- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

REJECTED A THIRD TIME!!!!

This is getting ridiculous. I resubmitted my tax return after reading that TT made an upgrade to the software to fix the Schedule 1116 problem. My return was STILL REJECTED. Please, can someone from TT please address the issue so that we can file our returns?

Thanks you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

I’m getting that error and have never had any foreign income. When I go to delete the form, it’s not even listed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Didn’t work for me. I have no idea why I’m getting this error. I have a very simple return and I’ve always used TT. I don’t have any foreign income whatsoever. When I try to delete the form it’s not even listed. I have one 1099-div and I’ve tried deleting and typing it in myself but no luck

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

now that is really odd, to have no foreign income you would have paid no foreign taxes and no Form 1116 should have been prepared so to get this rejection is truly odd. i still believe TT has bugs in their system that they are not fixing or advising people of the bug or any type of workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Very odd and frustrating. I finally just checked paid and went back into the tools and form 1116 finally showed up so I was able to delete it and file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

wonderful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Though I had foreign income and paid foreign tax last year, for year 2021 there is no foreign income. I don't know how to satisfy the TT Premier requirement on Form 1116.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

You should mark it as paid since you have already paid foreign taxes in the previous year.

Click on the link for more information

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

TurboTax Deluxe Desk Top CD 2021 (I am using)

Today (3/3/2022) had Foreign Tax Credit Form 1116 was updated at program. I checked whether my Tax return is ready for filing after update. On review I was advised not to e-file, however I can file by Snail Mail. Schedule B line 3 (xiv) needs correction for carry over. It appears program is still incomplete. I am waiting for an update with appropriate correction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

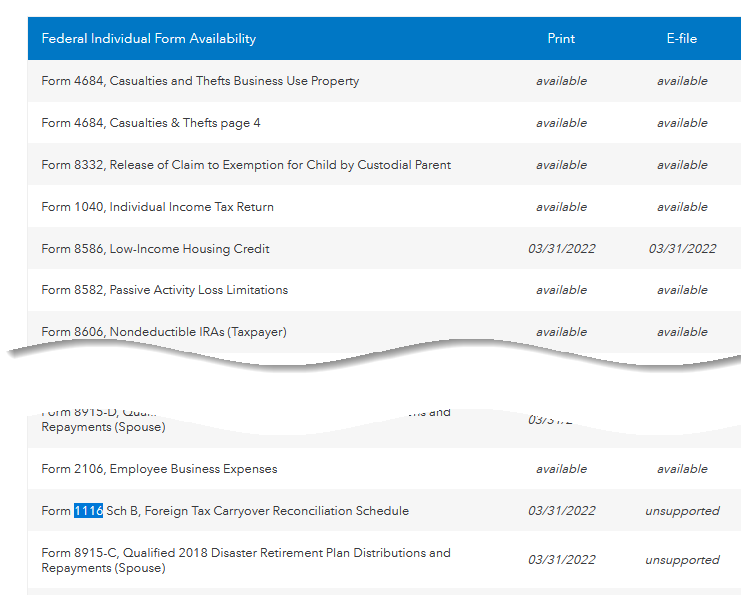

Form 1116 Foreign Tax Credit is now available but we are not expecting Form 1116 Schedule B until March 31st, when it will be available to Print and File by Mail but will be unsupported to e-file. Form 1116 Schedule B is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Please see the image below. Filing by Mail generally has delays and the last two years it has had substantial delays. You will be able to print your return after the forms are available but depending on how it impacts your return, you may wish to e-file without the credit, then after all the forms are available and your e-filed return has been processed, file an amendment to claim the credit.

If you decide to wait and file by mail, just re-enter the return after March 31st and take it through Review again.

If you prefer to file without the credit and amend later:

To revisit the section of the return for Foreign Tax Credit:

- Select Federal

- Click on Deductions and Credits

- Scroll down to the Estimates and Other Taxes Paid section and click on Show More

- Select Revisit/Start for Foreign Tax Credit

This should clear your return but if perhaps the form is still in your return and flags it in Review, you can manually delete the form.

In TurboTax Desktop

To be sure there is not a partially completed form in TurboTax, please check in Forms mode to delete the form from your return. You will want to make sure there is not a Form 1095-A or a Form 8962.

- Please go to the upper right-hand corner and click on Forms; it will show you a list of all the forms in the return along the left column.

- If you see a Form 1116 Schedule B, click on it and it will open in the pane on the right. You can click Delete Form, at the bottom.

- Go to the upper right-hand corner and click on Step-by-Step (or Easy Step) to switch back to Interview mode.

This should remove all traces of the form and allow you to file without that error message.

When you come back to amend, this TurboTax Help article has step by step directions to amend your return. You will want to wait until your original return is processed before you submit the amendment. Amend a Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Teresa (or whomever else may know the answer!),

Thanks for the latest update, very useful. I have a slightly different, but related, question I hope you can help with.

I have passive foreign income from a mutual fund in 2021 but no 2021 foreign tax was paid on it (at least not passed thru to me as such). I would like to claim the portion of that mutual fund income that is foreign to trigger the foreign tax credit using my foreign tax credit carryover.

The carryover is in turbotax but when I enter $0 in the foreign taxes paid box in the dividend income interview it then does NOT ask me for the portion of my income that is foreign or fill out the top section of 1116. Basically it acts as if I NEED to have a 2021 foreign tax paid amount >$600 to trigger the full use of the 1116 form even though I have foreign tax credit carryover greater than this amount that I would like to use.

How do I get the program to 'trigger' the use of the 1116 to activate my foreign tax CR carryover? Is this an issue in the program OR is it an IRS rule that you MUST have current year foreign taxes paid before accessing your foreign tax carryover?

I appreciate any help/clarification on this!

Bill

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 1116 Foreign Tax Credit Form - Worksheet Bug - Unable to E-File

Yes, unfortunately in order to be able to use the carryover, you must apply the foreign tax credit in the current year first. If you do not have one to apply, then you will not be able to apply the carryover.

@billpag

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

girigiri

Level 3

hjaystevens

New Member

Blue Storm

Returning Member

blueeyes3079

New Member

mc510

Level 2