- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Hi,

I am a software consultant and owner of S Corp and 100% work from home. I am 66% share holder and my wife (who is teacher) is 34% share holder of the S Corporation. I have already filed my Business (S Corp) return and generate (K1) for me and my wife. Now I am working on the Personal (1040) Joint return (using Turbotax Home and Business 2019) and not sure where and how to enter my Home Office (Utilities, HOA, Mortgage & Property Tax etc.) Expenses. I am using 1 specific room (almost 10% of my home space) as my home office.

As tax deadline are approaching therefore any help to get it resolved asap will really be appreciated.

Thanks,

SauGo

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

As an owner of the S-Corp, if you work for the S-Corp, the S-Corp has to pay a normal salary and you are an employee of your S-Corp.

As an employee, you cannot deduct home office expenses as they are job-related.

The best arrangement is for the S-Corp to reimburse you the cost of your home office under an accountable expense plan.

Please read this article for more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Hi MinhT1,

Thanks for your prompt reply and yes I withdrawal annual Salary as an Employee of S Corp. My wife is not withdrawing any salary as she is full time teacher. I have already filed my S Corp Taxes and imported both (me and my wife) K1 in to my personal return. As you have mentioned I can claim them as Un-reimbursed Expenses, but how (what form etc.) and where to enter that information in Turbotax. Do I have to adjust my K1 for this transaction or how to enter that information in my personal (1040) tax return, that's what I am struggling with and will really appreciate any help.

Thanks,

SauGo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Unfortunately, as an employee of your S-Corp, you cannot claim either the home office deduction or unreimbursed expenses.

Nothing can be done for tax year 2019. But you can set up an accountable plan with your S-Corp now and in 2020, submit an expense for your home office expenses for both 2019 and 2020. As it is an accountable plan, the amounts reimbursed are deductible by the S-Corp, but not taxable for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Hi MinhT1,

Once again thanks, reviewing my last year (2018) return I have noticed that my accountant has attached Schedule E with my tax return and on Page 2 he has item 27 "Unremibursed Partnership Expenses" checked and then also in line 28 in Nonpassive Income and Loss section he has home office expenses reported as (i) Nonpassive loss from Schedule K-1. Also I have noticed he hasn't taken any Depreciation of my Home, only 10% percent of Home Utilities, Mortgage, Insurance, and HOA. Is it the way I can do for this year and moving forward from this year will follow the accountable plan as you have suggested.

Thanks,

SauGo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Actually, you have an S-Corp and you are an employee of the S-Corp.

Your accountant was treating your S-Corp as a partnership in 2018 (which is not correct).

The IRS says: You can deduct unreimbursed ordinary and necessary expenses you paid on behalf of the partnership if you were required to pay these expenses under the partnership agreement. (see page E-9 of this document).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

I HAVE AN S-CORP AND RECEIVE A K-1.

HOW DO I DEDUCT DEDICATED HOME OFFICE EXPENSES.

TURBO TAX INSTRUCTIONS IN S-CORP ARE THAT THEY MUST BE TAKEN ON PERSONAL RETURN.

1. HOW DO I GENERATE A FORM 8829 FOR THE S-CORP IN MY PERSONAL RETURN?

2. IF I SOMEHOW GENERATE A FORM 8829, HOW DOES THAT DEDUCTION GET APPLIED TO K-1 INCOME?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

As @MinhT1 has said, as the owner of the S-Corp, you are required to receive reasonable compensation from the corporation for services you provide.

This would be as a W2 employee. Any home office expenses should be set up as reimbursements as part of an accountable plan and are deductions of the corporation.

They then reduce the amount of pass-through income from the Form 1120-S.

The Tax Cuts and Jobs Act of 2017 eliminated the deduction for employees to claim unreimbursed job expenses on their personal tax returns.

There is no current deductions allowed for you to claim home office deductions on your personal return in your situation.

They can and should to be claimed against the S-Corporation as business expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Hi SauGo,

We are in a very similar situation to the one you described in your comment last year. We just started an S-Corp, have a home office, filed our business return, and are working on our personal return. Did you find a solution for your questions about the home office deductions on the personal return?

Thanks!

-D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

As MinhT1 explains above, you are an employee of an S-Corporation and the Tax Cuts and Jobs Act of 2017 eliminated the deduction for employees to claim unreimbursed job expenses (including home office) on their personal tax returns.

However, there are alternative ways of handling this situation:

-

The S corporation can pay you rent for the home office.

-

The S corporation can pay you for the costs of a home office under an "accountable" plan for employee business expense reimbursement.

Please see this Intuit ProConnect article for more information: S-corporation home office deductions, reimbursements and expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Sorry for the late reply as @Irene2805 and @MinhT1 mentioned I have reimbursed to my self under accountable plan. Basically consolidate all the yearly home office expenses (including HOA, Water, Electricity, Gas, Phone, Mortgage Interest, Home Insurance) for last year and use the 10% (whetever the total home space percentage used for your home office) of that as reimbursement under accountable plan. I normally reimburse for last year, after filing my taxes for that year, so for 2020 will reimburse sometime in April or May 2021 after filing my 2020 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

I HAVE AN S-CORP AND RECEIVE A K-1.

