- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Agency bond is a little different beast. An Agency bond is a debt issued by a government-sponsored enterprise (GSE) or a federal agency.

The key difference between a GSE, like Fannie Mae, and a federal agency is that a GSE’s obligations are not guaranteed by the government, whereas a federal agency’s debt is backed up by a government guarantee.

You need to determine if your agency bond meets the rules for NY and CT.

New York

New York Tax Treatment of Interest Income on Federal, State is a bit more complicated with this statement: The subtraction modification applies only if the fund meets the 50% "U.S. Obligations" asset requirement under section 612(c) (1) of the Tax Law.

Connecticut

PS 9231 Connecticut Income Tax on Bonds or Obligations we see these requirements:

- a binding promise by the United States to pay specified sums at specified dates; and

- specific Congressional authorization which also pledged the faith and credit of the United States in support of the promise to pay.

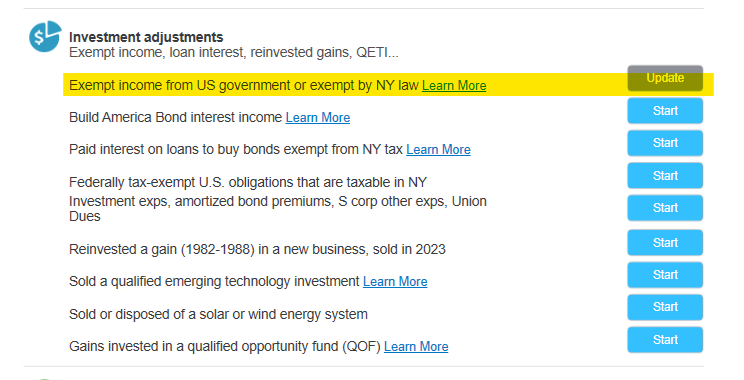

Once you determine the allowable amount of deduction, enter it in the program.

- return to the federal entry.

- If the interest is on 1099-INT it should be in box 3 for US obligations and carrying to the state. Edit the form and review

- if it is coming from a 1099-DIV:

- select edit

- select the box saying "A portion of these dividends is US Government interest" from the follow up screen.

- Continue on to enter the nontaxable portion.

The CT return should carry it through with no issues.

The NY return may require an adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"