- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

An S-Corporation is a pass-through entity - meaning the profits or losses 'pass through' to your personal return. You can take the section 179 deduction in the Deductions, Depreciation of Assets area of TurboTax Business.

You will add your SUV as an Asset.

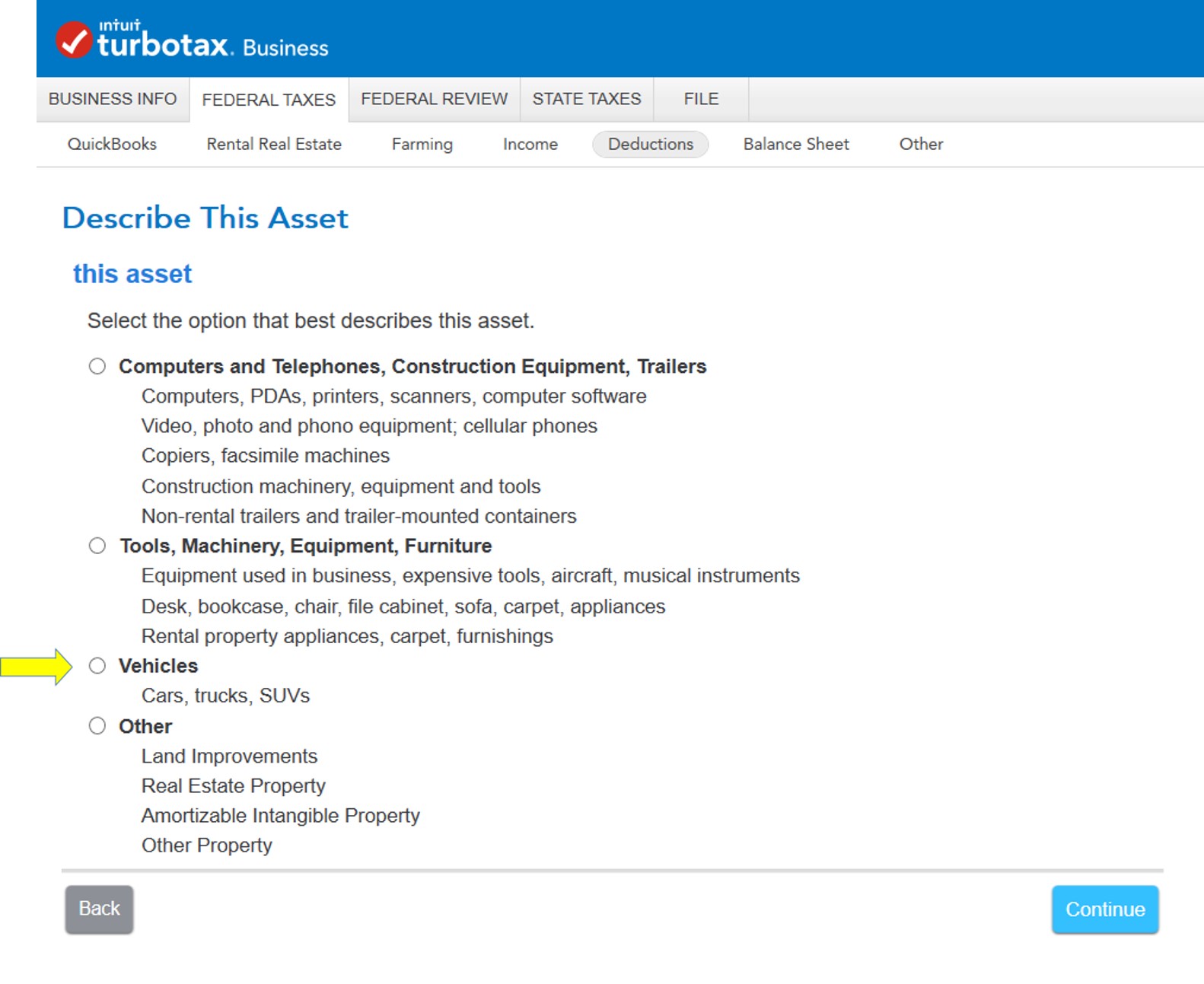

You will be able to select Vehicle as the Asset type:

You will be able to enter the SUV weight class and Cost on the following screens. You will also be able to elect the section 179 deduction for this year if you have sufficient profit. A section 179 deduction cannot increase a business' loss.

There are many tax advantages to an S-Corporation, especially in the area of vehicle expenses. You can be reimbursed as an employee for the operating expenses of your vehicle through an accountable plan. The reimbursements are not taxable to you and are business expenses to the S-Corporation.