HOW DO I DEDUCT DEDICATED HOME OFFICE EXPENSES.

TURBO TAX INSTRUCTIONS IN S-CORP ARE STATING THAT THEY MUST BE TAKEN ON PERSONAL RETURN.

The TurboTax instructions are EMPHASIZING that the Home Office Expenses are not supposed to be deducted within Form 1120-S (which is S corporation's tax return). They are deducted while you are preparing Individual Income Tax Return. WHERE????????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Due to the tax law changes for 2018 - 2025 employees cannot deduct Home office expenses since the Sch A was changed. You should have a W-2 from the business as an employee of the corporation.

There is no tax form for the home office deduction on the S-Corp tax return (Form 1120S), and with the Tax Cuts and Jobs Act (TCJA), employees who work from home are no longer entitled to claim home office expenses on Schedule A (Itemized Deductions). Shareholders can, however, be reimbursed for an allocated portion of their related home expenses for their home office, including rent, mortgage interest, property taxes, home interest, home insurance, utilities, repairs and maintenance. Just a quick note though – although many taxpayers no longer benefit from itemizing deductions, if you do, any mortgage interest and property taxes reimbursed by the S-Corp must be excluded from the amounts included on the shareholder/employee’s Schedule A. To deduct home office expenses, the S-Corp must set up an accountable plan to have the company reimburse for home office expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

Thank you for the detailed response to my question. I am sure many Small Business Owners are getting confused when have to deal with Home Office deduction, specifically those with S corp election. Please correct me if I am wrong. I will try to describe appropriate action to be taken from my prospective. In order to have this deduction I should create (write on piece of paper) Accountable Plan, which consists of list of expenses, based on accepted by IRS types of expenses related to Home Office, carefully calculate everything to make no mistakes (keep supporting documents), per some period of time of the tax year (month, quarter, year) and pay this amount from Business Bank Account to my Personal Bank Account and categorize this transaction in Quickbooks as Business Expense, like any other expenses (shipping, advertising, subscriptions, etc.). And this is how I get reimbursed for using home office as Business Owner running S corp. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How To Deduct S Corp - Home Office Business Expenses (On 1040 Joint Return)

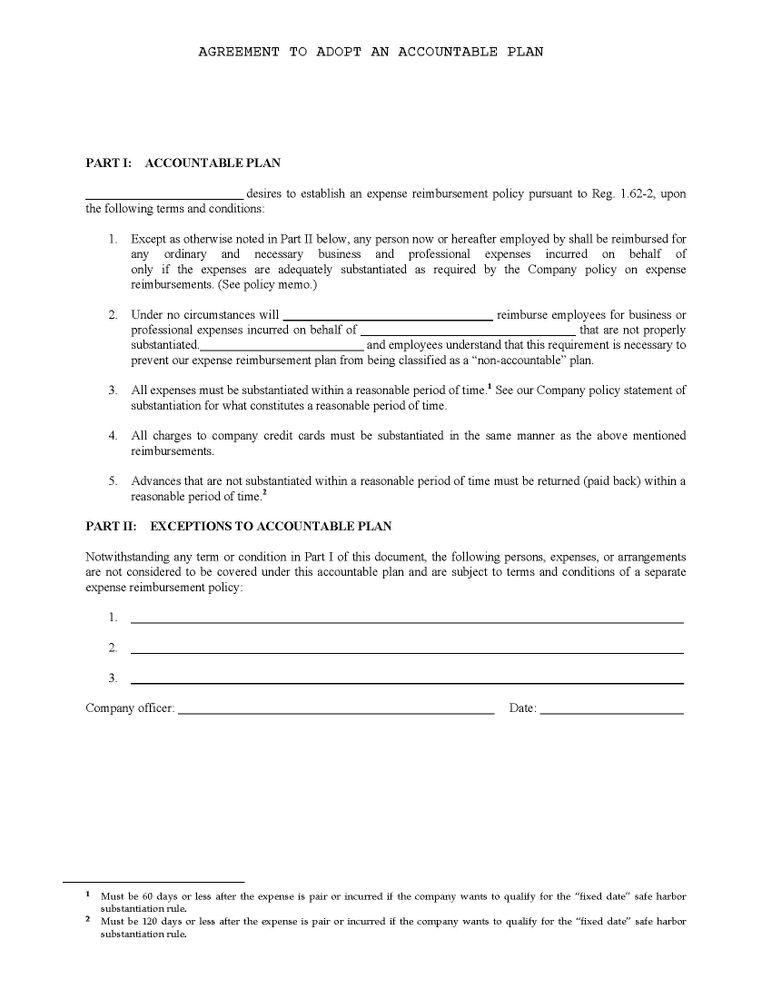

I just learned that some kind of internal company document should be created and signed by the company officer. See the attachment. Is there anything else to be done?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Viking99

Level 2

gavronm

New Member

Idealsol

New Member

user17557136899

Returning Member

c0ach269

Returning Member