- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@DianeW777I have read you replies in this post and another post, and now I am confused.

In 2019, I aggregated all my three rental properties into an enterprise and elected to use safe harbor (2019-38) to apply the QBI deduction because I met all the 2019-38 requirements, however, in the year of 2020, I didn't meet the safe harbor requirements because 250 hrs rental services were not conducted, which means I am not qualified to use QBI deduction on the income of my rental properties.

You mentioned above that 'Your aggregations must be reported consistently for all subsequent years.'

But there is no way in the Turbotax that I can aggregate my rental properties but not elect to use safe harbor?

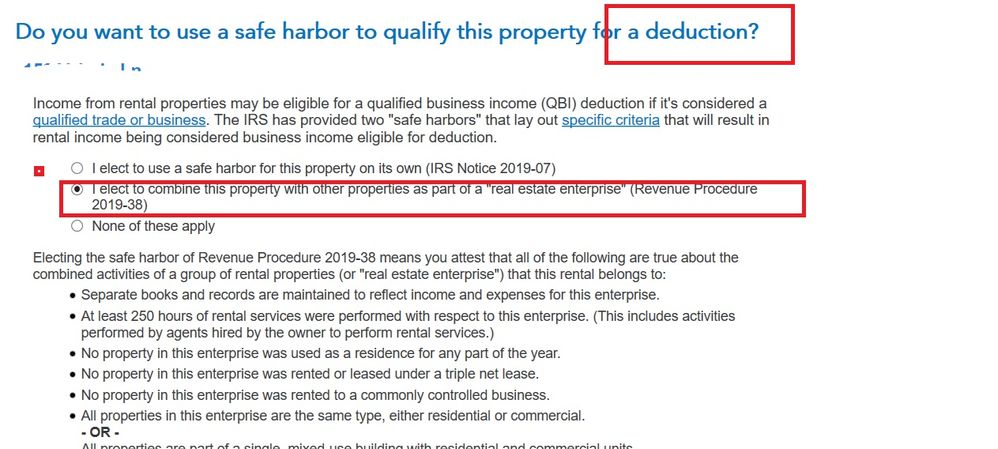

Once I select to aggregate and the QBI deduction is applied by default (I should not be qualified as I didn't meet the safe harbor requirements in 2020). See the screenshot.

So my quick question is:

For each of my rental properties, can I choose the following answers to avoid using QBI deduction for 2020 tax return even though I used the QBI deduction on the aggregation of my rentals in 2019:

1.' None of these apply' for the question of 'Do you want to use a safe harbor to qualify this property for a deduction"?

2. 'No, this income is not qualified' for the question of 'Is this Qualified Business Income'

Hope I have stated my question clearly, and thank you so much for your detailed and informative replies before.