- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 2555 calculation of foreign income under 330 day rule

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

I am not sure that TT is filling out the form 2555 correctly. Facts are as follows:

--US cit who lives, works and have tax home is foreign country since 2021

--been using 330 day rule vice bone fide resident because visas are based on limited employment (3 year contracts) and have read that is enough to not be a bone fide resident

--Foreign employer sent me to US for 3 months (Feb-March 2024). Salary paid by foreign empoyer during that time is about 16.5K (annual is 66,5k) and then I returned to foreign country for rest of years

--can use 12 month period May 2024 to May 2025 to establish 330 in foreign country (avoid the 3 months in US) for FEIE.

--I put full salary in "other" income under general income section given that is for calendar year. Then in section to fill out form 2555, list section list the May 2024 -May 2025 to establish foreign presence. tt asks me if I've travelled to the US in THAT 12 Month Period -- so does not exclude the money earned in the early part of 2024 as foreign income and form 2555 still lists my entire salary as exempt. I'm not sure how I have to answer the questions to get it to properly count ¼ as non-foreign income since I was physically in the US and the other ¾ as foreign income. Do I need to correct by hand? If so how?

My one thought: When I look at the actual 2555, I see a "Foreign Source and Salaries Smart Worksheet" where it lists my full 2024 salary from the foreign employer. Section C titled "adjustments" is blank. Should I put the 16.5 K earned while physically in US in that section by hand?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Yes, if you list May 01, 2024 -04/30/2025, you will qualify under the physical presence test. Since you were physically in the U.S. for ¼ of the year, the salary earned during that time does not qualify for the FEIE. You need to manually adjust the income reported on Form 2555 to reflect only the foreign-earned portion.

