In TurboTax Premium Online, your may be able to write off the full value of depreciable assets in the current year rather than depreciate the asset over several years.

To report expenses under Self-employment income, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click on the drop down arrow to the right of Self-employment.

- Click to the right of Self-employment income and expenses.

- At the screen Tell us the type of self-employment work you do, select Edit and click Done.

- Click the pencil to the right of Assets.

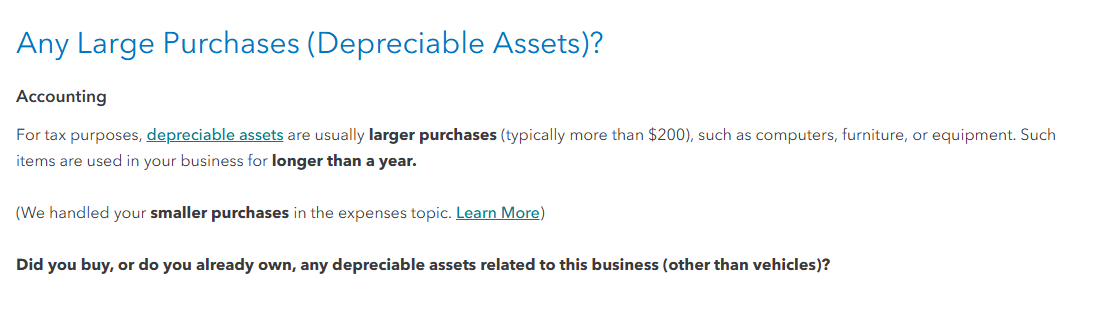

- At the screen Any Large Purchases (Depreciable Assets), you may qualify to expense the cost in the current year.

Or

- At the screen Business Asset Summary, select Add an Asset.

- Establish the asset by answering questions about the asset.

- If you qualify, you will be offered bonus depreciation or Section 179 depreciation to report the depreciation expense in the current year.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"