- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 8936

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

Hi,

I purchased a 2022 Chevrolet Bolt EUV on August 1, 2022 however, Turbo tax does not let me take the EV tax credit for the vehicle stating, Chevy or Tesla's no longer qualify.

However, I have read online that my EV does in fact qualify for the full tax credit. Can someone clear up the confusion here please as the IRS (9/14/2022) clearly indicated my Chevy Bolt EUV does qualify for the full tax credit but why is Turbotax stating otherwise?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

If placed in service after 12/31/2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

If the vehicle was placed in service in 2022 it is not eligible for the EV credit on a 2022 tax return.

The new rules for these vehicles becomes effective for tax year 2023 starting on 01/01/2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

@EVFan wrote:as the IRS (9/14/2022) clearly indicated my Chevy Bolt EUV does qualify for the full tax credit

I am curious to see what you are looking at that shows that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

Thanks for the reply.

So, can I add my 2022 vehicle on next year's return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

No. You bought it in 2022, so it can't go on your 2023 return. Unfortunately, you don't get the credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

Well, per the IRS and cars.com, my 2022 Chevy Bolt EUV which was placed in service in August 2022 does qualify for the full $7500 EV credit since it was manufactured in the U.S. has a 4.0+ Kw per hour battery, weighs less than 14,000 lbs., and is a 4-wheel vehicle.

Here's the information from Cars.com:

So, I am not sure why you are stating that it does not qualify. The online Turbotax is stating it does not qualify but from my car dealer manager along with online information, it does and it is the Turbotax software that is not up to date.

Tell me where my vehicle does not qualify rather than just stating it does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

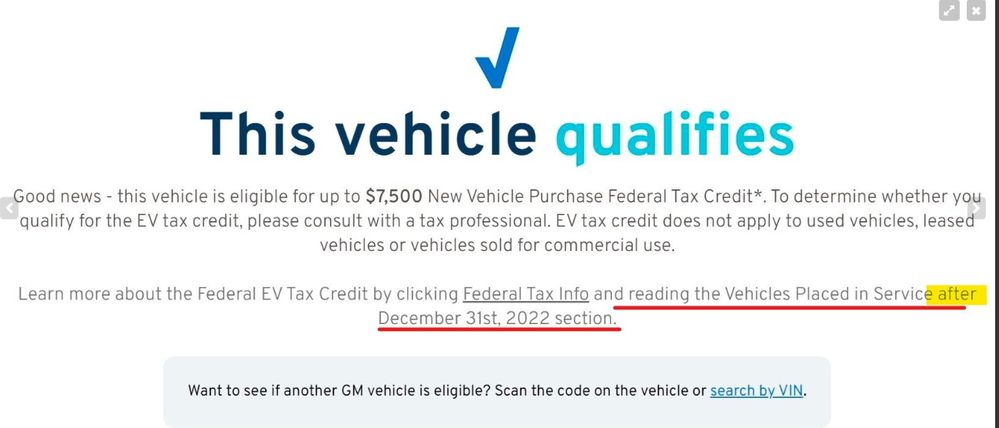

And, here's more proof that my 2022 Bolt EUV does in fact, qualify for the EV Fed Credit.

GM has created an online tool on its evlive site here: https://evlive.gm.com/ev-tax-credit which, enables buyers of the General’s electric vehicles to determine whether or not an EV qualifies for the “clean vehicle credit” federal income tax credit. The tool also shows how much credit the EV qualifies for out of the potential $7,500 maximum. The evlive site offers many other EV-related resources.

The tool enables potential purchasers to check on an EV’s tax credit eligibility by entering its VIN number in a search box and clicking or tapping “Search.”

Below, is the proof which, after entering my VIN number in the field, did generate a "qualifies" report.

And, as I stated earlier, TurboTax is causing likely thousands of EV owners across America to lose out on this updated IRS EV credit change on 2022 Chevy Bolt EUV vehicles.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

@EVFan Go to this federal government website and view the list of qualified vehicles. You will see that all the Chevrolet vehicles are not eligible for the tax credit for tax year 2022.

https://www.fueleconomy.gov/feg/tax2022.shtml

Chevrolet vehicles purchased after 3/31/20 and before 1/1/23 are not eligible for these tax credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

@EVFan Did you notice on the GM website that it specifically states -

Vehicles Placed in Service after December 31st, 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

Did you also take note on the GM site of the following message:

With relatively few EV models currently in its lineup, most of GM’s electric vehicles currently qualify for the $7,500 credit. This includes the2022 Chevy Bolt EV, the2022 Chevy Bolt EUV, the2023 Chevy Bolt EV, the2023 Chevy Bolt EUV, and the 2023 Cadillac Lyriq.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

If placed in service after 12/31/2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

@EVFan - I have read this thread. Unfortunately, you appear to be conveniently dismissing the date limitations on the credit.

For 2022 tax year, 2022 Bolt's aquired in 2022 were not eligible for the credit.

For 2023 tax year, 2022 Bolt's aquired in 2023 are eligible for the credit.

Since you purchased the vehicle in 2022, you must go by the 2022 eligibility rules; you can't simply decide to use the 2023 eligibility rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936

READ THE FIND PRINT ...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

revntadken

New Member

jdm277

New Member

Sam1346

Returning Member

wcivil

New Member

anynyheik

Returning Member