- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I report the sale of a third house in 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

Were any of these homes your personal residence ?

Were any of them rentals ?

Did you get one 1099-S form for the entire sale or 3 separate ones ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

If you're asking how to split the one price amongst the three properties, find out the fair market value (FMV) of each property. Based on that amount, figure out the FMV percentage of each property and apply that percentage to the sales price.

If the third house was a rental, see I sold my rental property. How do I report that?

If the third house was for personal use but not your main home, see Where do I enter the sale of second, third, etc., home, an inherited home, or land on my 2021 taxes?

If the third house was your main residence, see Is the money I made from a home sale taxable?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

In Dec 2021 I sold three rental properties. I had NEVER lived in any of them as my primary home. I sold them as a package deal to an investor and did not have to pay any closing costs or fees. TurboTax will only allow me to enter two of the houses. What do I do about the third house? I've tried getting an expert on the line but they only send me articles that have nothing to do with my situation. I need help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

In Dec 2021 I sold three rental properties. I had NEVER lived in any of them as my primary home. I sold them as a package deal to an investor and did not have to pay any closing costs or fees. TurboTax will only allow me to enter two of the houses. What do I do about the third house? I've tried getting an expert on the line but they only send me articles that have nothing to do with my situation. I need help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

In Dec 2021 I sold three rental properties. I had NEVER lived in any of them as my primary home. I sold them as a package deal to an investor and did not have to pay any closing costs or fees. TurboTax will only allow me to enter two of the houses. What do I do about the third house? I've tried getting an expert on the line but they only send me articles that have nothing to do with my situation. I need help!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

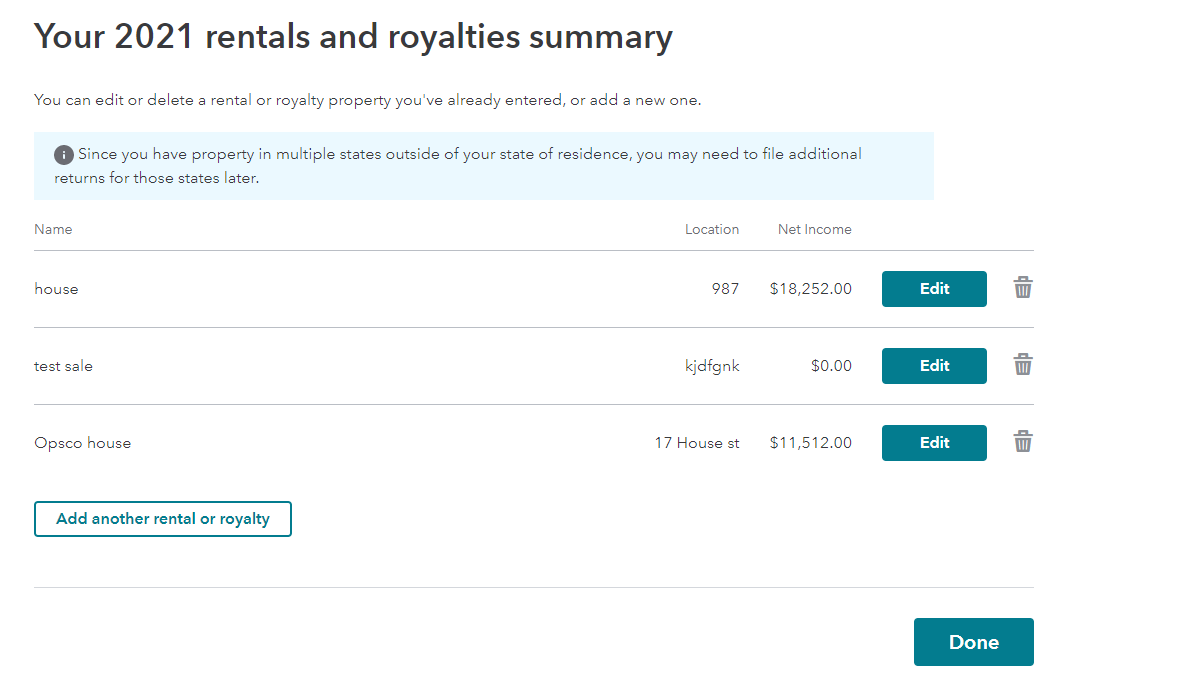

To enter the three houses sold as a package deal you would just allocate a portion of each sale to each house. You can allocate based on the value of the house or just split it in 3 if all house are of similar value. After you enter the first sale then click "Add another rental or royalty" when you get to the summary screen and then repeat for the third house.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report the sale of a third house in 2021?

If you have been reporting the rentals in the TT program AND properly depreciating the assets then you will divide the sales price and the cost of sale in any reasonable method you wish and then you will indicate that each asset was sold in the proper Sch E sections ... either go thru the program slowly and read all the screens to sell off all the assets OR upgrade to a LIVE help option OR use a local tax pro for this return ... what ever makes you feel the best.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Shamuj02

Level 1

anil

New Member

ramseym

New Member

Cindy10

New Member

William--Riley

New Member