taxpayer to claim donations on the state return even when that same Taxpayer takes the Standard Deduction on the Federal return. In this case, in order to compensate for the "missing" (deleted) cash donations entered under "Deductions & Credits" on the Federal screens, I suggest entering the cash donations under "Items" rather than "cash" on the Federal Deduction & Credits screen. This does not cause the "Final Review" error for filing the Federal Return while also transferring the full amount of charitable donations to the State return.

Yes, you are correct when you say this is a work-around. The Programmers are aware of the issue and if you would feel better waiting, that would be fine.

The purpose of TurboTax is to get your numbers on your 1040 where they belong.

This work-around for the $600 "Cash contributions for individuals who do not itemize deductions" gets the numbers where they should be, but again, if this makes you uncomfortable you might want to wait for more updates.

Below is a TurboTax link on the subject:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

@KrisD15 , thanks for the detailed explanation, appreciate it.. I only have one question left I think.

You indicated as follows "I suggest entering the cash donations under "Items" rather than "cash" on the Federal Deduction & Credits screen" I am using "Donations to Charity" under Charitable Donations on that screen, and when look for "items rather than cash", for some reason I am not seeing anything on that screen that describes that..

I guess I could remove the charity entries, which I do know gets the 600 entry and there is no error, and manually enter the charitable deductions on that screen I noted in the MN State return. But now of course I am wondering where the Items entry to which you refer, which I seem unable to find.. Perhaps I am glancing right over it..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

The items entry will be under the contribution section where the specific charity is listed. You should have an option to pick cash or item. Try adding a new contribution and you'll see what I'm talking about then back out without saving.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Thank you for thoroughly testing and giving a detailed explanation. Deleting all charitable contributions seemed a little extreme. I'm glad you narrowed it down to only the type (cash) of contribution that needs to be changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

@TheRealTax2 , @KrisD15 I see what you're talking about now,

However the listed items do not include cash, so it seems like that is not a valid option, or which "item" do you select to use? Like many people. their charitable contributions are to a church or some other organization on a regular basis, so I don't see how Items replaces the cash entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

You are 100% correct. This will get you past the error but an item does not equal cash. In the end, yoru numbers should be correct but the type of contribution is wrong. You may want to wait until TT fixes the bug through an update since cash is causing the issue. I opted to make the change below and double check manually...

Changing value back to 600 at the error window and then skipping 2nd check worked. I was able to e-file while maintaining the 600 value on the fed 1040. I would advise that you read your state tax form instructions to be sure you're not required to adjust for the 600 deduction if you take this route. My state didn't mention it, unlike last year where the 300 contribution had to be added back on state return. Good luck guys.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

The workaround seems to have worked for me. I don't have state income taxes, so I don't have that complication. However, a bug of this magnitude shakes my confidence in TurboTax. I have used TurboTax for many years, and it seems like the quality has gotten worse in recent years. The company needs to devote a lot more resources to their software development department (especially the testing team). I will seriously consider switching to a competing product next year!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Still cannot get past this.... When do we expect the fix to be in for this??

Turbo Downloaded & already installed the latest update... still having the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

I am having this issue as well. This is particularly vexing to me as I only live three miles away from Intuit in San Diego and can't get an answer on when it will be fixed. Not workarounded, but fixed.

George

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

How Do I get RID of this error? I don't like filing, with ERRORS, although it seems I am not the only one getting this error. What should I do? HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

I don't feel comfortable with this workaround, since after I put all my charity giving from money to items, it starts asking me for the addresses of my charities, AND my refund changed. Is there a timeline for a fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

It looks like this bug has been fixed. I had been holding off transmitting my taxes because of the bug. Two days ago I went back into TurboTax, and after letting it update itself I started a fresh federal return from scratch (rather than editing the one I had been working on). After entering all of my data, including charitable donations, I looked at the return. This time the "unacceptable value" error did not happen, and the $600 value was recorded correctly on my return.

I don't know I needed to completely re-do my return from scratch. I didn't try just editing the return that I previously worked on. Perhaps it also would have worked correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Started my taxes today on MAC TT desktop and the error is still there for married filing jointly. Any assistance from @turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Still having this problem and it's April 10th. Does TT have an online fix instead of a work around @KrisD15 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040/1040SR Wks" Charitable contributions: Charitable contributions has an unacceptable value Continues in 2022

Did you enter the Federal 1040 line 12b Charitable Cash Contributions under CARES Act:

- as a charitable contribution under Deductions & Credits, or

- as a separate entry at a screen after you are told The Standard Deduction is right for you!?

And it may be possible that you are reporting the entry at both places and that is the source of your problem.

Please advise.

@Mitz22

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rhondacburke

New Member

stefaniestiegel

New Member

mailsaurin

New Member

meltonyus

Level 1

georgiesboy

New Member