- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- If you paid off the loan in 2018, then put $0. If you pa...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

If you paid off your mortgage in 2018, what do you put for "final principal balance"? The TurboTax page says "If you paid off your loan this year, we need the balance before you made your final payment.", however, the answer by the TurboTax TaxPro on this question (https://intuit.me/2TAHzTc) says to put $0. Which is right?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

If you paid off the loan in 2018, then put $0. If you paid off the loan in 2019 (this year), then you will enter your final principal balance (your balance on 12/31/18)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

If you paid off the loan in 2018, then put $0. If you paid off the loan in 2019 (this year), then you will enter your final principal balance (your balance on 12/31/18)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

It's now 2020 and your solution doesn't work for mortgage paid off in 2019. When I put "0" for balance after entering the interest paid in 2019, TurboTax generates this error message in red: "Outstanding mortgage principal must have a value." The mortgage company didn't send a 1098 because the interest is under $600. How do I get past this page and still have my interest credited? Going through "Forms" and Step-by-Step as suggested in another 2019 post on this subject does not work for me. TurboTax needs to add a "Mortgage paid off last year" option as a workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

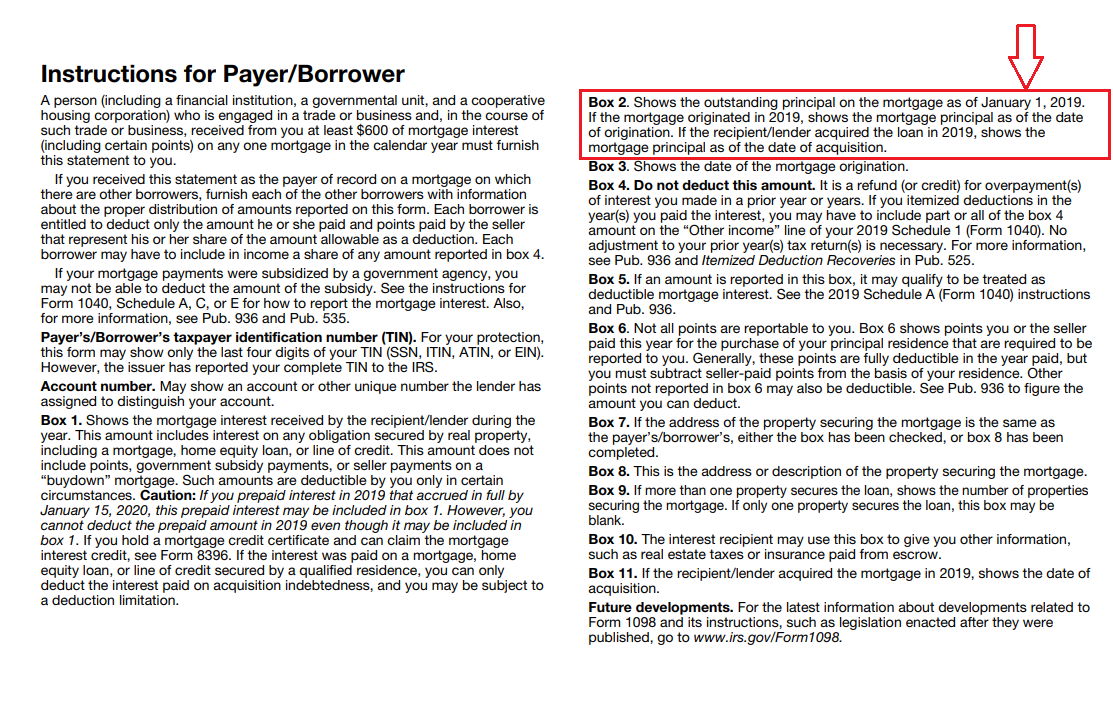

The outstanding mortgage amount is the balance as of 1/1/2019 not 12/31/2019.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mortgage paid off, what is the "final principal balance"?

Disregard my original. Since it doesn't present form instructions to us directly, the program ought to specify beginning-of-year or end-of-year. "Outstanding" generally means what remains, not what is begun with.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AE_1989

New Member

powelltyler95

New Member

jwallace19791123

New Member

in Education

jackkgan

Level 5

AndrewA87

Level 4