- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 8936 (2019) has an error

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

TurboTax has released an update to Form 8936. Follow these steps to insure that TurboTax is using the updated Form 8936.

-

Clear your browser's cookies and cache

-

Delete Form 8936

-

Enter your vehicle information on Form 8936

This link Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit has information you may find helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

thats my exact issue! but i bought a Tesla Performance 3

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

This form was updated, but it still has an error. Now it under calculates the rebate. I bought a Tesla on July 26, 2019. Rebate is supposed to be $7500 x 0.25 for a total of $1,875, but it instead it reads $1875 x 0.25 for a total of $469. Please fix this!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

It is 21 February 2020 and the IRS For 8936 has still not been fixed in TurboTax. Online help is useless. Telephone support tells me that the form was available two days ago. Oh, wait. The form was available yesterday. Oh, wait. Yeah, you can sign up for an e-mail update that never comes. I have been on hold waiting for a supervisor for 50 minutes.

The IRS released this form on 14 February 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

The issue is supposed to be fixed sometime today 2/21/2020.

Please also update your program before fixing the reject:

- If you are using the TurboTax CD/Download software program, open the program, from the top, under Online, select Check for Updates.

- If you are using the online version, it's an automatic update when you sign in and out.

If you are using TurboTax online version, I suggest you also clear your cache before logging back into the program. To clear cache, click here

https://ttlc.intuit.com/community/troubleshooting/help/how-to-clear-your-cache/00/26135

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Let's review.

I have checked for updates every day this week. I just checked again - my software is up to date.

You tell me that the updated form is "supposed" to be fixed sometime today.

Telephone support tells me that the form is "supposed" to be fixed Monday 24 February.

I have been told that the form was "supposed" to be fixed on the fifth, twelfth, twentieth, and twenty-first of February. None of these "supposed" fixed materialized.

Claims made by Turbotax support of "supposed" dates have no credibility. Please stop with the misinformation.

Theoretically, Intuit staff could get a realistic estimate of a fix date. That does not appear forthcoming.

I am left to trial-and-error to check the status of this software.

If you do not have credible information, please stop posting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

@LinaJ2020 lol? The form has been working since Wednesday on Turbotax online. You people really need to get your act together and get your stories straight. Every single "Employee Tax Expert" says something contradictory to each other, and contradictory to reality.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

TurboTax has released an update to Form 8936. Follow these steps to insure that TurboTax is using the updated Form 8936.

-

Clear your browser's cookies and cache

-

Delete Form 8936

-

Enter your vehicle information on Form 8936

This link Filing Tax Form 8936: Qualified Plug-in Electric Drive Motor Vehicle Credit has information you may find helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

I do understand that the online version of Turbotax correctly processes IRS Form 8936.

I am not using the online version of Turbtax.

I am using the Windows-based version of Turbotax.

As previously stated, I have confirmed that my software is up to date.

LeonardS posts misleading information about the issue. This is par for the course.

Let save you some time by reviewing once again:

I have been told that the Windows-based Turbotax was "supposed" to have corrected IRS Form 8936 on February fifth, twelfth, fourteenth, twentieth, and twenty-first. (I forgot about the fourteenth in a previous post, sorry.) I have been told today that Form 8936 is "supposed" to be fixed today. I have also been told today that Form 8936 is "supposed" to be fixed on Monday 24 February.

Theoretically, Intuit staff could get a realistic estimate on the status of this issue. This does not appear to be forthcoming.

As we see, Intuit staff like LeonardS will continue to provide disinformation.

Yes, Leonard - the online version is fixed. We have been talking about the Windows-based version. This is why your post regarding the online version is disinformation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

@weirdbaldguy If you have already verified that your TurboTax software is up to date by clicking on Online and then on Check for Updates and the 8936 is still not available or calculating incorrectly then try a manual update.

See this TurboTax support FAQ for manually updating the software to R18 using a Windows based PC - https://ttlc.intuit.com/community/updating/help/manually-update-turbotax-for-windows-software-basic-...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Thanks, I had my returns rejected twice. I will try again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Using turbotax online I have tried the above steps and still get an incorrect calculation is there anything else I can try?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

Note if you're still having issues you can just do what I did and file using the free fillable forms on the IRS site. If you already have all the numbers it's just a matter of copying them over to the fields there.

That or you can choose to file by mail and just correct form 8936 manually by editing the PDF or writing over it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

My version has the wrong value for line 4a This should be $7,500 for Tesla 3

With 4a being $7,500 then with purchase after 12/31/2018 and before 6/30/2019 line 4b would be 50%

My original form shows 4a as $3,750 and 4b as 50% yielding a net $1,875

Since I could not change the incorrect 4a to $7,500 I changed 4b to 100% to yield the proper net of $3,750

I expect this will cause a problem with the IRS

Please correct line 4a to the proper $7,500

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8936 (2019) has an error

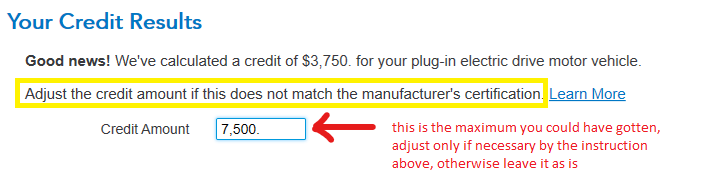

Be sure that you do not change the maximum credit amount shown on the screen, otherwise the calculation will not be correct.

Here is the explanation:

TurboTax will calculate your maximum credit based on the details entered for your vehicle and any applicable phase-out based on the purchase date.

On the screen where it shows the amount of credit you qualify to receive, the box at the bottom of the page is showing the maximum credit that would have been allowed for your vehicle had a phase-out not applied. Your credit may be limited by the phase-out. If you change the number on that screen, your credit will not be calculated correctly.

The information on the screen says this field is for adjusting the amount of maximum credit it is does not match the manufacturer's specification. The number entered here will be the maximum credit that you may receive prior to any limitation being applied. If you change it, your credit will be based on the number entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Gill_2026

New Member

jtrevor

Level 3

angeeeee

New Member

user17683222006

Level 1

quinnamg

Level 1