- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes, if you list May 01, 2024 -04/30/2025, you will qualify under the physical presence test. Since you were physically in the U.S. for ¼ of the year, the salary earned during that time does not qualify for the FEIE. You need to manually adjust the income reported on Form 2555 to reflect only the foreign-earned portion.

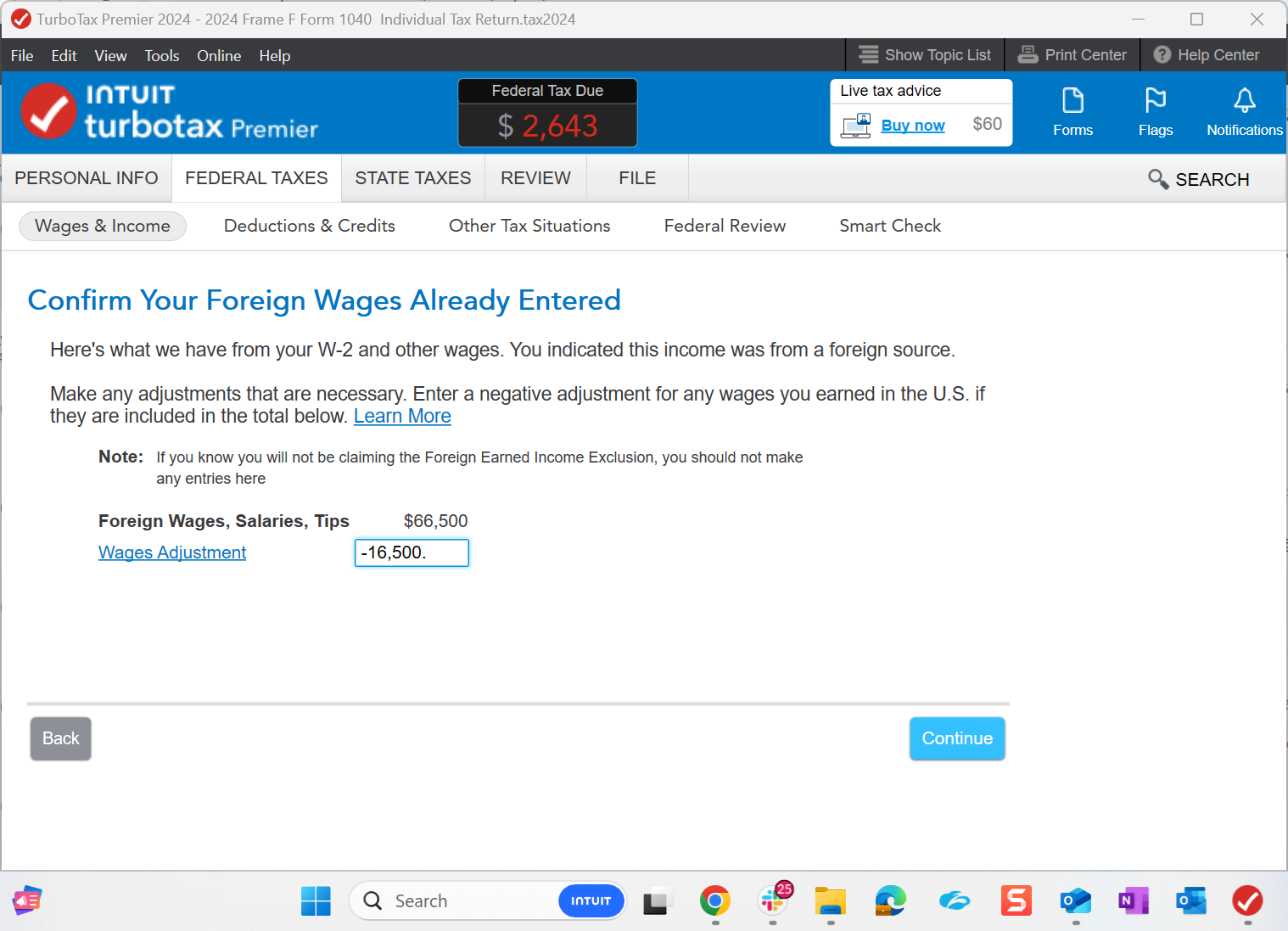

To manually adjust, there is a screen that shows where you can make that adjustment. Here's a screenshot of the screen where you will make the adjustment. Be sure to report the US wages as a negative number when making the adjustment.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 9, 2025

5:03 PM