- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Itemized and standard deductions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

Hi,

Last year TurboTax itemized my deductions for the best situation. This year it is saying the standard deduction is best. Our taxable income when up from 169K to 218K. However, mortgage interest (all primary residence) and taxes were about the same although I did refinance twice. Mortgage is under 620K. Last year, by itemizing, there was about 35K in deductions mostly mortgage interest and property taxes. This year interest was about 20K and property taxes were about the same, about 11K. Why would the standard deduction be better his year?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

It sounds like your mortgage interest may be reflected as being over the limit since you refinanced. I recommend reviewing your input to ensure your full mortgage interest deduction is allowed.

Mortgage interest deduction limits

Since you refinanced the same loan and if your total loan balance did not exceed $750,000 throughout the year, you will need to review your input.

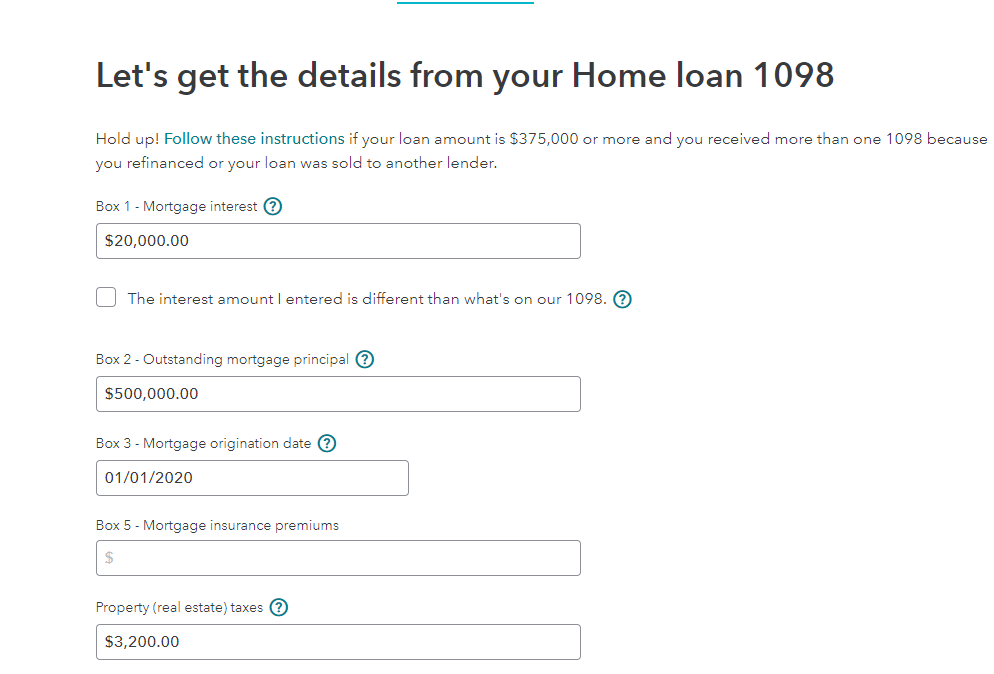

Be sure that you have entered $0 for the loan that was paid off in Box 2 - Outstanding mortgage principal on the screen titled Let's get the details from your Home loan 1098.

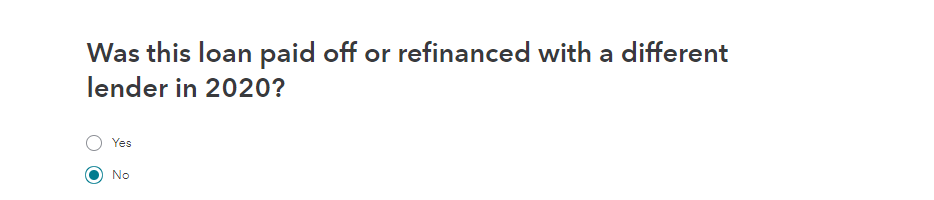

You will also want to select that the loan that was refinanced and is no longer there at the end of the year is marked as paid off during the year.

Please see the following link for additional information on entering the refinanced mortgage interest expense.

Once you make your corrections as outlined above, you should be able to itemize again as long as you meet the requirements and the total of your itemized deductions exceed your standard deduction.

Standard deduction versus itemized deduction

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

Thanks, what you say makes sense, but I never get the screen that asks whether it was paid off or refinanced with a different lender, maybe a bug??

I also refinanced twice with the same lender. Hopefully that is not an issue.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

If you refinanced with the same lender, you probably only received one 1098 form. If all of your mortgage interest is reported on that 1098, you are good to go. But look at your 2 year comparison, especially the itemized deductions part. You may not have reported all of your mortgage interest in 2020 - double check with your lender that your 1098 document reflects all of your mortgage interest paid in 2020. If you have multiple 1098 forms, please use these guidelines to ensure you are getting your full deduction. This article will link to the following document -

What do I do if I have multiple 1098s from refinancing my home debt? Your mortgage interest may be erroneously limited and that is why you are not getting as high of an itemized deduction as you are entitled to. Entering the forms as above will correct this and get you your full deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

I have exactly the same question and luckily found this thread and wondering if you have resolved the puzzle. I have done two refinance in year 2020. After reading the recommendation at https://ttlc.intuit.com/community/loans/help/what-do-i-do-if-i-have-multiple-1098s-from-refinancing-..., I added up those interests directly. The interest I paid for year 2019 was 19k and for year 2020 was 27k; the property tax I paid for year 2019 was 12k and for year 2020 was 14k. That implies I paid 10k more for year 2020 comparing to year 2019. Turbotax recommended itemized deduction for year 2019 but this year it recommends standard deduction for 2020. I still have no idea what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Itemized and standard deductions

In some cases, TurboTax was showing the screen that standard deduction was recommended, but that was the wrong screen and when you check the return, the itemized deductions on Schedule A was what was transferred to Line on the 1040.

Use TurboTax in a browser and clear browser settings for all time

- Sign into TurboTax

- Federal

- Deductions and Credits

- Go through all of the screens and see if the correct message appears

Then check the deduction taken:

- Tax Tools

- Tools

- View Tax Summary

- On the tax summary look at the line Itemized/Standard deduction to see the amount that is being reported.

@gaggeryt

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ninaya1

New Member

MADELYNNCAROL

New Member

jgilmer78

Returning Member

Omar80

Level 3

rtoler

Returning Member