- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I enter self employed health insurance deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

I need to get my self employed health insurance cost to show on Line 29, Form 1040

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

It depends on what kind of business you operate.

If your self-employment income is through a sole proprietorship reported on schedule C. You will need to use TurboTax Home and Business or TurboTax Self-Employed online. To enter the insurance premiums, you will do as follows:

- Go to the Business category.

- Go to the Business Income and Expense subcategory.

- Choose the option "I'll choose what I work on"

- On the screen labeled "Let's gather your business info", find the section labeled "Less Common Business Situations".

- Click start or update next to the line labeled Self-employed Health Insurance.

If the business is a partnership or an S-Corp, you will enter the self-employed health insurance at the end of the K-1 entry section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

It depends on what kind of business you operate.

If your self-employment income is through a sole proprietorship reported on schedule C. You will need to use TurboTax Home and Business or TurboTax Self-Employed online. To enter the insurance premiums, you will do as follows:

- Go to the Business category.

- Go to the Business Income and Expense subcategory.

- Choose the option "I'll choose what I work on"

- On the screen labeled "Let's gather your business info", find the section labeled "Less Common Business Situations".

- Click start or update next to the line labeled Self-employed Health Insurance.

If the business is a partnership or an S-Corp, you will enter the self-employed health insurance at the end of the K-1 entry section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

I have gone through those steps several times. When I click on self employed health insurance it simply goes to the next window about self employed retirement plan. Not way to put in the amount I pay. Can't find a way to enter the numbers. Help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

Are you filing a Sch C ? Or do you get a K-1 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

I have the same issue.

following the instruction provided did NOT allow me to enter my self-employed health insurance. When I go into the corresponding business, there's no place to enter the insurance expenses.

I am sole proprietor.

Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

Where to enter Self Employed Health Ins

Self-employed health insurance deduction goes on Form 1040 Schedule 1 line 16 then to 1040 line 8a, as long as the expense is not greater than your net self-employment income. If it does exceed your net self-employment income it gets split automatically. An amount equal to your net self-employment income goes on Form 1040 Schedule 1 line 16, and the remainder gets added in to medical expenses on Schedule A.

BUT do not enter any Health Care Marketplace insurance you bought. If you enter the 1095-A and select the "Self-employed and bought a Marketplace plan" box, it will automatically include those premiums in the SE Health Insurance section. So you shouldn't enter it again on schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

@Ricky20 wrote:

I have the same issue.

following the instruction provided did NOT allow me to enter my self-employed health insurance. When I go into the corresponding business, there's no place to enter the insurance expenses.

I am sole proprietor.

Please help!

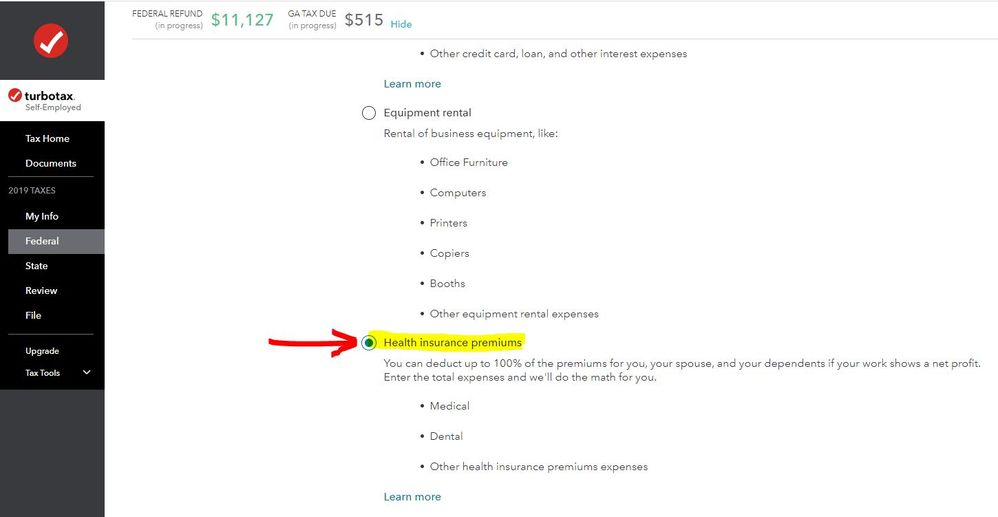

Edit your business. Click on Add Expenses for this work

Scroll down and click on Less common expenses to open the section.

Scroll down and click on Health insurance premiums

Continue

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

I have the same problem. When I go to Business Expense, Less Common, Insurance, Turbo Tax tells me my health insurance premiums were put into Schedule C - Medical Costs. This is even though my business made a good profit. The cost should go to Schedule 1 and be deductible for my business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

You must have entered it under Employee expenses. That is only for employees you pay . Delete it from there.

Where to enter Self Employed Health Insurance

https://ttlc.intuit.com/community/entering-importing/help/where-do-i-enter-my-health-insurance-premi...

Or did you mean Schedule A?

Self-employed health insurance deduction goes on Schedule 1 line 17 (which goes to 1040 line 10), as long as the expense is not greater than your net self-employment income (your net profit on Schedule C reduced by 1/2 of your self-employment tax)

If it does exceed your net self-employment income it gets split automatically. An amount equal to your net self-employment income goes on Schedule 1 and the remainder gets added in to medical expenses on Schedule A. It will not reduce any SE Tax on a net profit. It just reduces your AGI.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

Do you have your health insurance for your business through the Marketplace? If you do, when you edit your Form 1095-A, on the Let us know if these situations apply to you screen, be sure to check the box for I'm self-employed and bought a Marketplace plan. This will automatically add premium payments you made to the business you connect with the Form 1095A and will not automatically add them to your Schedule A itemized deductions.

You can select which type of business and if you have more than one, it will show a dropdown to select which to link.

If you have vision or dental insurance which was not included in your Form 1095-A, you may enter those in your Schedule C under health insurance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employed health insurance deduction?

WOW!! It worked.

I could not get Self-Employed Health Insurance Expenses added to Schedule 1, Line 17. Following your instructions, the deductions are now in Schedule 1.

I am using Premiere and thought that I would have needed Home and Business because it advertises as working on 'Self Employment Deductions'. I assume that Home and Business had a Worksheet, and it may have been straight forward, but with your instructions it worked.

Thanks, John

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

swick

Returning Member

business mileage for rental real

New Member

shikhiss13

Level 1

mc510

Level 2