- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I received income on government bonds that are not taxable in minnesota where do deduct that from my total

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

I received income on Government bonds that are not taxable in the state of Minnesota. When downloading my Federal to State it did not subtract these government bonds form the total of my income. I cannot find the place to enter this total to reduce my taxable income . I need some help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

You should have a 1099-INT or a 1099-DIV for the non taxable bond interest.

This link is a comprehensive thread with screenshots about how to report the nontaxable bond.

Here's a TurboTax article about bond interest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

The interest I receive are Federal Home Loan Bank bonds . This interest is not taxable in the State of Minnesota. I cannot find the place to put it on my Federal return or on my state return so it will deduct from my taxable income for the state. I have looked and tried everything.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

it depends on what box is entered on the 1099-INT. The correct entry would be in Box 2 of the 1099-INT. I tested this in my Turbo Tax online program and when I listed an amount in Box 2, the Minnesota AGI was reduced by the amount I entered.

in fact, You must pay federal income tax on federal bond interest, but you do not pay Minnesota income tax. the Federal Home Loan Bond is certainly a bond that is not taxable in the State of Minnesota.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

I tried it and it did not work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

You are correct, interest income on municipal bonds are not taxable to the IRS, and not taxable to the state as long as the bond is from your home state.

To enter your non-taxable interest income from municipal bonds please follow these steps:

- Click on Federal > Wages & Income.

- Scroll down to the Interest and Dividends section and click on the Start/Revisit box next to Interest on 1099-INT.

- Answer Yes to Did you receive any interest income?

- On the next screen, click on I'll type it in myself.

- On the next screen, Let's get your 1099-INT or brokerage statement details, mark the box My form has info in more than just box 1 (this is uncommon).

- Enter tax-exempt interest in Box 8.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

I had the same issue. Turbo Tax was not deducting the Goverment Bond interest from my state taxable income. But then I realized I'd entered it as interest in Box 1 on the 1099-INT and not Box 3. So I corrected it and moved it to Box 3. Unfortunately Turbo Tax did not recognize the change and it was still taxable. I had to delete the 1099 AND the state tax return (https://ttlc.intuit.com/community/state-taxes/help/how-do-i-clear-my-state-return-in-the-turbotax-fo...) and then re-enter the 1099-INT using Box 3 and then start the state return from scratch. Then it correctly deducted it. Not sure if this is the situation you have ran into or not, but this is how I got it to work!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

I have the same question about agency bond interest for NY and CT. Please provide a method to not pay state taxes on it. (It seems the way to "solve" this is state specific or turbotax state specific. This is for 2023 interest.)

thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

Agency bond is a little different beast. An Agency bond is a debt issued by a government-sponsored enterprise (GSE) or a federal agency.

The key difference between a GSE, like Fannie Mae, and a federal agency is that a GSE’s obligations are not guaranteed by the government, whereas a federal agency’s debt is backed up by a government guarantee.

You need to determine if your agency bond meets the rules for NY and CT.

New York

New York Tax Treatment of Interest Income on Federal, State is a bit more complicated with this statement: The subtraction modification applies only if the fund meets the 50% "U.S. Obligations" asset requirement under section 612(c) (1) of the Tax Law.

Connecticut

PS 9231 Connecticut Income Tax on Bonds or Obligations we see these requirements:

- a binding promise by the United States to pay specified sums at specified dates; and

- specific Congressional authorization which also pledged the faith and credit of the United States in support of the promise to pay.

Once you determine the allowable amount of deduction, enter it in the program.

- return to the federal entry.

- If the interest is on 1099-INT it should be in box 3 for US obligations and carrying to the state. Edit the form and review

- if it is coming from a 1099-DIV:

- select edit

- select the box saying "A portion of these dividends is US Government interest" from the follow up screen.

- Continue on to enter the nontaxable portion.

The CT return should carry it through with no issues.

The NY return may require an adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

Thanks for the reply.

Sorry about the confusion, I was referring to having the same issue as the person who had interest from Federal Home Loans Bank bonds and Federal Farm Credit Banks (Funding Corporation) bonds. These bonds' interest payments are not state taxable. The 50% rule is not applicable (not funds) and they're not dividends, they are on 1099-INT.

However, I find it a bit sketchy to edit the 1099-INT and change interest in Box 3.

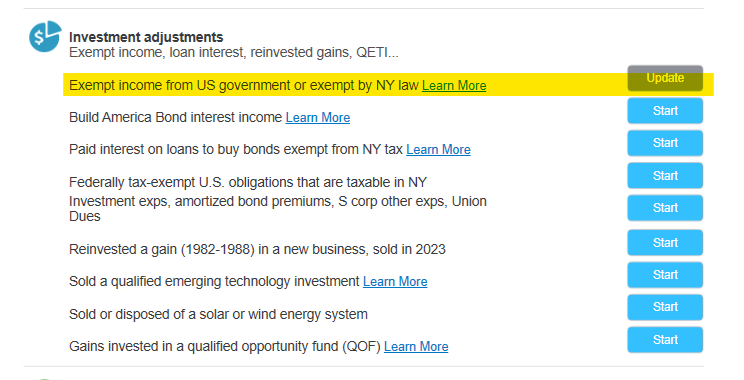

I added the total of this type of interest in the NY return to the adjustment you highlight in yellow and said NY source was 0.

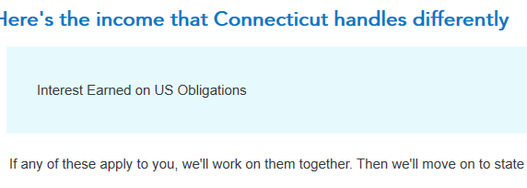

For CT I edited the "interests earned on US Obligations" at the top of the Income section (the very first item as below) and added the total amount.

Please let me know if this is not correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received income on government bonds that are not taxable in minnesota where do deduct that from my total

Yes. You are correct to allocate this to Connecticut income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17522872699

New Member

long-r11

New Member

cnhowardcell

Returning Member

ashleehess81

New Member

templeone05

Returning Member