- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Personal vehicle used by S Corp

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal vehicle used by S Corp

In 2020 I purchased a personal truck that I use predominantly for business with my single member S corp. From what I understand, I need to reimburse my personal self for all business miles driven and record this reimbursement on my 1120-S.

Should I use the standard mileage rate or the actual expense method? I have read conflicting things since the truck weighs over 6000 lbs. Also is there a way to use the 179 Deduction/Depreciation for this vehicle since it is under my personal name? Do I need to include any of this reimbursement information on my personal taxes as well?

Any help is greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal vehicle used by S Corp

You can use either one that may benefit you and your business. Standard Mileage deduction is solely for mileage usage, while actual expenses include gas, repairs, insurance, depreciation, and other expenses related the business vehicle usage. If the vehicle used for business was over 6,000 pounds, you may qualify for Section 179 or bonus depreciation. deduction.

Form 1120-S is a type of corporation that passes income directly to the shareholders on form Schedule K-1 to avoid double taxation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal vehicle used by S Corp

@JoannaB2 Thank you for the reply! It sounds like I just get to choose which deduction would work best for the mileage vs actual expenses. Do I enter that under "vehicle expenses" on the 1120 s?

Do I make the Section 179 deduction on the 1120s form even if the vehicle is owned personally and not by the S corp? and if so, where do I input that on the Turbo Tax Business edition?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal vehicle used by S Corp

An S-Corporation is a pass-through entity - meaning the profits or losses 'pass through' to your personal return. You can take the section 179 deduction in the Deductions, Depreciation of Assets area of TurboTax Business.

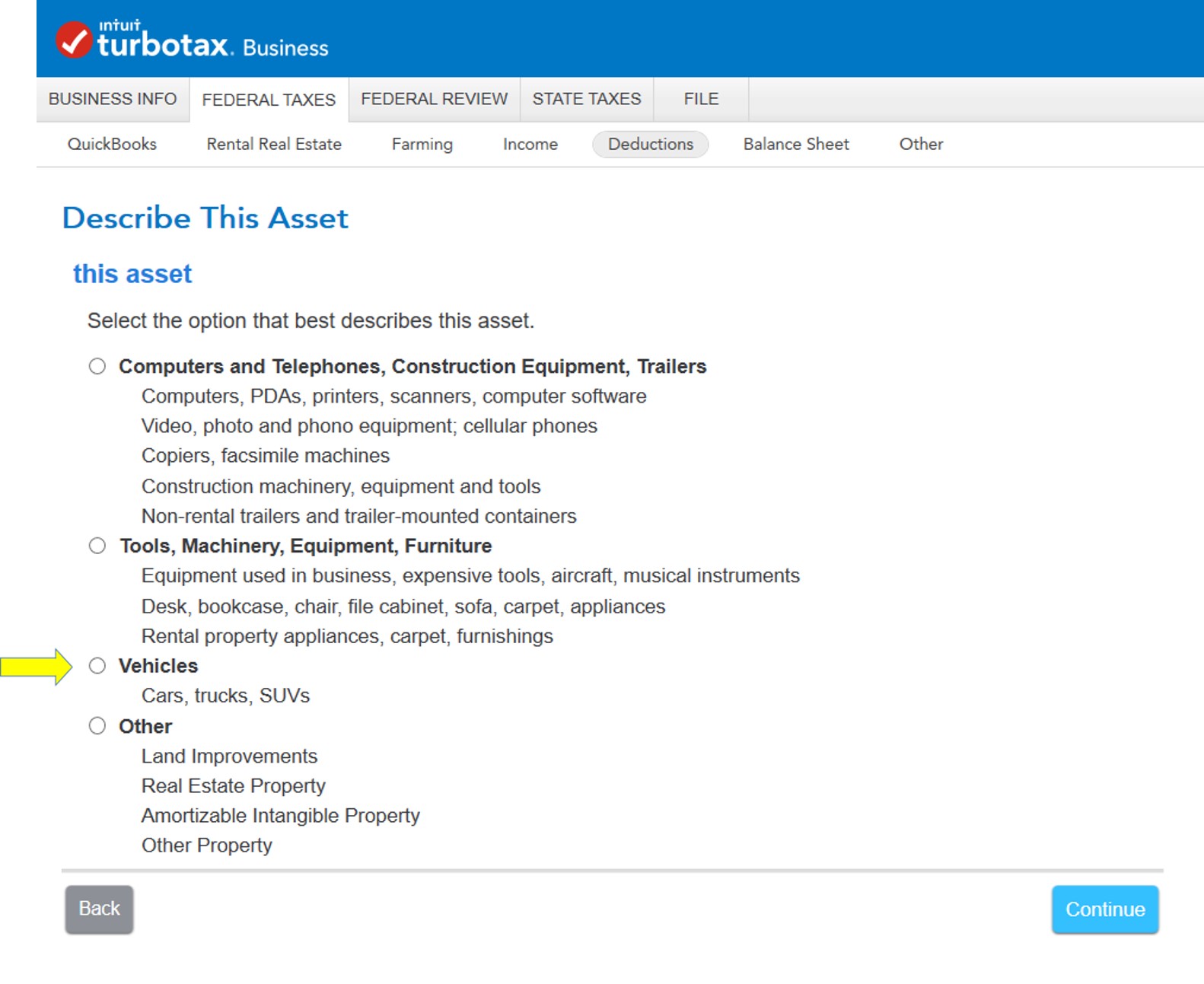

You will add your SUV as an Asset.

You will be able to select Vehicle as the Asset type:

You will be able to enter the SUV weight class and Cost on the following screens. You will also be able to elect the section 179 deduction for this year if you have sufficient profit. A section 179 deduction cannot increase a business' loss.

There are many tax advantages to an S-Corporation, especially in the area of vehicle expenses. You can be reimbursed as an employee for the operating expenses of your vehicle through an accountable plan. The reimbursements are not taxable to you and are business expenses to the S-Corporation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Personal vehicle used by S Corp

No, DON'T enter the vehicle for depreciation on the corporate return if the corporation does not own the vehicle.

Are you talking about 2020? It is too late for an Accountable Reimbursement now. If the corporation reimburses you now, it would be a Nonaccountable Plan, and the reimbursement needs to be added to your W-2 wages.

Corporation tax returns really are NOT a do-it-yourself thing. You REALLY need to be going to a good tax professional for the corporate return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

justine626

Level 1

Bwcland1

Level 1

Letty7

Level 1

savadhamid

New Member

robglobal

New Member