- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

What new law are you talking about? I know of no such law. 2020 EIC is based on your 2020 earned income and total AGI, not 2019 income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

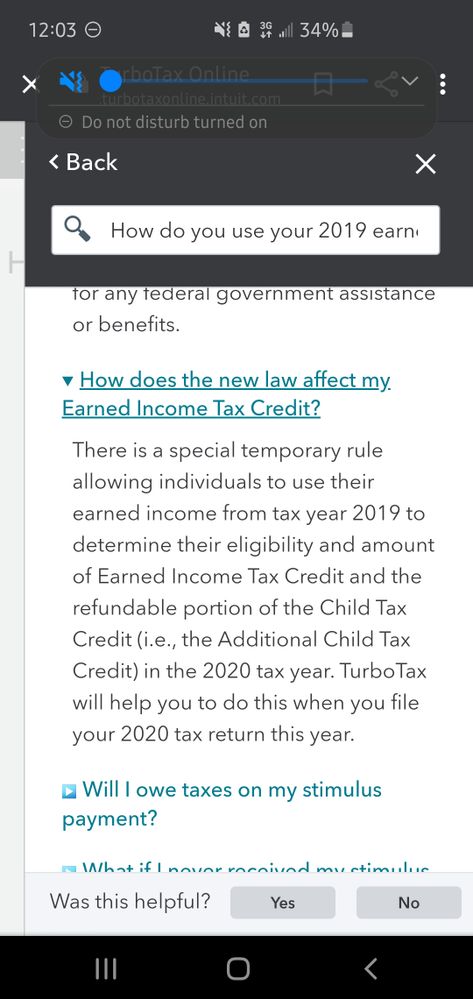

There is a lookback that will allow you to choose using your 2019 income for EIC on the 2020 return, It is in the EIC section.

(I had a screenshot but messed it up...sorry)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

Here is a thread with screen shot of the EIC forms

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

I stand corrected. I could not find it in any IRS pub but it in in the 1040 instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

@macuser_22 Seems like there are a few more little surprises----found out about this one a few hours ago. Self-employed parents who missed work due to children doing remote learning can get up to 50 days of sick leave credit capped at $200/day

https://www.irs.gov/pub/irs-dft/f7202--dft.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

It won't give me the option or I can't find it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

