- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- I'm having trouble figuring out the sales expenses. Is that pretty much the closing costs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm having trouble figuring out the sales expenses. Is that pretty much the closing costs?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm having trouble figuring out the sales expenses. Is that pretty much the closing costs?

Yes. These would include closing costs that you paid at closing that are not included elsewhere on your tax return. (So if you are reporting mortgage interest payments or property tax payments related to the sale elsewhere on your tax return, do not include these two costs as selling expenses also.)

You are allowed to deduct from the sales price almost any type of selling expenses, provided that they don’t physically affect the property. Such expenses may include:

- advertising

- appraisal fees

- attorney fees

- closing fees

- document preparation fees

- escrow fees

- mortgage satisfaction fees

- notary fees

- points paid by seller to obtain financing for buyer

- real estate broker's commission

- recording fees (if paid by the seller)

- costs of removing title clouds

- settlement fees

- title search fees, and

- transfer or stamp taxes charged by city, county, or state governments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm having trouble figuring out the sales expenses. Is that pretty much the closing costs?

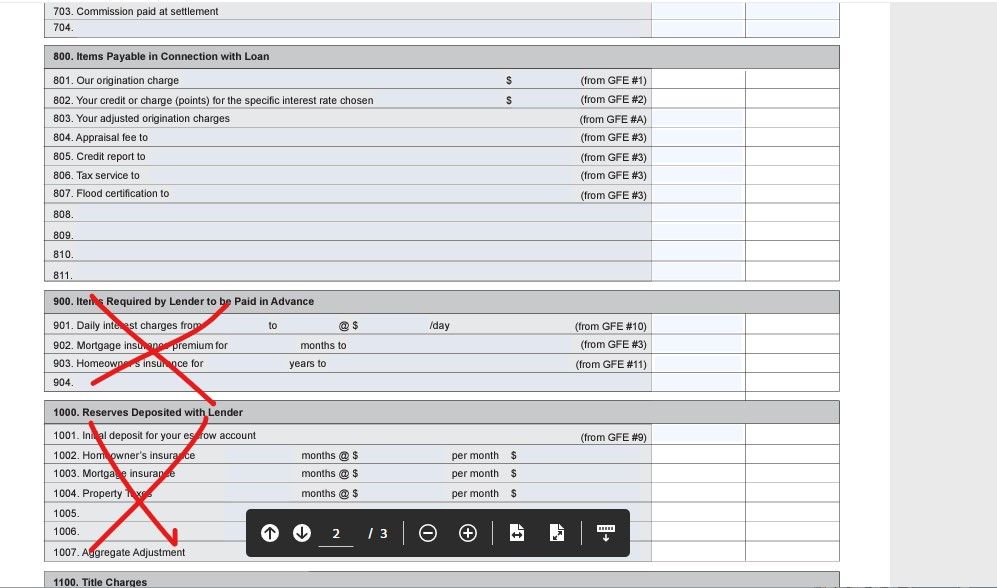

I am looking at my HUD settlement statement. It seems that line 1400 settlement charges would constitute the sales expenses? Is that correct?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm having trouble figuring out the sales expenses. Is that pretty much the closing costs?

Nope ... you cannot just take the amount on line 1400 ... you cannot use the 900 or 1000 sections at all and there maybe other items that were not closing costs so you have to look carefully.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BenFen101

New Member

slogan96

New Member

mjckhc

Returning Member

emh_SpencerTop

Level 2

Matthew B

New Member