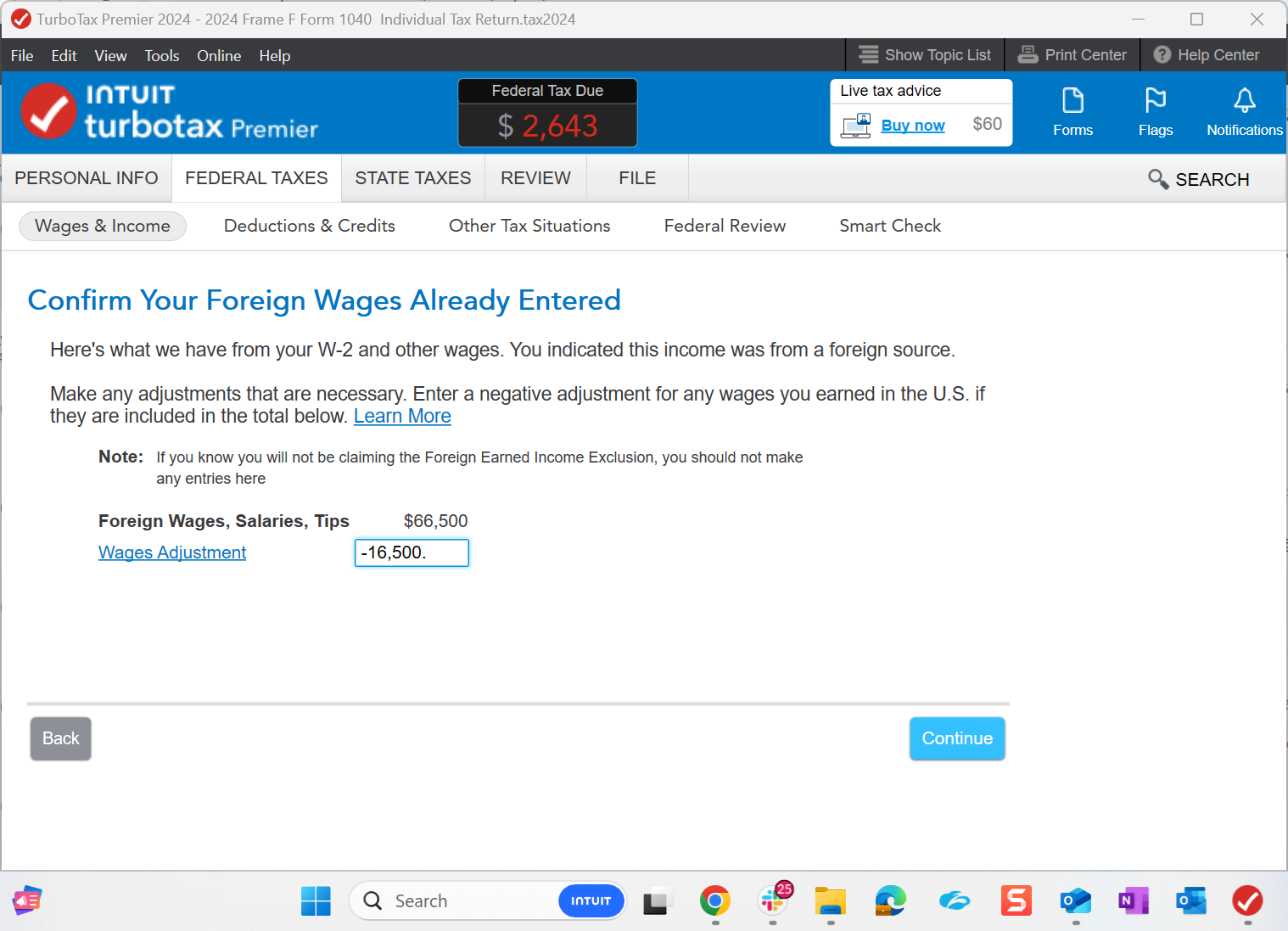

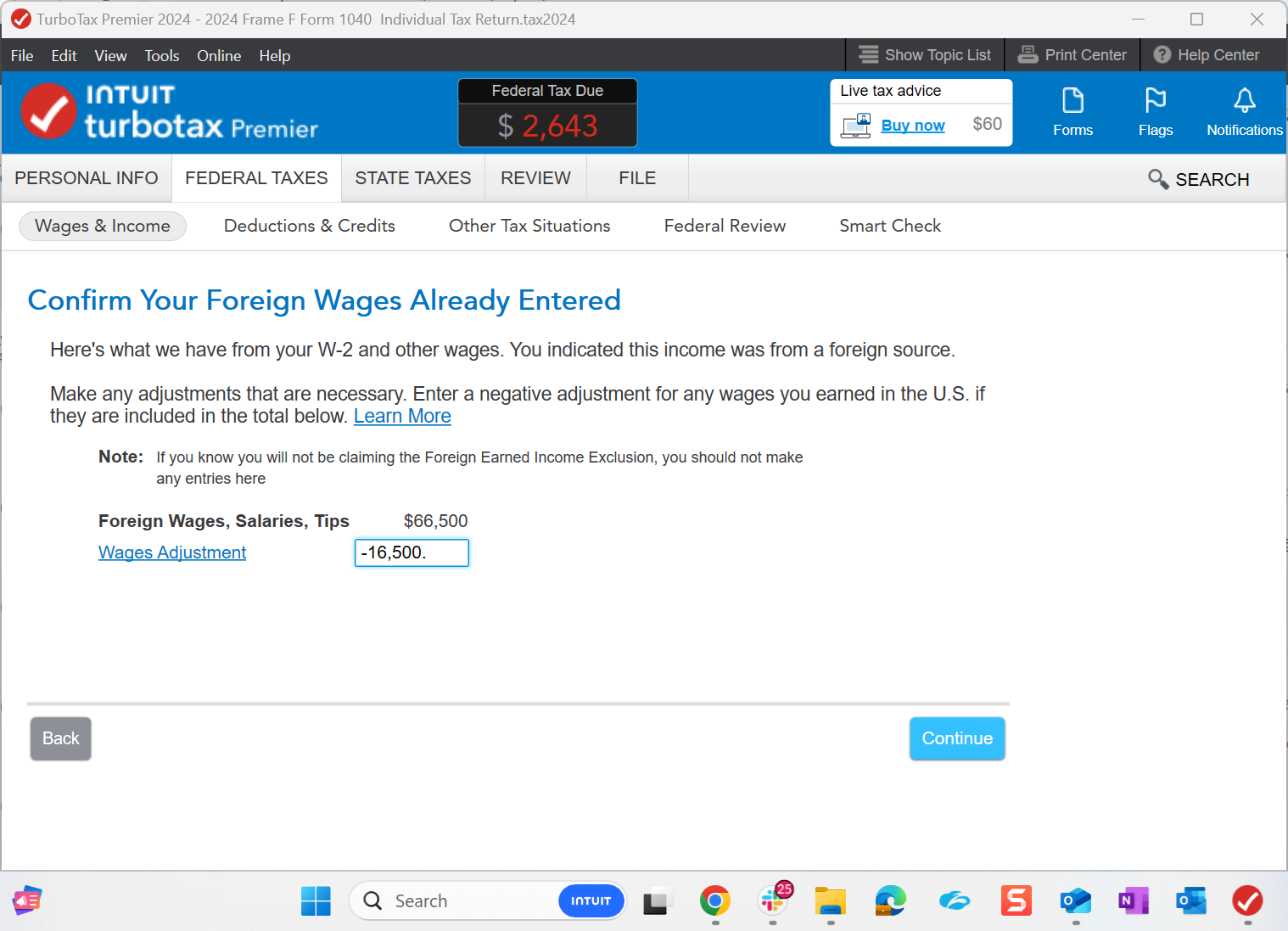

To manually adjust, there is a screen that shows where you can make that adjustment. Here's a screenshot of the screen where you will make the adjustment. Be sure to report the US wages as a negative number when making the adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Yes, if you list May 01, 2024 -04/30/2025, you will qualify under the physical presence test. Since you were physically in the U.S. for ¼ of the year, the salary earned during that time does not qualify for the FEIE. You need to manually adjust the income reported on Form 2555 to reflect only the foreign-earned portion.

To manually adjust, there is a screen that shows where you can make that adjustment. Here's a screenshot of the screen where you will make the adjustment. Be sure to report the US wages as a negative number when making the adjustment.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

I was able to correctly pro-rate the US income. One follow-on question: using May24-May25. Form asks for days in US and if worked during the 12 mo period used. I listed 1 US trip over Christmas/New Years where I worked 2 days in 2025. Even though that period is used for establishing the 33o days, I shouldn’t count the 2 days in 2025 as part of my 2024 income should I?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Correct, that income shouldn't be included on your 2024 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

When filling out the questions on travel to the US during the May24 to May 25 time period then, do I just no enter that there were any business days in the US (and I assume include them in my 2025 taxes)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Correct, the information about income earned in 2025 as well as travel dates will go on your 2025 tax return.

The only 2025 date that is relevant on the 2024 return is the ending date for your qualification period. If that date is in May, keep in mind that you will not be able to file your return until that date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Do you mean that I just end the Christmas visit at 12/31/24 instead of stating when I left in 2025?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 2555 calculation of foreign income under 330 day rule

Yes, for the dates of the December visit, put the last date as 12/31/204. On your 2025 return, you will enter 01/01/25-the date you left in 2025.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anitagorod

New Member

Tessmama

New Member

Balsamiq12

Level 1

tompatty66

New Member

Raph

Community Manager

in Events