- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Net operating loss (NOL) carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

I've used Turbotax Deluxe for many years and am using it for my 2022 return. Here's my question:

If I have a large loss on line 8 (1040SR) which causes the AGI, line 11, to be negative, will Turbotax automatically carry forward the 2022 negative AGI as a NOL (Schedule 1 line 8a) on my 2023 return (assuming schedule 1 doesn't change and using Turbotax Deluxe for 2023)??

If not, is there a way to manually enter the 2022 negative AGI as a NOL on the 2023 return??

Thanks, Nick

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

Thanks for the quick reply. I looked for the Turbotax entry you displayed in your reply and I can't find it in Turbotax Deluxe. So how will I be able to claim this NOL carryover in 2023?? Do I need a different version of Turbotax??

Thanks, Nick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

to calculate use schedule A of form 1045. read the instructions because business income and losses get entered on certain lines while nonbusiness income and deductions get entered on other lines. the short version. your NOL is the excess of business losses over business income reduced by the excess, if any, of nonbusiness income over nonbusiness deductions.

https://www.irs.gov/site-index-search?search=1045&field_pup_historical_1=1&field_pup_historical=1

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

TurboTax Deluxe online does have a place for a net operating loss carryforward.

To enter your 2021 NOL carryforward:

- Type net operating loss in Search

- Select Jump to net operating loss

As Champs @Anonymous_ and @Mike9241 say, TurboTax does not calculate a NOL carryforward, so you will have to use Schedule A of Form 1045 to figure your carryforward each year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

Thanks for the feedback. I'm using Turbotax CD (not online) but I did a search for "net operating loss" as you suggested and the CD version worked just as you described and I was able to manually enter a NOL value and explanation. So thanks a lot. I will definitely make a note of this process.

Thanks, Nick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

I am using TurboTax Deluxe download edition for my 2022 taxes. I cannot access the page that Ernie SO referenced when typing in Net Operating Loss in the search ("Mm, sorry., this is outside my expertise.) I have a NOL carryover (individual) that I need to enter on Line 8A of Schedule 1. It won't let me enter it manually. Do I need a different version of TurboTax to be able to do this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

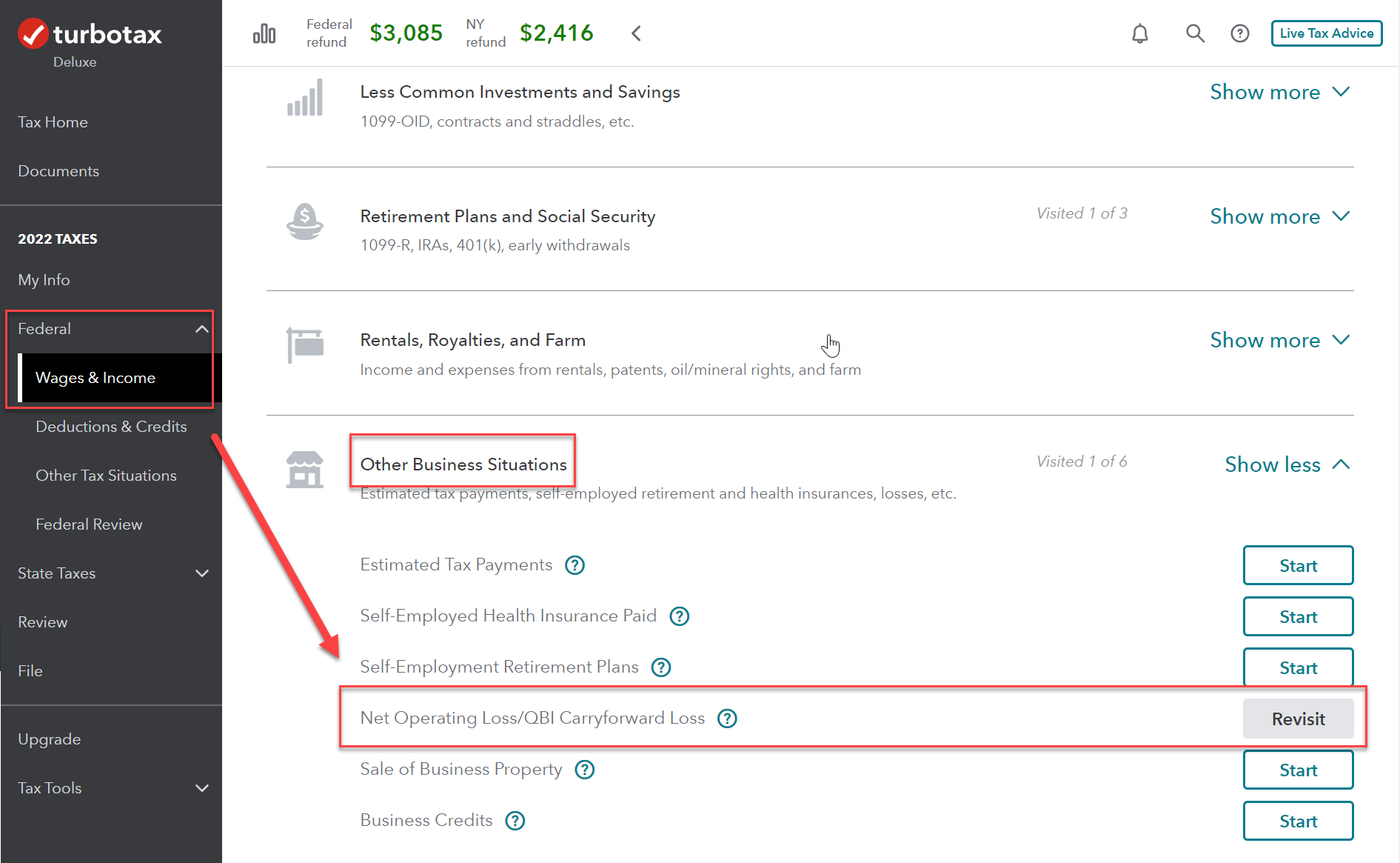

Success! TurboTax Deluxe - Wages & Income - Business Items - Business Deductions and Credits - Net Operating Loss. Put in your NOL and AMT NOL from the previous tax return (enter as a positive number) and it will go directly to Line 8a in Schedule 1 of the 2022 tax year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

If I do not deed 100% of the carryover to reduce my taxes, can I use only a portion and then use the balance in another year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

Yes, the un-used NOL can be carried forward indefinitely.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

Hello mpholland - I found your response when I was searching for how to enter my NOL carryover into TurboTax 2023. I have the same edition (deluxe, personal + business, etc) that you refer to in 2022. However, I cannot find the sections (and names) you mentioned in your post. Can you please share exactly how you entered your NOL carryover with me? Or give me more detail on how you entered it? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

I have a large NOL that I'm carrying from a past year. When I manually enter the amount on Sch 1, 8a my income goes to a large negative number since I don't have income that needs off-setting this year. Should I only enter NOL in Sch 1, 8a that I want to apply for the current tax year? e.g. If I have $700,000 NOL and $200,000 income next year, should I only enter the portion of my $700,000 NOL in Sch 1, 8a that I want to apply in that year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Net operating loss (NOL) carryover

You do need to take as much NOL as possible, you can't "save" any for next year.

However what isn't used this year can get carried forward.

You can enter it all and let the program figure it out.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joncarterconstruction

New Member

salscaringella26

New Member

jlondon11

Level 1

kandc-harrington

New Member

djwallace_us

New Member