- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- How do I calculate the \\\"outstanding mortgage principal\\\" when I bought my house in Sept 2024?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the \\\"outstanding mortgage principal\\\" when I bought my house in Sept 2024?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the \\\"outstanding mortgage principal\\\" when I bought my house in Sept 2024?

Do you have a Form 1098 and is there an amount in Box 2? The entire mortgage is considered principal on the day you purchased the home. TurboTax is asking for the total amount mortgaged when you purchased the home.

TurboTax needs to know if you have more than $750,000 in mortgage debt since that is the maximum amount that interest can be deducted on. See - How much mortgage interest can I deduct?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the \\\"outstanding mortgage principal\\\" when I bought my house in Sept 2024?

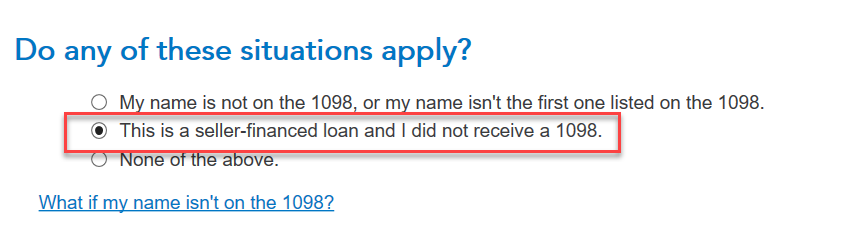

No, I do not have a 1098. I bought the house under land contract from my grandparents.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I calculate the \\\"outstanding mortgage principal\\\" when I bought my house in Sept 2024?

The amount of debt you owe is your outstanding balance.

Since it is seller financed, that is the option you select. You enter the interest you paid on the loan to them and they enter the interest received on their return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

dougiedd

Returning Member

user17539892623

Returning Member

wcrisler

New Member

ahkhan99

New Member