- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

does not give 1099-s form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

There is no Form 1099-S entry in TurboTax. Just report the sale of vacant land using the gross proceeds and date shown on the form.

- Tap Federal in the left column

- Select Wages & Income

- Scroll down to Investment and Savings

- Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- On “Your investments and savings” tap +Add investments

- Skip “Get Ready to be Impressed”

- On “Let’s import your tax info, tap Enter in a different way

- On “OK, let’s start with one investment type, select Other, then Continue

- On “Tell us more about this sale,” enter Vacant Land

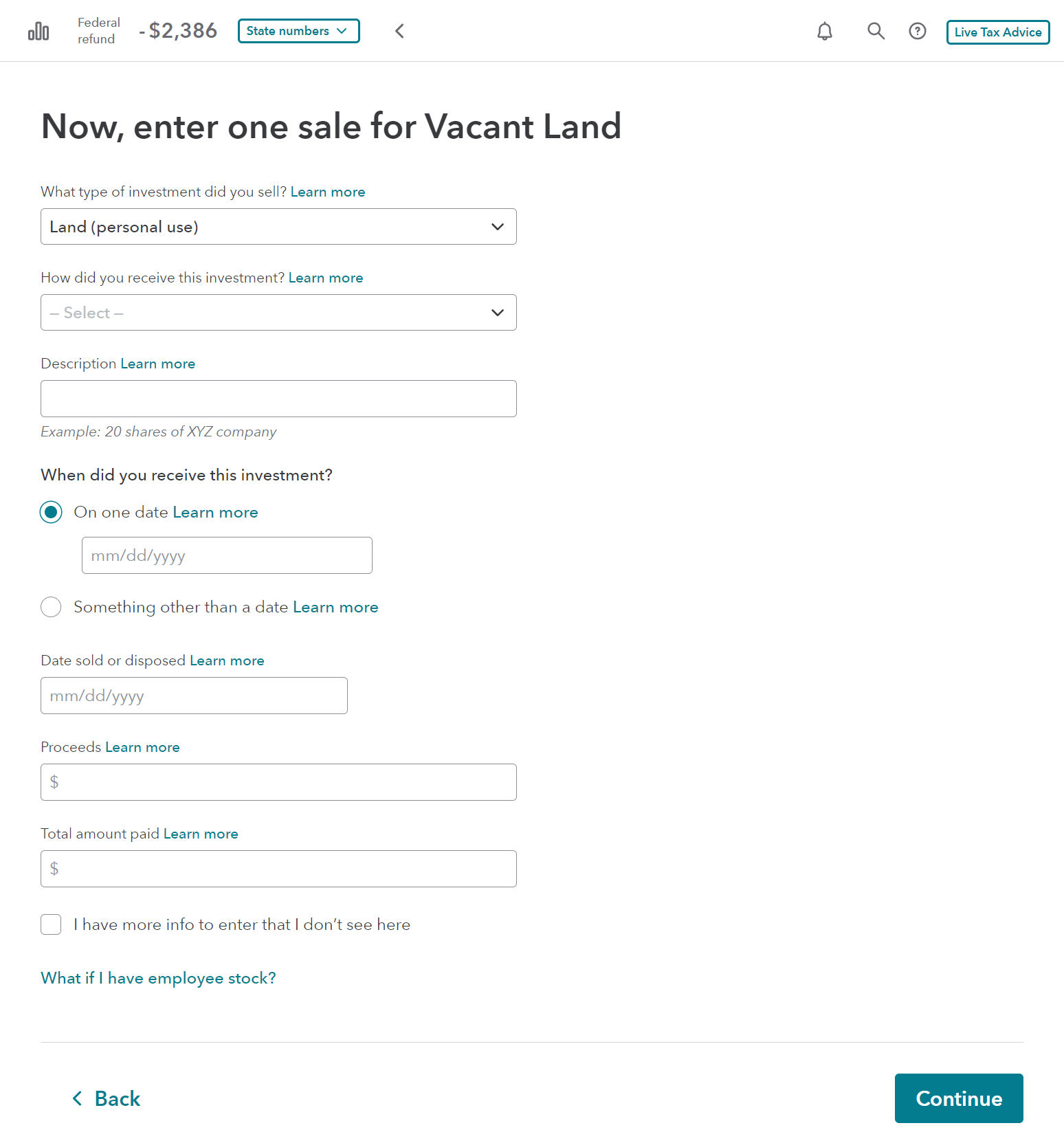

- On “Now, enter one sale for Vacant Land," in the box What type of investment type did you sell? choose Land (personal use) or Land (other investment purpose)

- Fill in the rest of the info

@MGanahi

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

Where do you list the improvements to vacant land and the costs of selling (closing fees, excise taxes, etc.) on the Premier forms for a 1099S sale?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

The TurboTax programs each differ slightly when entering the sale of land.

No matter which program you use, that sale is reported on Schedule D as a Capital Gain (or loss).

Enter under

Personal Income

Stocks, Mutual Funds, Bonds, Other (some programs include Crypto)

Select NO to having a 1099-B

Select that you want to enter one sale at a time

Either select Land from the drop-down if available, or type LAND in the description box

Enter the date sold and sale proceeds using your 1099-S

Enter the date you bought the land

Enter your cost and the cost of improvements as the "Cost or other basis"

Select "Long-term" if you owned the land for more than one year (Short-term is one year or less)

Continue through three screens to "Select any less common adjustments that apply" and select "The reported sales price did not deduct all fees or selling expenses"

Enter the additional fees in the dialog box which appears.

If sold at a gain, the income will be listed on Schedule D and flow to your 1040 Line 7

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold a piece of land, a vacant lot, and received form 1099-S. All that is being asked in Turbo Tax for income is did I sell a house. Where do I enter this sale of land?

what tt edition are you using and c/d or internet down load

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

samman2922

New Member

LLarsen1

Level 1

user17552925565

Level 1

user17539892623

Returning Member

Aowens6972

New Member