- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Penalty on estimated payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

I sold a rental house in Dec of 2020. At the time of sale I paid an estimated state tax. The only place I can see to enter this is in the estimated taxes section, but when I do this it says I owe a penalty (presumably because the entire payment wasn't made until the 4th quarter, when the house was sold). How do I rectify this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

You can use the Annualized Income Installment Method.

If you don’t receive your income evenly throughout the year (for example, your income from a repair shop you operate is much larger in the summer than it is during the rest of the year), your required estimated tax payment for one or more periods may be less than the amount figured using the regular installment method.

In Turbo Tax, look for the screen that says "Possible Penalty Exception" - go through and answer the questions and TurboTax will create the forms needed to report to the IRS to have the penalty removed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

You can use the Annualized Income Installment Method.

If you don’t receive your income evenly throughout the year (for example, your income from a repair shop you operate is much larger in the summer than it is during the rest of the year), your required estimated tax payment for one or more periods may be less than the amount figured using the regular installment method.

In Turbo Tax, look for the screen that says "Possible Penalty Exception" - go through and answer the questions and TurboTax will create the forms needed to report to the IRS to have the penalty removed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

I have to say this was very confusing in TT (I thought the program was supposed to take me through things clearly, step by step!). I think I finally got it fixed by annualizing the income. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

Actually, I replied too soon. Once I entered all the annualized info (and I made sure each box had the correct cummulative amount), it still said I owed a penalty! This can't be. The sale was in Dec and I paid the tax in December! Many of the questions in this section didn't apply to me, because I don't usually make estimated tax payments. This was simply state tax that they required I pay up front out of the proceeds from the sale. I have no other estimated taxes to report.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

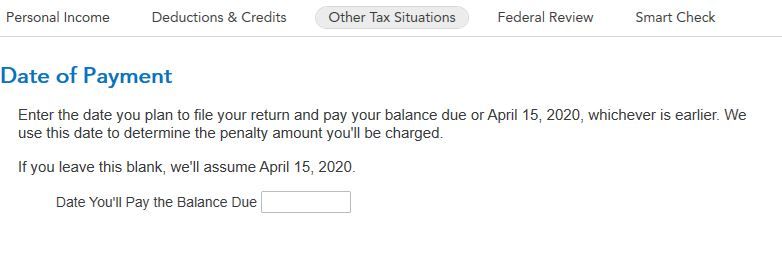

So I'm now guessing that the penalty is for not paying FED tax on this Dec windfall by Jan 15, 2021. Am I correct? Another confusion--as I proceed through the penalty section, I see this screen:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Penalty on estimated payment

The fourth quarter estimated tax is due January 15, so if you paid it after then you may get a penalty.

The due date for 2020 tax returns in April 15, 2021, so if you are seeing that in the 2020 TurboTax program, it is wrong. TurboTax rolls out their program as early as possible to allow tax payers to begin work on their tax return, but updates are common early in the tax season.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

llclark25

Level 2

diannevanasse

New Member

dfelger5

New Member

plourdeca

New Member

smiddle

New Member