- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

I used the QBI deduction on the income of my rental properties. Do I have to use the QBI deduction this year? or I can opt out QBI ?

Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

Please read this Community answer which addresses your question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

@MinhT1The post you mentioned above actually didn't answer my question as that post didn't mention if he/she used QBI in the previous year or not.

My situation is I used QBI last year, so can I opt out of using it this year? Or I have to continue to use it?

I recalled I read an article before that once QBI is applied in one year and it must be applied in the following years, but I am not sure. That's why I posted the question here.

Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

A Taxpayer cannot pick and choose when to "accept" the Qualified Business Income Deduction, HOWEVER they can elect the safe harbor to treat rental real estate as a business one year, and then not the next year depending on whether the taxpayer meets the requirements.

If fact, the election to treat the rental as a business needs to be made each year.

So in your situation, Yes, you could have used the safe harbor last year and received the QBI and not use it this year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

@KrisD15what if I select to aggregate my rental properties into one enterprise under the safe harbor (Revenue Procedure 2019-38) this year, Do I have to aggregate them again the following year? or I can opt out of it?

According to this Turbotax official article: https://proconnect.intuit.com/taxprocenter/tax-law-and-news/aggregating-business-entities-for-the-qb...

"Once an aggregation has been formed, it must remain consistent from year to year and may not be disaggregated unless there is a significant change in facts and circumstances."

I suppose the lack of 250 hrs rental service next year will be considered a significant change to disqualify the safe harbor / aggregation?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

Yes. Your aggregations must be reported consistently for all subsequent years, unless there is a significant change in facts and circumstances that disqualify the aggregation.

What is a significant change? It depends on all the facts and circumstances as indicated. You would be required to explain your reasons why changing from aggregation to singular use for the qualified business income deduction (QBID) will be a better choice. Right now this is ambiguous.

To qualify for aggregation, you must meet all 5 conditions:

- The same person or group of persons own (directly or indirectly) 50% or more of each business being aggregated.

- The 50% or more ownership exists for more than half the year.

- All tax items attributable to each business are reported on tax returns with the same tax year end (e.g., all businesses use a calendar year).

- None of the businesses are a specified service trade or business, or SSTB (any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners).

- The businesses being aggregated satisfy at least 2 of these 3 requirements:

- (a) the businesses provide products and services that are the same (e.g., a restaurant and a food truck) or customarily provided together (e.g. a gas station and a car wash),

- (b) the businesses share facilities or significant centralized elements (e.g., personnel, accounting, legal, manufacturing, purchasing, human resources, or information technology services), and

- (c) the businesses operate in coordination with or reliance on each other (e.g., they have supply chain interdependencies).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

@DianeW777I have read you replies in this post and another post, and now I am confused.

In 2019, I aggregated all my three rental properties into an enterprise and elected to use safe harbor (2019-38) to apply the QBI deduction because I met all the 2019-38 requirements, however, in the year of 2020, I didn't meet the safe harbor requirements because 250 hrs rental services were not conducted, which means I am not qualified to use QBI deduction on the income of my rental properties.

You mentioned above that 'Your aggregations must be reported consistently for all subsequent years.'

But there is no way in the Turbotax that I can aggregate my rental properties but not elect to use safe harbor?

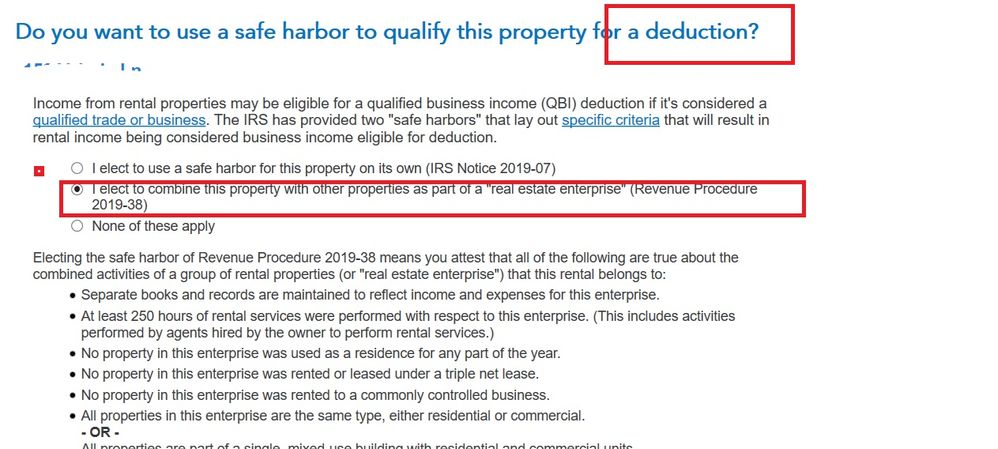

Once I select to aggregate and the QBI deduction is applied by default (I should not be qualified as I didn't meet the safe harbor requirements in 2020). See the screenshot.

So my quick question is:

For each of my rental properties, can I choose the following answers to avoid using QBI deduction for 2020 tax return even though I used the QBI deduction on the aggregation of my rentals in 2019:

1.' None of these apply' for the question of 'Do you want to use a safe harbor to qualify this property for a deduction"?

2. 'No, this income is not qualified' for the question of 'Is this Qualified Business Income'

Hope I have stated my question clearly, and thank you so much for your detailed and informative replies before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Once QBI deduction is used in one year, does the taxpayer have to use QBI deduction all the following years?

Yes, you can use those selections to eliminate the QBI for 2020, since the safe harbor can not be met. If you know the property doesn't qualify for 2020, then it's reasonable to eliminate the deduction. I apologize for the confusion and you are welcome.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Donald-Palmadessa11

New Member

TEAMBERA

New Member

roses0305

New Member

alvin4

New Member

ericbeauchesne

New Member

in Education