- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

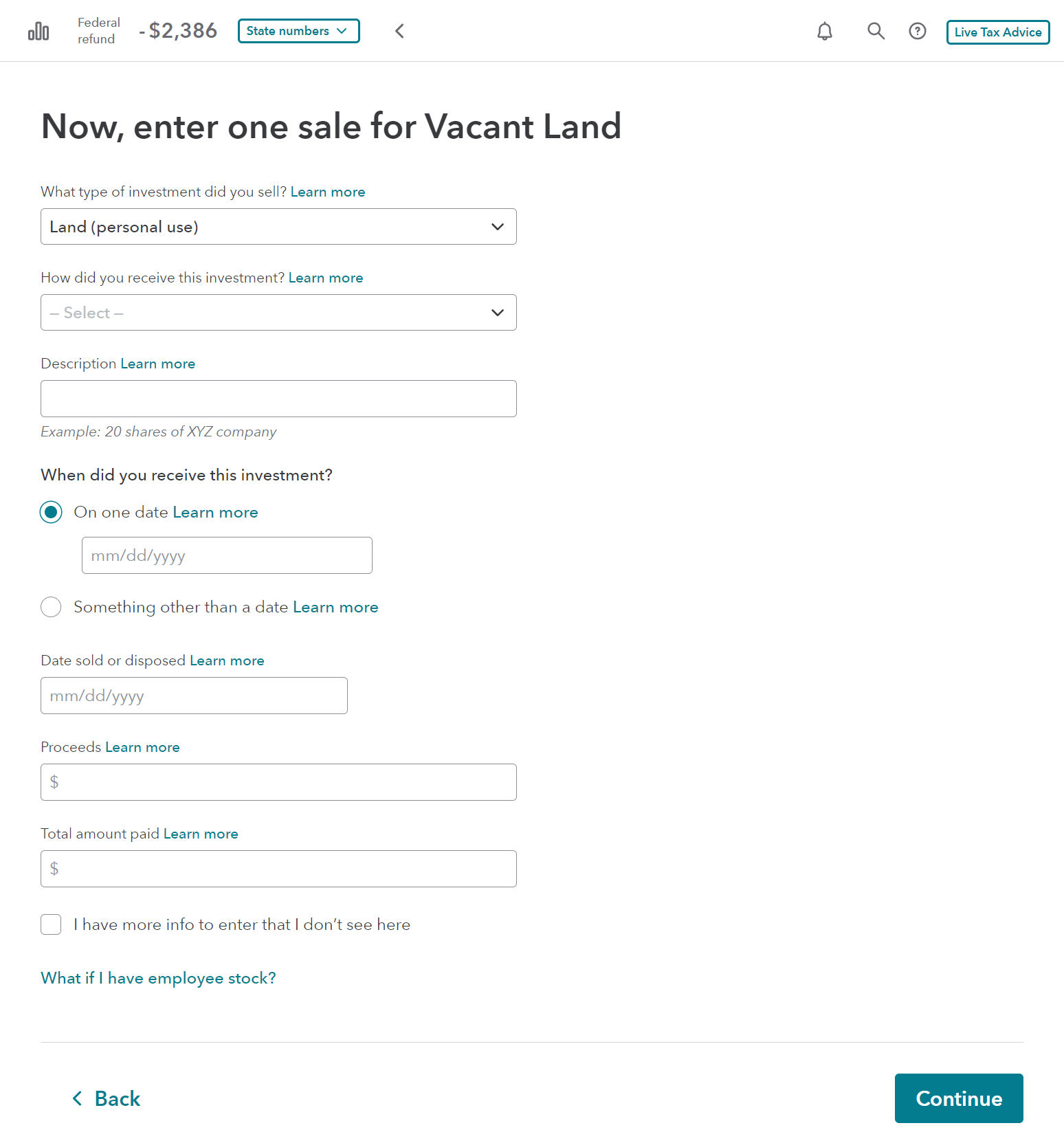

There is no Form 1099-S entry in TurboTax. Just report the sale of vacant land using the gross proceeds and date shown on the form.

- Tap Federal in the left column

- Select Wages & Income

- Scroll down to Investment and Savings

- Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- On “Your investments and savings” tap +Add investments

- Skip “Get Ready to be Impressed”

- On “Let’s import your tax info, tap Enter in a different way

- On “OK, let’s start with one investment type, select Other, then Continue

- On “Tell us more about this sale,” enter Vacant Land

- On “Now, enter one sale for Vacant Land," in the box What type of investment type did you sell? choose Land (personal use) or Land (other investment purpose)

- Fill in the rest of the info

@MGanahi

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 25, 2023

8:18 PM