- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How to deal with "UNDETERMINED TERM TRSACTIONA FOR NONCOVERED TAX LOTS..." on 1099-B for silver and gold trust funds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with "UNDETERMINED TERM TRSACTIONA FOR NONCOVERED TAX LOTS..." on 1099-B for silver and gold trust funds

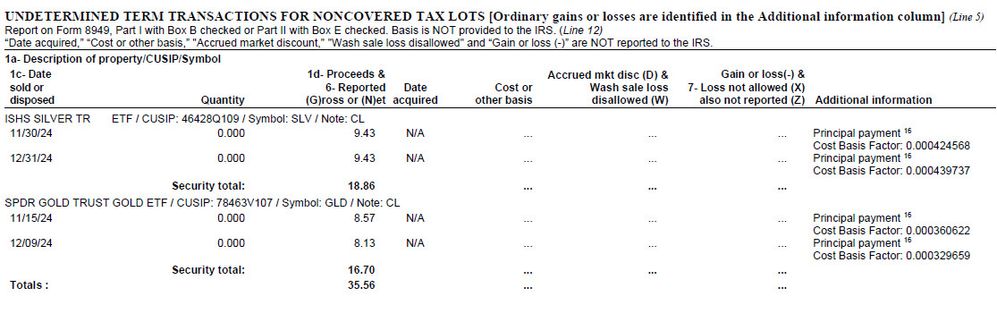

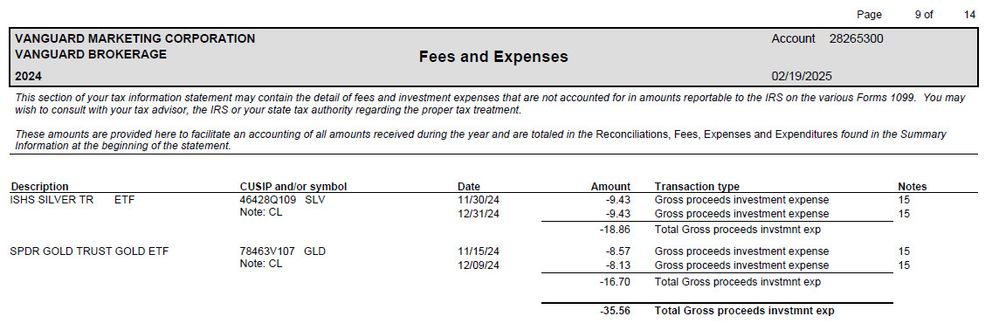

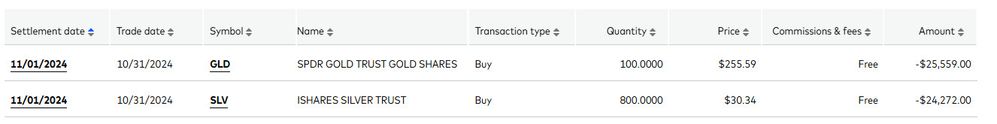

On Nov 1, 2024, I purchased gold and silver TRUST fund shares in a taxable Vanguard fund. My 1099-B shows "UNDETERMINED TERM TRSACTION FOR NONCOVERED TAX LOTS ..." with sales for November 30 and December 31 for the silver and gold funds. Note it is "sales" although I did not sell any shares! The only column listed is Column 1d for Proceeds (no Date acquired, cost basis or gain/loss). I also see a Section of "Fees and Expenses" for the two funds whose amounts match the Column 1d Proceeds in the "UNDETERMINED ..."SECTION OF 1099-B.

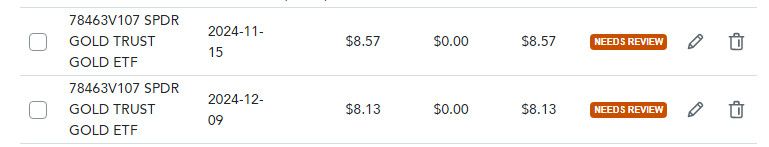

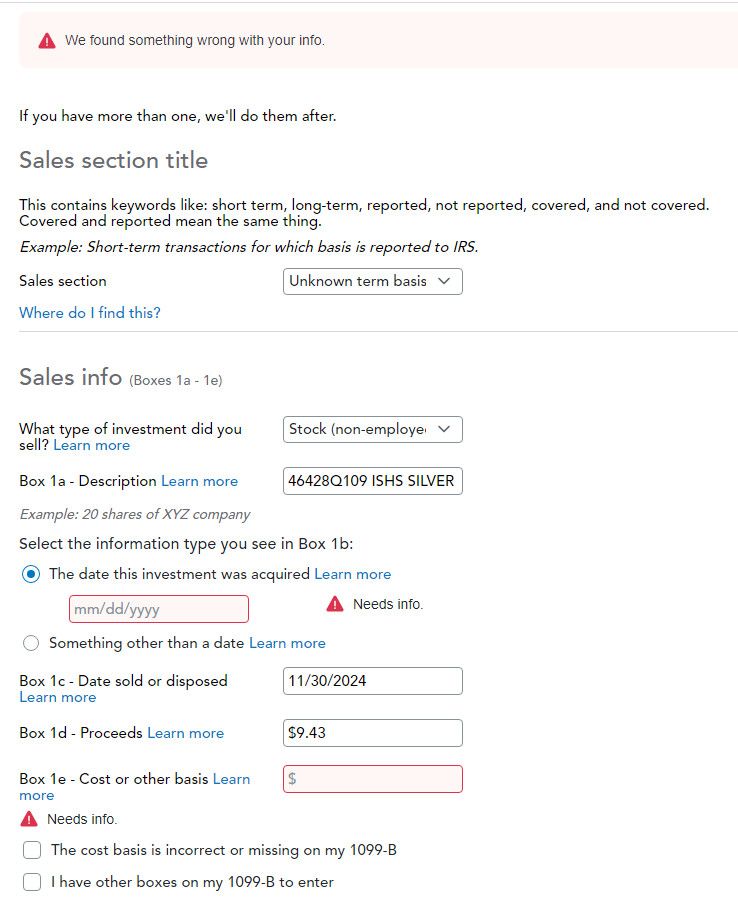

My question is what to do with this information and where to place in TurboTax. I have downloaded the data from Vanguard to my 2024 TT Premier. All goes OK until the check for investing income and I get a message that Vanguard "Needs Review" of the 1099-B.

Note: I am in the Step-by-Step mode. When I click on the Smart Check (pencil icon), it gives me some of the 1099-B Sales info (Boxes 1a - 1e). Box 1c - Date sold is already filled in: for the November transaction, it has a date of 11/15/2024, and for the December transaction it has 12/09/2024. For November, 1d has proceeds of $8.57, and December has 1d Proceeds of $8.13. Missing for both months are two items: date acquired and Box 1e - Cost or other basis.

What should I be entering for Box 1e (the original cost amount, a reduced basis or what)? Is date acquired the same for each month, i.e., 11/01/2024? I am confused ... is this a capital gain, a dividend, or a fund expense? Is my cost basis going down by this amount each month?

I appreciate your patience with this newbie dealing with Trust fund shares in a taxable account. I wish I'd never done it!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deal with "UNDETERMINED TERM TRSACTIONA FOR NONCOVERED TAX LOTS..." on 1099-B for silver and gold trust funds

For Box 1E, you would enter 0 since there's no cost basis reported for there transactions. The date acquired would be 11/1/2024, since this was the settlement date. This is treated like a short-term capital gain even though it's an investment expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tpgrogan

Level 1

b_benson1

New Member

skonger

Returning Member

hunterbean2022

New Member

icefyre123

Returning Member