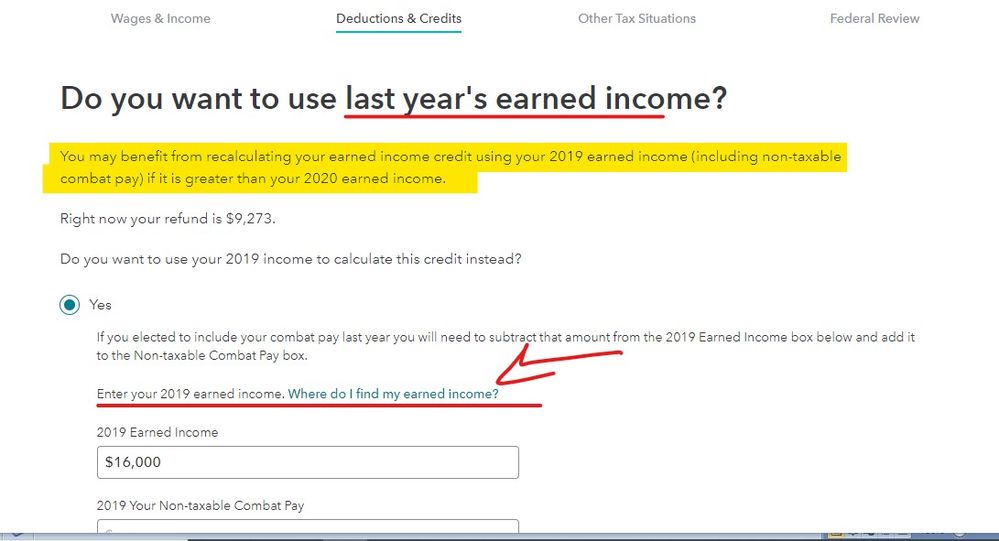

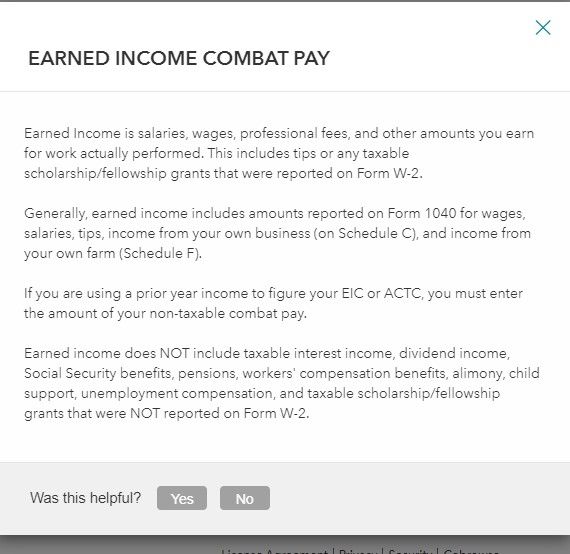

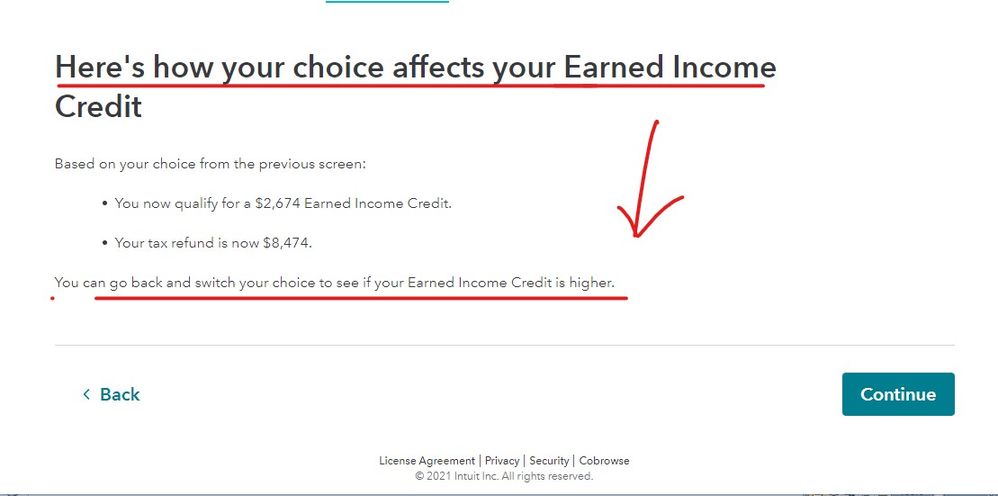

Look for these screens in the EIC interview section of the return after you have entered in all your income and dependents ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

I can not get a screen to give me the choice of using 2019 income. It insists on using 2020 which includes some unemployment. I also tried to fix it in the work sheet but still leaves line 11 as 2020 income. I made sure software updated

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

Try this.

You still MUST enter all of your 2020 income into your 2020 tax return, including any unemployment you received.

Please follow these steps in TurboTax:

- Login to your TurboTax Account

- Click on the Search box on the top and type "EIC"

- Click on “Jump to EIC”

- Answer the questions until you reach the screen "Do you want to use last year’s earned income?"

- Note your current refund amount using your 2020 earned income at the top of the screen.

- Click "Yes", enter your "2019 Earned Income" if the field is blank and click "continue".

- Compare the new refund amount using your 2019 earned income with the previously noted refund amount using your 2020 earned income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

Same question. I have already tried the forum answers and email answers multiple times. I can NOT get an interview screen to allow me to choose between 2019 and 2020 income for earned income credit.IT skips directly to one that says my 2020 income is too high

I also can not override the worksheet which always has 2020 income on line 9 even though the rest of sheet had the 2019 autopopulated (from when I transferred the 2019 return to create a 2020 return.) I can check the box for 2019 or 2020 but either way line 9 never changes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I use the new law on earned income tax credit. How can I use my 2019 earned income for 2020. I also have a child this year but I don't understand how to do it?

The 2019 lookback function can ONLY be used if the 2020 earned income is less than the 2019 earned income. So if your 2020 earned income it too high to get the EIC you cannot use the prior year info instead to force a credit to populate.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chiroman11

New Member

meltonyus

Level 1

Majk_Mom

Level 2

in Education

georgiesboy

New Member

user17555332003

New Member